1. Forex Market Insight

EUR/USD

The euro closed down 0.67% against the dollar yesterday, 3rd November 2022 at 0.9748. The energy crisis and the risk of recession in the eurozone kept the euro under pressure.

Sweden’s Bank warned that gas shortages across Europe are likely to last for this coming winter. The bank said that even if Europe’s gas stocks are close to saturation, but assuming consumption levels are in line with historical averages, Europe is still short of 270 terawatts per hour of gas supply, making it difficult to survive the winter. Cold weather could further exacerbate the situation.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9723 line today. If the EUR runs below the 0.9723 line, then pay attention to the support strength of the two positions of 0.9669 and 0.9633. If the strength of EUR rises over the 0.9723 line, then pay attention to the suppression strength of the two positions of 0.9810 and 0.9852.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England raised interest rates from 2.25% to 3% on Thursday, 3rd November 2022 the biggest hike since 1989, as the central bank fights the twin forces of a slowing economy and feverish inflation.

The Bank of England said it now expects inflation to reach a 40-year high of around 11% this quarter, but played down expectations of further sharp rate hikes. The Bank of England also said the U.K. has entered a recession that is likely to last two years, longer than the one that lasted during the 2008-09 financial crisis. After the Bank of England statement, the pound touched a two-week low against the dollar.

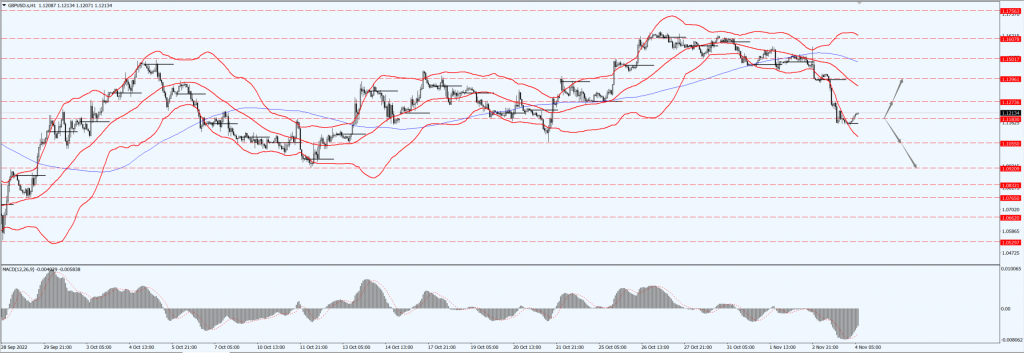

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1183-line today. If GBP runs below the 1.1183-line, it will pay attention to the suppression strength of the two positions of 1.1055 and 1.0920. If GBP runs above the 1.1183-line, then pay attention to the suppression strength of the two positions of 1.1273 and 1.1396.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell to their lowest in more than a month on Thursday, 3rd November 2022 with the dollar and U.S. Treasury yields jumping after Federal Reserve Chairman Jerome Powell made a hawkish statement, dampening the appeal of gold.

Spot gold was down 0.3% at $1,629.97 an ounce, after falling more than 1% earlier to touch its lowest since Sept. 28. The focus now shifts to the U.S. October nonfarm payrolls data due out Friday, 4th November 2022 which could provide more clues to the Federal Reserve’s trajectory of interest rate hikes.

The data showed that the U.S. service sector grew at its slowest pace in nearly two-and-a-half years in October, suggesting that the Fed’s continued rate hikes are slowing overall economic demand. This provided some respite for gold.

Later, Powell warned that do not think the Fed will soon pause interest rate hikes. “It is too early to consider suspending interest rate hikes.”

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1645-line today. If the gold price runs below the 1645-line, then it will pay attention to the support strength of the 1613 and 1616 positions. If the gold price breaks above the 1645-line, then pay attention to the suppression strength of the two positions of the 1653 and 1661.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell about 2% Thursday, 3rd November 2022 as a U.S. interest rate hike pushed the dollar higher and epidemic concerns raised fears that a global recession could hit fuel demand.

However, declines were capped by concerns over tight supplies. The EU embargo on Russian oil due to Russia’s invasion of Ukraine will take effect on Dec. 5, followed by a halt to oil product imports in February.

Lower output from the Organization of the Petroleum Exporting Countries (OPEC) also brought support to oil prices, with a Reuters survey finding that OPEC production fell in October for the first time since June.

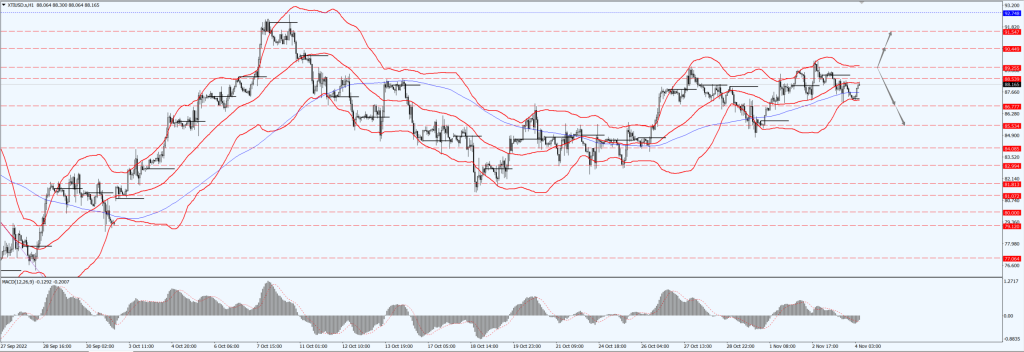

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 89.25 line today. If the oil price runs above the 89.25-line, then focus on the suppression strength of the two positions of 90.44 and 91.54. If the oil price runs below the 89.25-line, then pay attention to the support strength of the two positions of 86.77 and 85.53.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.