1. Daily technical analysis of selected currency pairs

EUR/JPY Bullish

Image Features: forms “Megaphone Bottom (Bullish)” pattern

Target

Opportunity recognized 2021 Aug 23 for the period of up to 2 weeks

+0.463 (46.3 pips) price change since the Technical Event at 128.947

Technical Analysis

We found a pattern called Megaphone Bottom on 2021 Aug 23 at 09:00 GMT on a 1 hour chart, providing a target price for up to 2 weeks in the range of 130.000 to 130.200.

The faster moving average crossed above the slower moving average on 2021 Aug 24 at 16:00 GMT, signaling a new uptrend has been established.

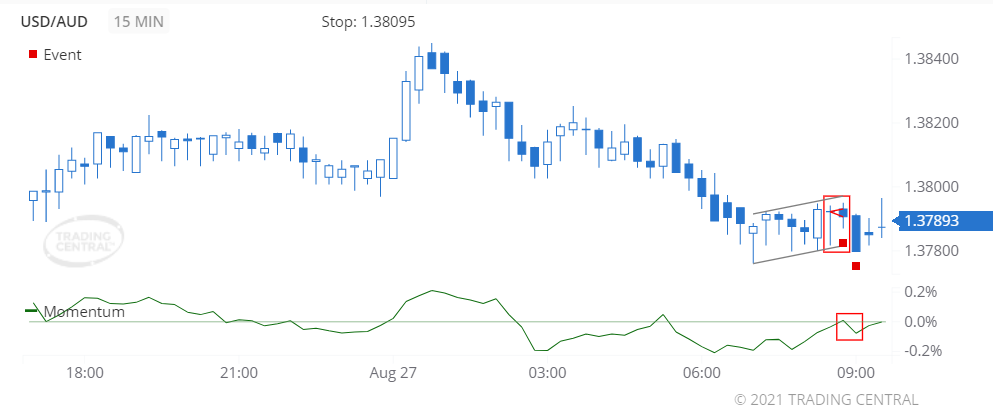

USD/AUD Bearish

Image Features: forms “Engulfing Line (Bearish)” pattern

Target

Opportunity recognized 2021 Aug 27 for the period of up to 12 hours

-0.00013 (1.3 pips) price change since the Technical Event at 1.37906

Technical Analysis

We found a pattern called Engulfing Line (Bearish) on 2021 Aug 27 at 08:45 GMT on a 15 minute chart suggesting the outlook is bearish for up to 12 hours.

The Momentum oscillator crossed below 0 on 2021 Aug 27 at 09:00 GMT, thereby signaling a new accelerating downtrend.

2. Daily Analyst’s View

EUR/USD

may rise 20 – 30 pips

Pivot

1.1740

Our preference

Long positions above 1.1740 with targets at 1.1770 & 1.1780 in extension.

Alternative scenario

Below 1.1740 look for further downside with 1.1725 & 1.1715 as targets.

Comment

The RSI lacks downward momentum.

GBP/USD

may rise 21 – 36 pips

Pivot

1.3680

Our preference

Long positions above 1.3680 with targets at 1.3720 & 1.3735 in extension.

Alternative scenario

Below 1.3680 look for further downside with 1.3660 & 1.3635 as targets.

Comment

The RSI shows upside momentum.

USD/CAD

may fall 32 – 57 pips

Pivot

1.2710

Our preference

Short positions below 1.2710 with targets at 1.2640 & 1.2615 in extension.

Alternative scenario

Above 1.2710 look for further upside with 1.2730 & 1.2750 as targets.

Comment

The RSI shows downside momentum.

Gold

may rise to 1805.00 – 1809.00

Pivot

1789.00

Our preference

Long positions above 1789.00 with targets at 1805.00 & 1809.00 in extension.

Alternative scenario

Below 1789.00 look for further downside with 1779.00 & 1775.00 as targets.

Comment

The break above 1789.00 is a positive signal that has opened a path to 1805.00.

Crude Oil (WTI)

may rise to 69.00 – 69.85

Pivot

67.50

Our preference

Long positions above 67.50 with targets at 69.00 & 69.85 in extension.

Alternative scenario

Below 67.50 look for further downside with 66.90 & 66.30 as targets.

Comment

The RSI lacks downward momentum.

S&P 500 (CME)

may fall to 4454.00 – 4462.00

Pivot

4484.00

Our preference

Short positions below 4484.00 with targets at 4462.00 & 4454.00 in extension.

Alternative scenario

Above 4484.00 look for further upside with 4498.00 & 4508.00 as targets.

Comment

The index currently faces a challenging resistance area at 4484.00.

Nasdaq 100 (CME)

may fall to 15240.00 – 15265.00

Pivot

15350.00

Our preference

Short positions below 15350.00 with targets at 15265.00 & 15240.00 in extension.

Alternative scenario

Above 15350.00 look for further upside with 15400.00 & 15465.00 as targets.

Comment

As long as the resistance at 15350.00 is not surpassed, the risk of the break below 15265.00 remains high.

Hang Seng (HKFE)

may fall to 24940.00 – 25140.00

Pivot

25435.00

Our preference

Short positions below 25435.00 with targets at 25140.00 & 24940.00 in extension.

Alternative scenario

Above 25435.00 look for further upside with 25600.00 & 25750.00 as targets.

Comment

A break below 25140.00 would trigger a drop towards 24940.00.

Disclaimer:

This report is prepared and published by Trading Central for all clients of Doo Prime. As a third-party indicator tool, Trading Central is only for your strategic reference during the investment process and does not constitute advice or a recommendation by Doo Prime or Trading Central. Neither Doo Prime nor Trading Central are responsible to bear the relevant legal liabilities for the investment risks arising from your use of this report to make buying and selling decisions.