1. Forex Market Insight

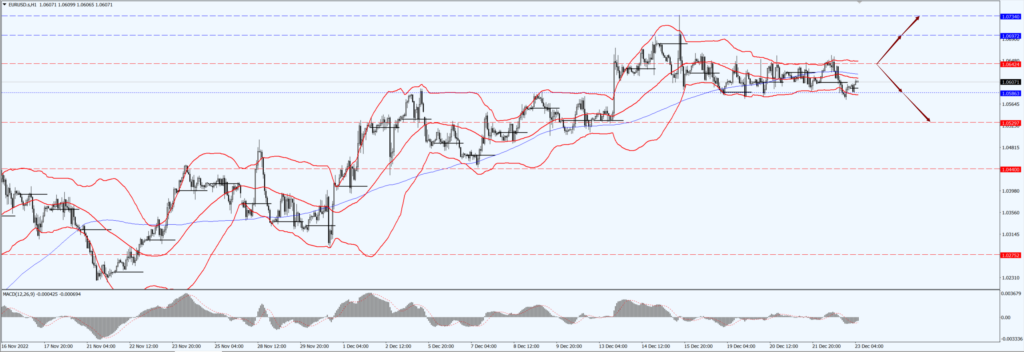

EUR/USD

The ECB may tighten monetary policy more than the Bank of England next year. So far this year, the euro has topped the performance of the G10 currencies, with only the dollar and the Swiss franc outperforming the euro.

Considering the Russian-Ukrainian conflict and the current recession that the eurozone may be in, the euro’s performance in the G10 currencies can be quite bright. The euro fell 0.1% against the dollar on Thursday to close at $1.0595, after having risen 0.5% earlier in the session.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0642 line today. If the EUR runs below the 1.0642 line, then pay attention to the support strength of the two positions of 1.0586 and 1.0529. If the strength of EUR rises over the 1.0642 line, then pay attention to the suppression strength of the two positions of 1.0697 and 1.0734.

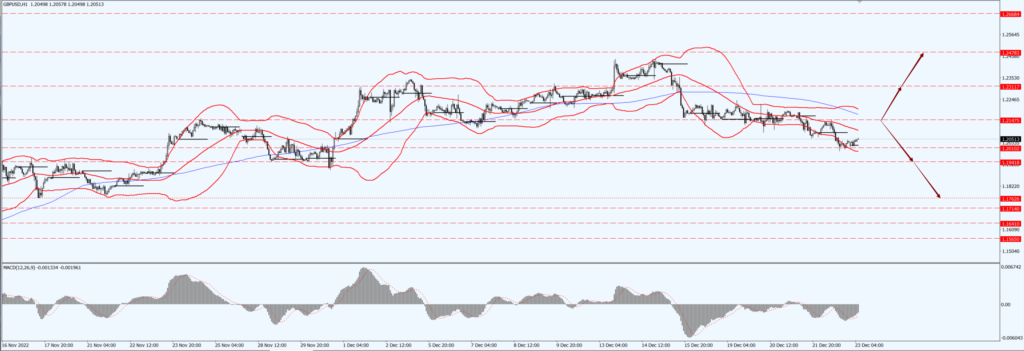

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell to a new three-week low against the dollar on Thursday, 22nd December 2022 falling 0.44% to close at $1.2034 after data showed the U.K. economy contracted slightly more than expected.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2147-line today. If GBP runs below the 1.2147-line, it will pay attention to the suppression strength of the two positions of 1.194 and 1.1762. If GBP runs above the 1.2147-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell Thursday 22nd December 2022 after U.S. economic data showed the economy rebounded faster than previously estimated, boosting the dollar and potentially making the Federal Reserve more aggressive on its path to fighting inflation.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1783-line today. If the gold price runs below the 1783-line, then it will pay attention to the support strength of the 1768 and 1747 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of 1793 and 1808.

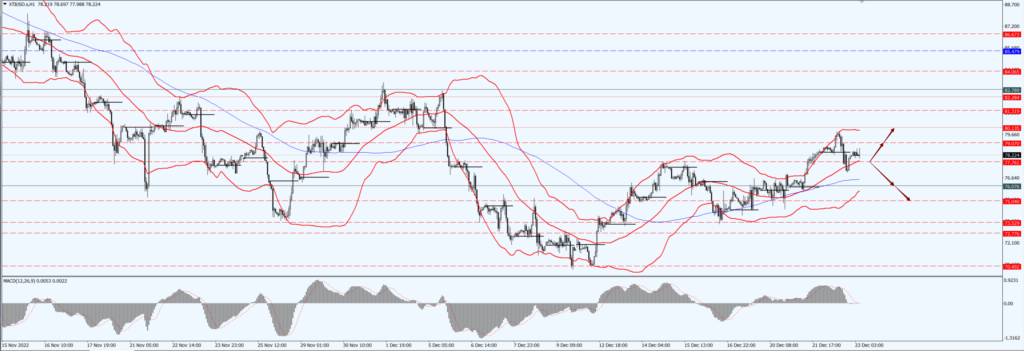

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell about $1 in choppy trading Thursday, 22nd December 2022 with the impact of a U.S. winter storm that has strained the country’s crude inventories overshadowed by concerns that a Fed rate hike and a surge in new crown cases will dampen demand.

Earlier in the session, both major indicator crudes were up $1 at one point. Oil prices gave back gains after the release of U.S. economic data. The data showed that initial jobless claims rose less than expected last week and that the economy rebounded faster than previously estimated in the third quarter.

The strong data heightened concerns that the Federal Reserve is more likely to raise interest rates further, which could slow the economy and hamper fuel consumption.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 77.76- line today. If the oil price runs above the 77.76 -line, then focus on the suppression strength of the two positions of 79.07 and 80.13. If the oil price runs below the 75.04 -line, then pay attention to the support strength of the two positions of 76.07 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.