1. Forex Market Insight

EUR/USD

The euro initially rose against the dollar on Wednesday, 2nd November 2022 but later turned lower, closing down 0.60% at 0.9814.

Eurozone economic risks remain a drag on the euro. Eurozone manufacturing PMI fell to 46.4 in October, the weakest figure since the peak of the recession caused by the pandemic.

A sharp drop in demand remains a key drag as inflation continues to climb and uncertainty is high. A deterioration in the situation is expected to loom in the coming months, despite the reduction in backlogs of work acting as a buffer to current output and employment.

The outlook for the next 12 months remains gloomy, as most producers expect their output to decline. In addition, strikes in Europe, which are not yet over, continue to hit the eurozone economy.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9810 line today. If the EUR runs below the 0.9810 line, then pay attention to the support strength of the two positions of 0.9764 and 0.9723. If the strength of EUR rises over the 0.9810 line, then pay attention to the suppression strength of the two positions of 0.9852 and 0.9909.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound closed down 0.78% against the dollar on Wednesday, 2nd November 2022 at 1.1389. The market is expected to see the Bank of England announce a 75 basis point rate hike on Thursday, but the pound does not appear to be boosted by the expected rate hike. The British economy is still facing challenges, even to deal with the power outage crisis.

As winter approaches, energy security in the UK is a growing concern. The British newspaper “The Guardian” on November 1 revealed a confidential document, which shows that the British government has prepared a contingency plan to deal with a possible seven-day-long national power outage situation.

The sources said the British government did not want to make the plan public because it did not want people to link it to the Russia-Ukraine conflict, energy supplies and the cost of living. But the discussion of the plan proves that government officials are indeed concerned about a possible “worst-case scenario”.

Technical Analysis:

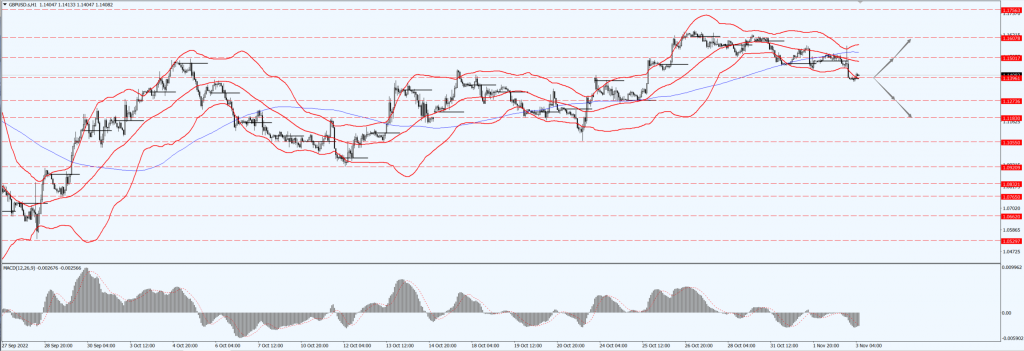

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1396-line today. If GBP runs below the 1.1396-line, it will pay attention to the suppression strength of the two positions of 1.1273 and 1.1830. If GBP runs above the 1.1396 -line, then pay attention to the suppression strength of the two positions of 1.1501 and 1.1607.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold rose and then fell on Wednesday, 2nd November 2022 jumping more than 1% after the Fed hinted it might slow the pace of interest rate hikes, but later turned lower after the Fed raised rates by 75 basis points as expected, but said it might slow the pace of rate hikes in the future to take into account the cumulative effect of its “tightening monetary policy” actions so far.

Later, Powell warned that do not think the Fed will soon pause interest rate hikes. “It is too early to consider suspending interest rate hikes.”

Technical Analysis:

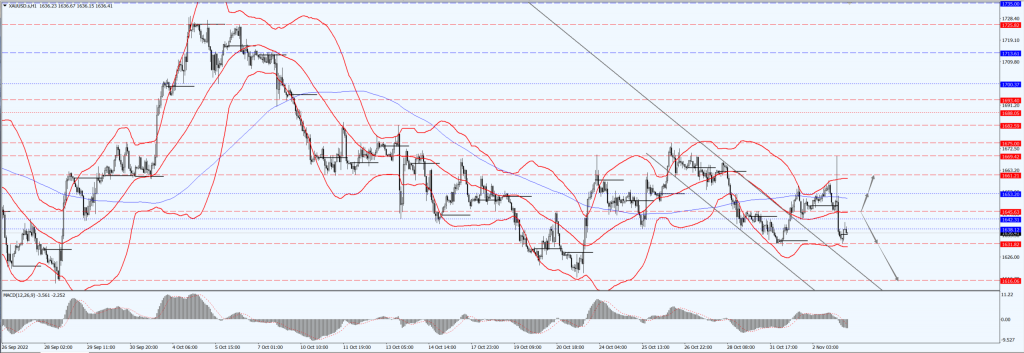

(Gold 1-hour Chart)

Gold pays attention to the 1645-line today. If the gold price runs below the 1645-line, then it will pay attention to the support strength of the 1613 and 1616 positions. If the gold price breaks above the 1645-line, then pay attention to the suppression strength of the two positions of the 1653 and 1661.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose on Wednesday, 2nd November 2022 accelerating after the Federal Reserve raised interest rates by 75 basis points for the fourth time this year, although the settlement price of the index crude contract ended up within the day’s trading range.

The market was earlier supported by another drop in U.S. oil inventories as refineries increased production activity ahead of the winter heating season. Production from the Organization of Petroleum Exporting Countries (OPEC) fell in October for the first time since June, in addition to being 1.36 million barrels per day below its target.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 89.25 line today. If the oil price runs above the 89.25-line, then focus on the suppression strength of the two positions of 90.44 and 91.54. If the oil price runs below the 89.25-line, then pay attention to the support strength of the two positions of 86.77 and 85.53.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.