1. Forex Market Insight

EUR/USD

The euro hit a new nine-month high of $1.0874 against the dollar earlier Monday, 16th January 2023, before retreating to close at $1.0820, down about 0.11%.

Germany, Italy, and Slovakia are all expected to have lower GDP in 2023 than they did before the outbreak. Moody’s expects the eurozone’s sovereign credit outlook to be negative this year, and said the region faces a “mild recession”.

Germany avoided an economic downturn in the fourth quarter of last year, as officials had previously predicted. Moody’s pessimistic outlook suggests that this surprisingly strong performance will not last. Moody’s said that if stagflation ensues, it could have “severe” credit consequences for some southern European countries.

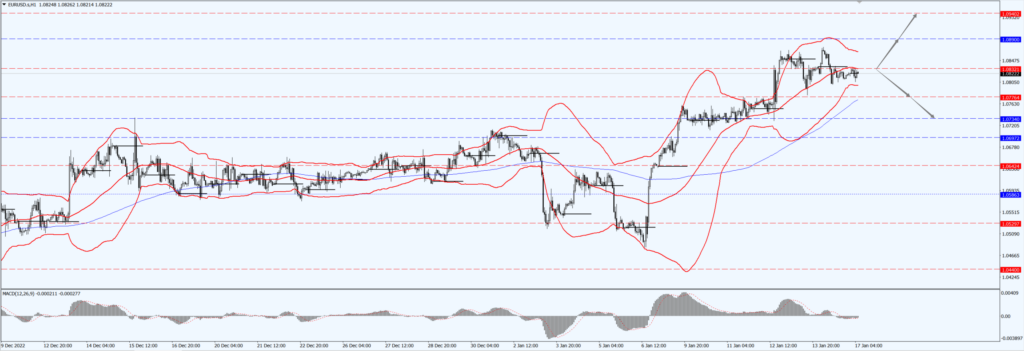

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0832 line today. If the EUR runs below the 1.0832 line, then pay attention to the support strength of the two positions of 1.0776 and 1.0734. If the strength of EUR rises over the 1.0832 line, then pay attention to the suppression strength of the two positions of 1.0890 and 1.0940.

GBP Intraday Trend Analysis

Fundamental Analysis:

The U.K. gross domestic product (GDP) monthly report showed that the U.K. economy unexpectedly expanded by 0.1% in November, compared to expectations of -0.2% and the previous value of 0.5%.

Meanwhile, the services index for the three months ending November came in at -0.1%, compared to expectations of -0.4% and the previous value of -0.1%. GBP/USD is expected to look steadily towards 1.30 this year.

While the market has anticipated that the UK economy is in recession, recent favorable energy price developments have increased the likelihood that the recession will be shallower and shorter than expected.

In the Bank of England’s latest forecast, they expect the recession could last until mid-2024. This pessimistic assessment leaves more room for unexpected growth in the year ahead.

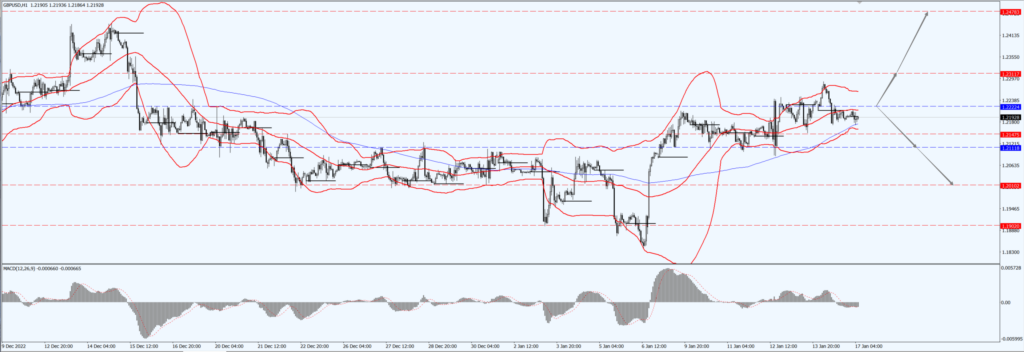

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2222-line today. If GBP runs below the 1.2222-line, it will pay attention to the suppression strength of the two positions of 1.2111 and 1.2010. If GBP runs above the 1.2222-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices retreated from more than eight-month highs on Monday, 16th January 2023, but remained above the key $1,900 per ounce level as the market expects the Federal Reserve to be less aggressive on interest rate hikes.

Spot gold fell 0.3 percent to $1,914.16 an ounce, after touching its highest since late April at $1,929 earlier in the session.

Technical Analysis:

(Gold 1-hour Chart)

GGold pays attention to the 1909-line today. If the gold price runs below the 1909-line, then it will pay attention to the support strength of the 1892 and 1880 positions. If the gold price breaks above the 1909-line, then pay attention to the suppression strength of the two positions of 1910 and 1932.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell Monday 16th January 2023, but held near their highest level so far this month, easing restrictions on new crowns and raising hopes for a recovery in its demand.

Both major indicators of crude oil rose more than 8% last week, the biggest weekly gain since October, and China’s crude oil imports rose 4% in December from a year earlier, while travel is expected to pick up during the Chinese New Year holiday that begins this weekend, brightening the outlook for the transportation fuel.

The Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) will release their monthly reports this week, which investors will be watching closely to gauge the outlook for global supply and demand.

The market is also watching the World Economic Forum in Davos, which opens on Monday, and this week’s Bank of Japan meeting to determine whether the central bank will defend its mega-stimulus policy.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 79.28- line today. If the oil price runs above the 79.28 -line, then focus on the suppression strength of the two positions of 80.13 and 81.31. If the oil price runs below the 79.28 -line, then pay attention to the support strength of the two positions of 78.14 and 76.94.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.