1. Forex Market Insight

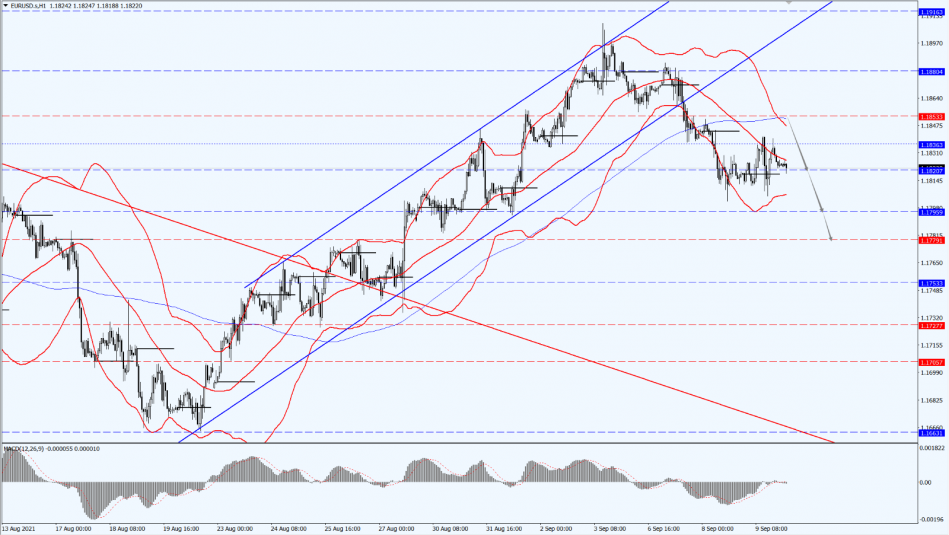

EUR/USD

The European Central Bank (ECB) will slow the pace of emergency bond purchases in the coming quarter, taking the first small step towards phasing out emergency aid. Nevertheless, the emergency aid has bolstered the eurozone economy during the pandemic.

In the past two quarters, the ECB has been purchasing 80 billion euros of assets per month, and the bank did not provide guidance on the specific size of the bond purchases over the next three months.

However, three sources told Reuters that policymakers at the meeting for the PEPP to set a monthly target of public bond purchases between 60-70 billion euros, maintaining the flexibility to increase or reduce bond purchases according to market conditions.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, the euro continues to pay attention to the 1.1853-line. As long as the euro runs steadily below the 1.1853-line, it will maintain the bearish trend. Below, pay attention to the support of the 1.1795 and 1.1779 positions. If the euro rises above the 1.1853-line, it will open up room for further recovery. At that time, pay attention to the suppression of the 1.1880-line.

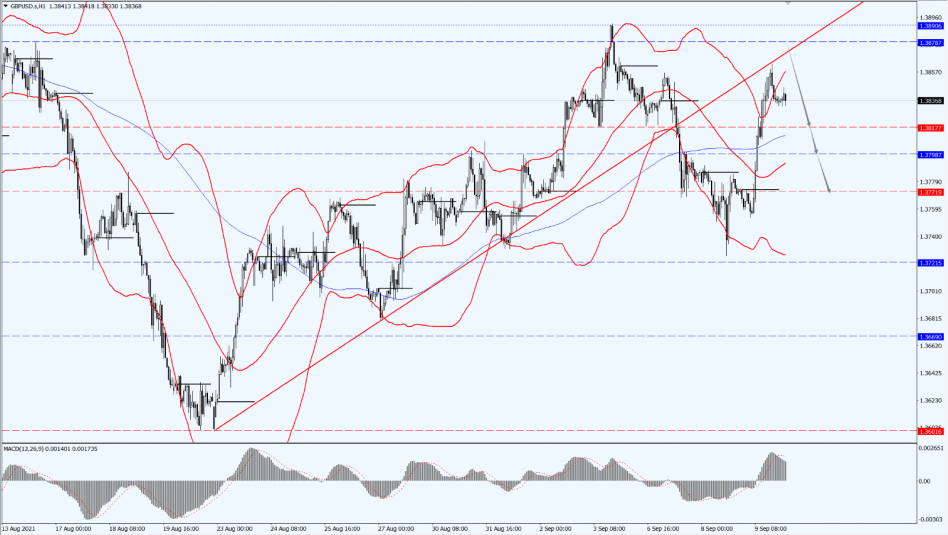

GBP Intraday Trend Analysis

Fundamental Analysis:

While investors expect the Bank of England to raise its benchmark interest rate in May 2022, they have digested their expectations of a cumulative 28 basis point hike by the end of 2022. However, Goldman Sachs’ economists do not expect the Bank of England to raise rates until the third quarter of 2023 as there is more slack in the U.K. economy than the Bank of England expects.

