EUR/USD remained under pressure as it closed down 0.03% at 0.9702 on Wednesday, 12th October 2022.

The Fed’s aggressive interest rate hikes have put currencies such as the euro under pressure, and the economic outlook for the eurozone has become more pessimistic, facing high costs and industrial relocation.

The Federal Reserve and the European Central Bank to fight inflation by raising interest rates in a big way, but the suppression effect is difficult to show in the short term, while the trend of recession in the U.S. and European economies is becoming more and more obvious.

It is expected that from the fourth quarter of this year to the first quarter of next year, the U.S. consumer and labor market momentum will weaken significantly, and the recession will follow.

This will have a significant impact on the world economy.

At the same time, tight energy supply and high prices are the main reason for the eurozone economy towards recession, the European Central Bank to raise interest rates and tighten the financing environment, but also for the economic outlook over a layer of gloom.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9701-line today. If EUR runs steadily below the 0.9701-line, then pay attention to the support strength of the two positions of 0.9641 and 0.9559. If the strength of EUR breaks above the 0.9701-line, then pay attention to the suppression strength of the two positions of 0.9770 and 0.9810.

GBP Intraday Trend Analysis

Fundamental Analysis:

Long-term U.K. government bond yields jumped again, with the 20-year hitting a 14-year high, after Bank of England Governor Tony Blair reiterated late Tuesday, 11th October 2022, that the central bank would end its emergency bond-buying program on Friday, 14th October 2022, and asked pension fund managers to complete rebalancing their positions by then.

The pound fell to a two-week low of $1.0925 after Bailey’s speech, which was reiterated by a central bank spokesman on Wednesday.

The pound later rallied to $1.1083, up 1.2%, after the Financial Times reported that the Bank of England hinted to private banks that it might extend its bond purchases.

Technical Analysis:

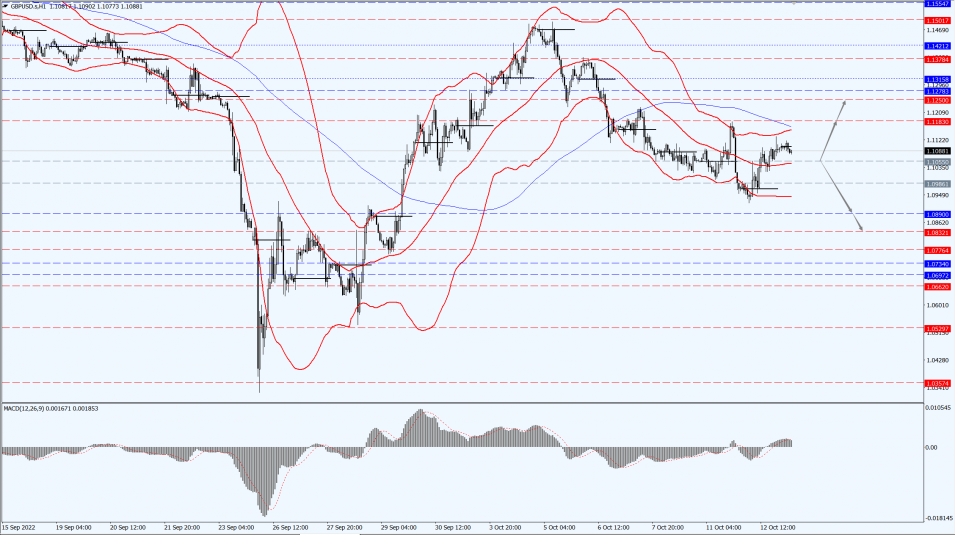

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1055-line today. If GBP runs below the 1.1055-line, it will pay attention to the suppression strength of the two positions of 1.0890 and 1.0832. If GBP runs above the 1.1055-line, then pay attention to the suppression strength of the two positions of 1.1183 and 1.1250.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices were firmer on Wednesday, 12th October 2022, with the dollar and U.S. Treasury yields falling after the release of the minutes of the Federal Reserve’s last policy meeting, providing support for gold prices.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1660-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1642 and 1627 positions. If the gold price breaks above the 1660-line, then pay attention to the suppression strength of the two positions of the 1680 and 1693.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Crude oil futures fell for a third straight day on Wednesday, 12th October 2022, on continued concerns about demand, a stronger dollar and expectations of further interest rate hikes by major central banks.

Both the Organization of Petroleum Exporting Countries (OPEC) and the U.S. Department of Energy have cut their demand forecasts.

Last week, OPEC, along with its allies including Russia, agreed to reduce supply by 2 million barrels per day, driving prices higher.

OPEC on Wednesday, 12th October 2022, lowered its forecast for global oil demand growth in 2022, the fourth cut since April, and also slashed its forecast for next year, citing a slowdown in the economy due to an epidemic as well as high inflation.

OPEC said in the report, “The world economy has entered a period of heightened uncertainty and rising challenges due to high inflation, tightening monetary policies by major central banks, high levels of sovereign debt in many regions, and persistent supply problems.”

The U.S. Department of Energy lowered its estimates for U.S. and global production and demand.

The department now expects U.S. crude oil consumption to grow by just 0.9% in 2023, down from its previous forecast of 1.7 percent growth.

Globally, the sector expects consumption to grow by only 1.5%, down from the previous forecast of 2% growth.

Technical Analysis:

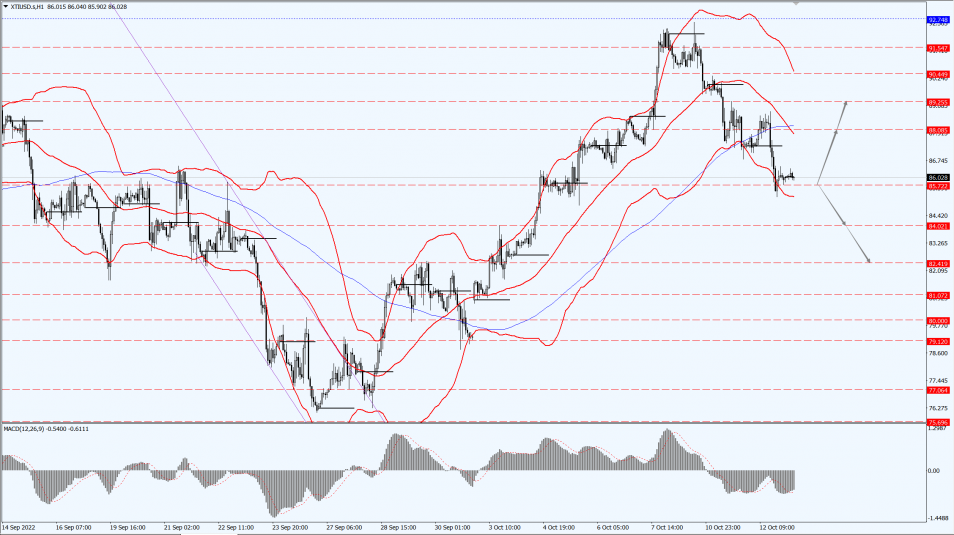

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85.72-line today. If the oil price runs above the 85.72-line, then focus on the suppression strength of the two positions of 88.08 and 89.25. If the oil price runs below the 85.72-line, then pay attention to the support strength of the two positions of 84.02 and 82.41.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.