1. Forex Market Insight

EUR/USD

The euro rose to a 20-day high ahead of Thursday’s (27th October 2022) European Central Bank meeting.

The ECB is expected to raise interest rates by 75 basis points at the meeting to rein in soaring inflation. The euro was up 0.87% against the dollar at $0.99595.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9909 line today. If the EUR runs below the 0.9909 line, then pay attention to the support strength of the two positions of 0.9852 and 0.9810. If the strength of EUR rises over the 0.9909 line, then pay attention to the suppression strength of the two positions of 1.0116 and 0.9999.

GBP Intraday Trend Analysis

Fundamental Analysis:

Sterling rallied to a six-week high on Tuesday, 25th October 2022 as risk sentiment improved supported by Rishi Sunak becoming British Prime Minister.

He is tasked with responding to the growing economic crisis and deep-rooted divisions within the ruling Conservative Party.

The pound surged to its highest since 15th September 2022 against the dollar, up 1.66% at $1.147.

Technical Analysis:

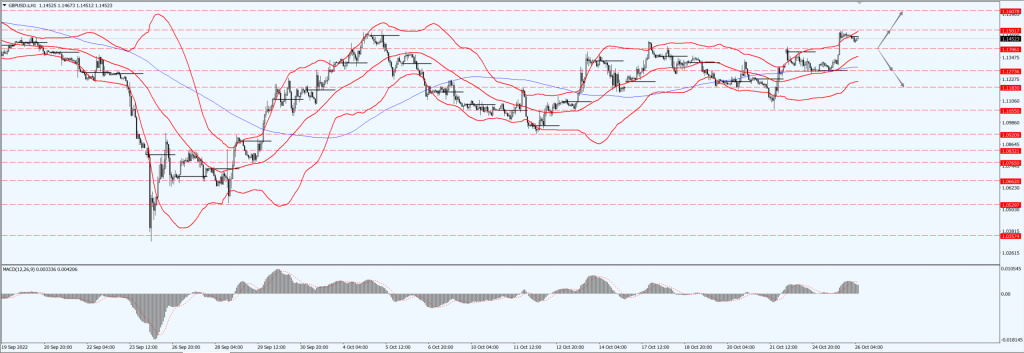

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1396-line today. If GBP runs below the 1.396-line, it will pay attention to the suppression strength of the two positions of 1.273 and 1.1183. If GBP runs above the 1.1396 -line, then pay attention to the suppression strength of the two positions of 1.1501 and 1.1607.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices edged higher on Tuesday, 25th October 2022. This comes after weak data of U.S economic stoked hopes the Federal Reserve will slow its aggressive pace of rate hikes and dragging the dollar lower.

A survey released Monday, 24th October 2022 showed that U.S. business activity contracted for the fourth straight month, triggered the market hopes that the aggressive rate rising stance of the Federal Reserve might soften.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1645-line today. If the gold price runs below the 1645-line, then it will pay attention to the support strength of the 1637 and 1627 positions. If the gold price breaks above the 1645-line, then pay attention to the suppression strength of the two positions of the 1661 and 1675.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices edged up on Tuesday, 25th October 2022, rebounding from an early fall of more than $1 a barrel, buoyed by a weaker dollar and supply concerns highlighted by Saudi Arabia’s energy minister.

The dollar index fell in late afternoon trading, making dollar-denominated oil less expensive for holders of other currencies and helping push oil prices higher.

Saudi Energy Minister Prince Abdulaziz said on Tuesday, 25th October 2022 that some countries are using their emergency oil stocks to manipulate the market. That gave further support to oil prices.

Technical Analysis:

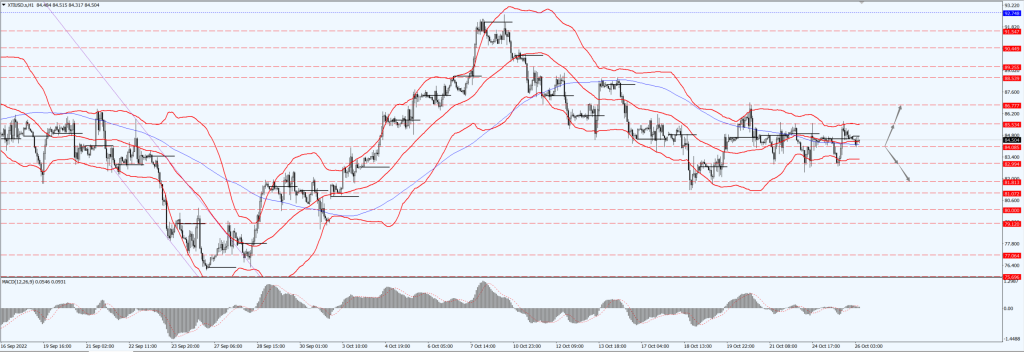

(Crude Oil 1-hour Chart)

Oil prices focus on the 84.08 line today. If the oil price runs above the 84.08-line, then focus on the suppression strength of the two positions of 85.53 and 86.77. If the oil price runs below the 84.08-line, then pay attention to the support strength of the two positions of 82.99 and 81.81.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.