Steffan Ball, Goldman Sachs’ chief U.K. economist, said the situation could get worse when the government’s wage support program ends on Sept. 30. With that said, the job market outlook will play a key role in determining when the Bank of England will begin to raise interest rates from their current record low of 0.1%.

Adding to that, Goldman Sachs forecasts unemployment to peak at 5.5% in the second half of the year, while the Bank sees a gradual decline in unemployment. Thus, excess capacity means lower inflationary pressures, making an immediate rate hike even less necessary.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

Today, the pound is focused on the suppression of the pressure range from 1.3878 to 1.3890. Once the pressure drops, it will form a double top pattern. At that time, consider whether there is an opportunity for short positions.

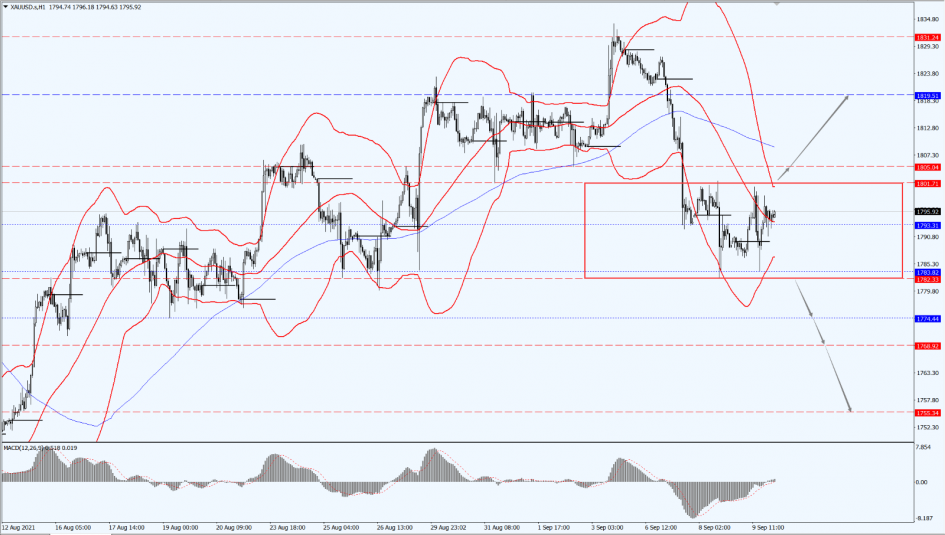

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices strengthened yesterday, boosted by a slight retreat in the dollar. However, the market renewed bets that the Federal Reserve may begin to taper its economic support measures early and the European Central Bank’s gradual draw back on its bond purchases have limited gold price gains.

Likewise, spot gold rose by 0.30% to $1,794.58 per ounce while the U.S. gold futures closed up by 0.4% and settled at $1,800 per ounce.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the direction of the breakthrough in the range of 1801 to 1782. If it breaks through 1801 and above, it will open up room for further rebound. If it falls below 1782, it will continue the downward trend for gold prices.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil futures fell by $1.16, or 1.7%, to settle at $68.14 per barrel yesterday, while Brent Crude oil fell by $1.15, or 1.6%, to settle at $71.45 per barrel. Both major contracts settled at their lowest since Aug. 26.

Oil prices came under pressure after China announced that it will organize the release of national reserves of crude oil to ease the pressure of rising raw material prices. During this interval, EIA data showed that crude oil inventories fell by 1.528 million barrels in the week ended Sept. 3, missing expectations by 4.75 million barrels. At the same time, U.S. Treasuries rose as investors sought safer assets, causing serious fear in the oil market.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are focused on the breakthrough direction of the 66.83 to 68.57 range. As long as the oil price does not break above the 68.57-line, the trend will maintain bearish. However, if the oil price drops below the 66.83-line, it could possibly open up a greater downside potential. Otherwise, it will switch to a wide range of shocks. At this stage, the shock range is 66.83 to 68.57.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.