1. Forex Market Insight

EUR/USD

Retail sales in the U.S. rose 3.0% last month, the largest increase in nearly two years, and unrevised data for December showed a 1.1% decline in retail sales.

Economists had forecast retail sales to rise 1.8% in January, with estimates ranging from 0.5% to 3.0%. The U.S. government reported that consumer prices accelerated in January, rising 0.5% on a month-over-month basis, partly due to higher rent and food costs.

The rise was in line with the expectations of economists interviewed by Reuters and well above the 0.1% monthly increase in December. Prices rose 6.4% year-on-year, down from 6.5% in December, but higher than the 6.2% increase expected by economists.

Dragged down by a stronger dollar, the euro fell 0.5% against the dollar on Wednesday, 15th February 2023, to close at $1.0686.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0697 line today. If the EUR runs below the 1.0697 line, then pay attention to the support strength of the two positions of 1.0642 and 1.0529. If the strength of EUR rises over the 1.0697 line, then pay attention to the suppression strength of the two positions of 1.0776 and 1.0802.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell 1.17% against the dollar to $1.2032 on Wednesday, 15th February 2023, after data showed that British inflation fell more than expected in January to an annual rate of 10.1%, partially easing pressure on the Bank of England to continue raising interest rates.

Technical Analysis:

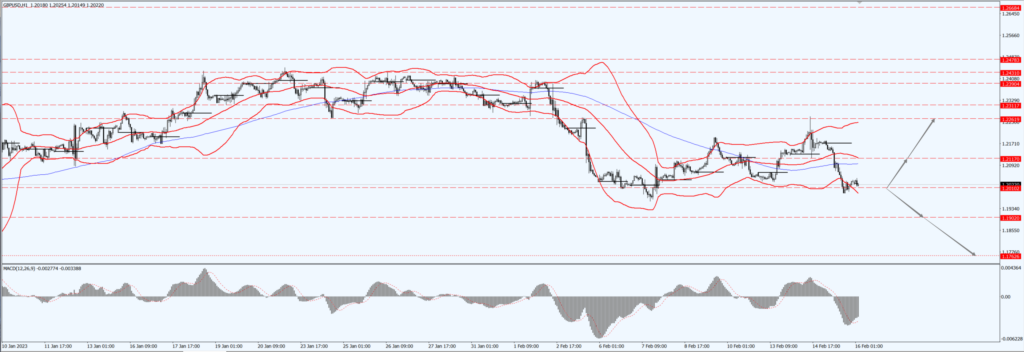

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2010-line today. If GBP runs below the 1.2010-line, it will pay attention to the suppression strength of the two positions of 1.1902 and 1.1762. If GBP runs above the 1.2010-line, then pay attention to the suppression strength of the two positions of 1.2117 and 1.2261.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices hit their lowest in more than a month on Wednesday, 15th February 2023, weighed down by a stronger dollar and better-than-expected U.S. economic data that raised concerns about possible further interest rate hikes by the Federal Reserve.

U.S. retail sales rose 3% in January from a year earlier, indicating that the economy remains resilient despite rising borrowing costs.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1832-line today. If the gold price runs below the 1832-line, then it will pay attention to the support strength of the 1820 and 1808 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of 1847 and 1868.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell slightly on Wednesday, 15th February 2023, as the dollar strengthened and investors worried that rising interest rates would slow the economy and hit fuel demand.

The decline was limited as the market took into account that it was data adjustments that led to a large increase in U.S. crude inventories and the International Energy Agency (IEA) raised its forecast for global oil demand growth.

The IEA raised its forecast for oil demand growth in 2023 and said there could be a supply shortage in the second half of the year due to constrained output from the Organization of the Petroleum Exporting Countries (OPEC) and an allied coalition of OPEC+ oil producers.

The IEA said China will account for nearly half of this year’s oil demand growth after the country eased its new crown restrictions, and also said that by the end of the first quarter, Russian production will be reduced by about 1 million barrels per day by the impact of the ban on European seaborne imports and the implementation of price caps by the Group of Seven (G7).

OPEC also raised its forecast for global oil demand growth on Tuesday, noting that the market will be tighter in 2023.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 78.93 – line today. If the oil price runs above the 78.93 -line, then focus on the suppression strength of the two positions of 80.13 and 8131.28. If the oil price runs below the 78.83 -line, then pay attention to the support strength of the two positions of 78.14 and 77.31.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.