1. Forex Market Insight

EUR/USD

The euro fluctuated against the U.S. dollar last week, mainly due to the strong U.S. dollar, and the European Central Bank’s interest rate hike expectations limited the euro’s decline.

The latest statistics released by Eurostat show that the Harmonized Consumer Price Index (HICP) in the eurozone recorded a year-on-year increase of 8.5% in January, a decrease of 0.7 percentage points from 9.2% in December 2022.

Sub-item data show that energy prices in the eurozone rose 17.2% year-on-year in January, lower than the 25.5% in December last year. The decline in energy prices is the main reason for lowering inflation.

The European Central Bank started to raise interest rates in July last year and has raised interest rates four times in a row, with a cumulative increase of 250 basis points.

European Central Bank President Christine Lagarde reiterated after raising interest rates this month that the European Central Bank still prioritizes curbing inflation. It is expected that interest rates in the eurozone will peak at 3.5% in the summer of 2023.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0697 line today. If the EUR runs below the 1.0697 line, then pay attention to the support strength of the two positions of 1.0642 and 1.0529. If the strength of EUR rises over the 1.0697 line, then pay attention to the suppression strength of the two positions of 1.0776 and 1.0802.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell against the U.S. dollar last week, and British inflation fell and economic recession expectations rose, further putting pressure on the pound.

According to data released by the National Bureau of Statistics of the United Kingdom on February 15, the British Consumer Price Index (CPI) rose by 10.1% year-on-year in January, which was lower than the 10.5% increase in December last year, shrinking for the third consecutive month.

Slower increases in transportation, catering and hotel prices were the main reasons for the drop in inflation for the month, the data showed. There are growing signs that UK business costs are “slowing down” as prices such as crude oil and electricity fall, but remain high overall, especially in the steel and food sectors.

The labor market has shown signs of easing, suggesting that upward pressure on inflation from rising wages may be easing. This is by far the clearest signal from the Bank of England to slow down the pace of interest rate hikes, indicating that the central bank may raise interest rates by 25 basis points or even pause interest rate hikes in March.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2010-line today. If GBP runs below the 1.2010-line, it will pay attention to the suppression strength of the two positions of 1.1902 and 1.1762. If GBP runs above the 1.2010-line, then pay attention to the suppression strength of the two positions of 1.2117 and 1.2261.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Oil prices settled down more than $2 on Friday, 17th February 2023, and fell sharply for the week as traders worried that further U.S. interest rate hikes would weigh on demand and were nervous about growing signs of ample supplies of crude and refined products.

The U.S. Energy Information Administration (EIA) reported on Wednesday that crude inventories jumped by 16.3 million barrels in the week to Feb. 10 to 471.4 million barrels, the highest level since June 2021. Heating oil crack spreads fell 5% on Friday, 17th February 2023 as warm weather in mid-February reduced demand.

Saudi Energy Minister Prince Abdulaziz said the current OPEC+ production pact by OPEC and its allies would remain in place until the end of the year, adding that he remained cautious about China’s demand forecasts.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1832-line today. If the gold price runs below the 1832-line, then it will pay attention to the support strength of the 1820 and 1808 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of 1847 and 1868.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices settled down more than $2 on Friday, 17th February 2023 and fell sharply for the week as traders worried that further U.S. interest rate hikes would weigh on demand and were nervous about growing signs of ample supplies of crude and refined products.

The U.S. Energy Information Administration (EIA) reported on Wednesday that crude inventories jumped by 16.3 million barrels in the week to Feb. 10 to 471.4 million barrels, the highest level since June 2021. Heating oil crack spreads fell 5% on Friday, 17th February 2023 as warm weather in mid-February reduced demand.

Saudi Energy Minister Prince Abdulaziz said the current OPEC+ production pact by OPEC and its allies would remain in place until the end of the year, adding that he remained cautious on China’s demand forecasts.

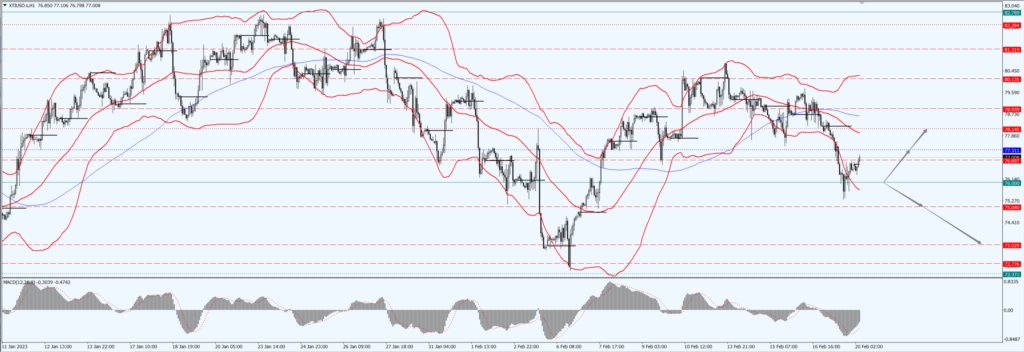

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices today focus on 76.00 – line, if oil prices run at 76.00 – line above, then pay attention to 77.31 and 78.14 two positions of suppression strength; if oil prices run at 76.00 – line below, then pay attention to 75.04 and 73.52 two positions of support strength.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.