1. Forex Market Insight

EUR/USD

The euro fell more than 1% to return below parity against the dollar after the European Central Bank (ECB) raised interest rates and U.S. data showed the world’s largest economy rebounded more than expected in the third quarter.

The ECB raised its deposit rate by 75 basis points to the highest level since 2009 at 1.5% to prevent rapid price growth from becoming entrenched. Further rate hikes are almost certain, but with the economy ‘softening’, the pace of interest rate hikes is still up for debate.

ECB President Christine Lagarde said at the news conference, while risks to the eurozone’s growth outlook have turned to the downside, the central bank has made substantial progress in removing monetary accommodation through three consecutive rate increases.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9999 line today. If the EUR runs below the 0.9999 line, then pay attention to the support strength of the two positions of 0.9909 and 0.9852. If the strength of EUR rises over the 0.9999 line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound closed 0.58% lower against the dollar at 1.1560 on Thursday, 27th October 2022 it has gained for two days after the appointment of Sunak as British prime minister.

UK economic activity contracted at its fastest pace in nearly two years in October, suggesting the country has fallen into recession amid political uncertainty and high energy and borrowing costs that could put pressure on the pound.

In addition, the strike in the United Kingdom is still ongoing, which weighed heavily on economic growth and the pound. British railway workers union RMT announced a strike action that will take place on 9th November 2022.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1396 and 1.1273. If GBP runs above the 1.1501 -line, then pay attention to the suppression strength of the two positions of 1.1607 and 1.1756.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell in oscillating trading Thursday, 27th October 2022 as a rising dollar overshadowed support from expectations that the Federal Reserve will slow rate hikes after next week’s policy meeting.

The data showed that the U.S. economy rebounded more than expected in the third quarter amid a shrinking trade deficit, returning to growth after contracting in the first half of the year. By raising rates, the Fed will discourage consumers from making large purchases.

The market expects the Fed to raise the target overnight rate by another 75 basis points at its November 1-2 policy meeting, with the possibility of a scaled-back rate hike in December. U.S. rate hike would increase the opportunity cost of holding non-yielding gold.

In addition to next week’s U.S. monetary policy meeting, investors will focus on the release on Friday of U.S. personal income data for September, which will include the latest reading of an inflation measure closely watched by the Fed.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1668-line today. If the gold price runs below the Gold pays attention to the 1668-line today. If the gold price runs below the 1668-line, then it will pay attention to the support strength of the 1661 and 1645 positions. If the gold price breaks above the 1668-line, then pay attention to the suppression strength of the two positions of the 1675 and 1682.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose more than $1 on Thursday, 27th October 2022 extending a nearly 3 percent rally from the previous day, as optimism over record U.S. crude exports and signs of waning recession fears overshadowed concerns about weak demand from China.

Technical Analysis:

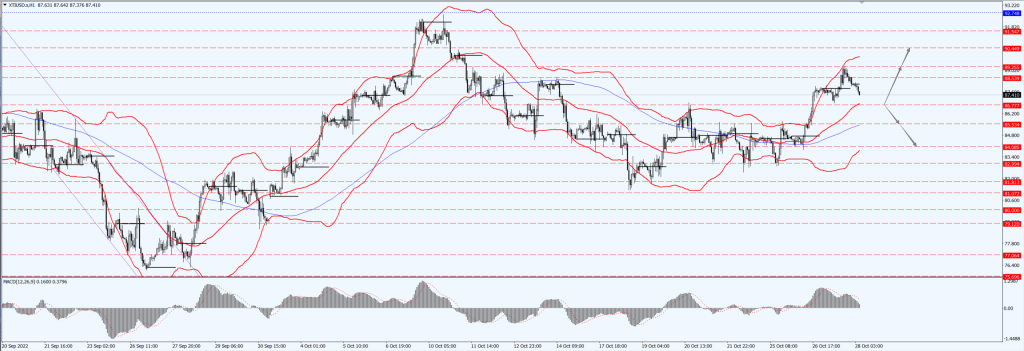

(Crude Oil 1-hour Chart)

Oil prices focus on the 86.77 line today. If the oil price runs above the 86.77-line, then focus on the suppression strength of the two positions of 89.25 and 90.44. If the oil price runs below the 86.77-line, then pay attention to the support strength of the two positions of 85.53 and 84.08.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.