1. Forex Market Insight

EUR/USD

EUR/USD holds steady, failing to break the lowest record of 1.0757 since April 2020, which was set last week. The officials of the European Central Bank delivered hawkish comments, with markets betting that interest rates in the Euro zone will rise soon.

The European Central Bank is widely expected to raise interest rates at the beginning of the third quarter. Yet, the latest Euro zone PMI data published last week indicated a sharp increase in activity in the Euro zone’s dominant services sector in April, while manufacturers struggled as supply chain disruptions caused by the pandemic were exacerbated by Russia’s invasion of Ukraine.

Accordingly, the poor overall economic conditions in the Euro area and the differences in monetary policy between Europe and the United States will continue to be negative for the Euro. Coupled with the rise on the wall of the dollar, it is still difficult to change the weak trend of the Euro in the near future.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0776-line today. If the euro runs steadily below the 1.0776-line, then pay attention to the support strength of the two positions of 1.0734 and 1.0697. If the strength of the euro breaks above the 1.0776-line, then pay attention to the suppression strength of the two positions of 1.0832 and 1.0890.

GBP Intraday Trend Analysis

Fundamental Analysis:

The U.S. dollar index was last up 0.33% at 100.63, having been in decline for most of the session after Federal Reserve Chairman Jerome Powell said a 50 basis point rate hike would be discussed at its May meeting and that a slightly faster pace of action by the FOMC would be appropriate.

Coupled with the strong U.S. economy and less impact from the Russian-Ukrainian conflict, the Fed may still raise interest rates faster and more aggressively than the Bank of England, leading to continued weakness in the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2872-line today. If the pound runs above the 1.2872-line, it will pay attention to the suppression strength of the two positions of 1.2807 and 1.2668. If the pound runs below the 1.2872-line, then pay attention to the support strength of the 1.2991-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Russian negotiators confirmed that they had held “several long-term talks” with Ukraine, which cooled risk aversion, while signs of accelerated tightening by the Federal Reserve boosted U.S.

Treasury yields and helped the U.S. dollar index hit three consecutive weekly rises, repeatedly refreshing more than two-year high, causing gold prices to mark their largest weekly decline since mid-March. The survey shows that the market’s bullish sentiment on the gold market outlook has dropped significantly.

There are few economic data on this trading day, focusing on news related to the situation in Russia and Ukraine and the pandemic.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1940-line today. If the gold price runs steadily above the 1940-line, then it will pay attention to the support strength of the 1958 and 1974 positions. If the gold price breaks below the 1940-line, then pay attention to the suppression strength of the two positions of the 1919-line and 1909-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

When the United States called on European countries to impose sanctions on Russia, France also joined the sanctions.

The Russo-Ukrainian War reflects the scale of European dependence on Russian energy. On top of that, Macron called on Europe to reduce its dependence on Russian fossil fuels, moreover, he advocated nuclear energy as a means to establish French energy sovereignty.

The European Union is ready to impose sensible sanctions on Russian oil imports. If Russian oil is sanctioned, oil prices may continue to rise.

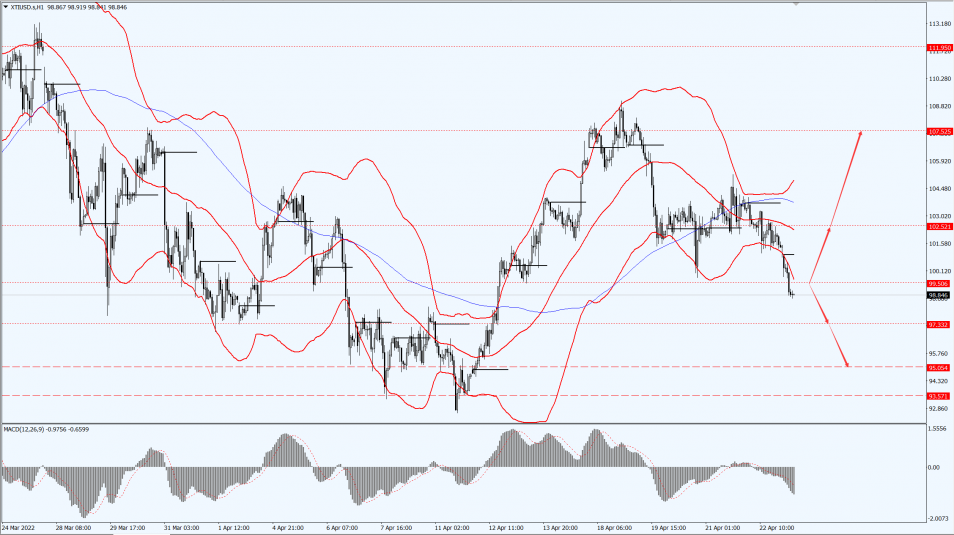

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 99.50-line today. If the oil price runs above the 99.50-line, then focus on the suppression strength of the 102.52 and 107.52 positions. If the oil price runs below the 99.50-line, then pay attention to the support strength of the 97.33 and 95.05 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.