1. Forex Market Insight

EUR/USD

Last week, the Federal Reserve announced its fourth consecutive rate hike of 75 basis points, bringing the cumulative rate hike for the year to 375 basis points.

At the press conference, Fed Chairman Jerome Powell admitted that he was considering slowing the pace of rate hikes but that the rate terminal would be higher than the 4.6% forecast at the September meeting. Some market participants believe the ECB’s policy will move closer to that of the Federal Reserve.

In response, Lagarde responded that the bank is paying close attention to the potential spillovers, but will not simply mimic their policies because the economic conditions of the 19 countries in the eurozone are not the same as those in the United States.

Lagarde said she noted the downward trend in the euro exchange rate, ” Clearly the exchange rate matters and has to be taken into account in our inflation projections.” At the same time she also reiterated her commitment to bring eurozone inflation down to the ECB’s 2%.

Inflation in the eurozone is very high and action must be taken, she said. To reduce inflation, the ECB dares to take any necessary measures and use any tools, including tapering.

Lagarde also pointed out that the bank still has a long way to go in the matter of raising interest rates. On Friday, 4th November 2022, the euro rose 2.2% against the dollar to $ 0.9960.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9909 line today. If the EUR runs below the 0.9909 line, then pay attention to the support strength of the two positions of 0.9852 and 0.9810. If the strength of EUR rises over the 0.9909 line, then pay attention to the suppression strength of the two positions of 0.9999 and 1.0116

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England announced at its policy meeting on Thursday, 3rd November 2022 that it would raise interest rates to 3% from 2.25%, the largest rate increase since 1989.

The Bank of England expects inflation to reach a 40-year high of about 11% this quarter and said the U.K. has entered a recession that is likely to last two years – longer than during the 2008-09 financial crisis.

Technical Analysis:

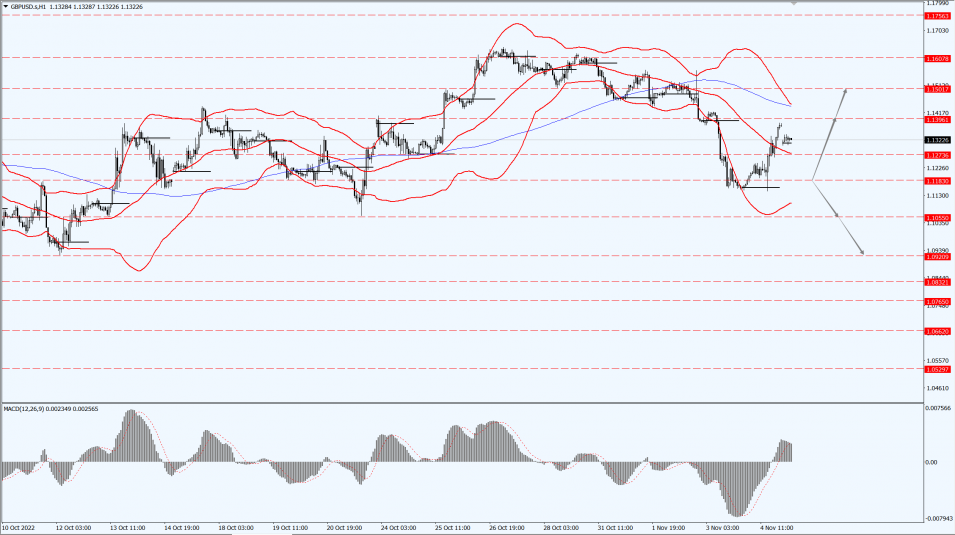

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1183-line today. If GBP runs below the 1.1183-line, it will pay attention to the suppression strength of the two positions of 1.1055 and 1.0920. If GBP runs above the 1.1183-line, then pay attention to the suppression strength of the two positions of 1.1396 and 1.1501.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices jumped 3% on Friday, 4th November 2022, as the dollar fell after data showed the U.S. unemployment rate rose in October, raising expectations that the Federal Reserve will soften its stance on aggressive rate hikes going forward.

U.S. employers hired more workers than expected in October, but the unemployment rate rose to 3.7 %, indicating a loosening of labor market conditions.

Technical Analysis:

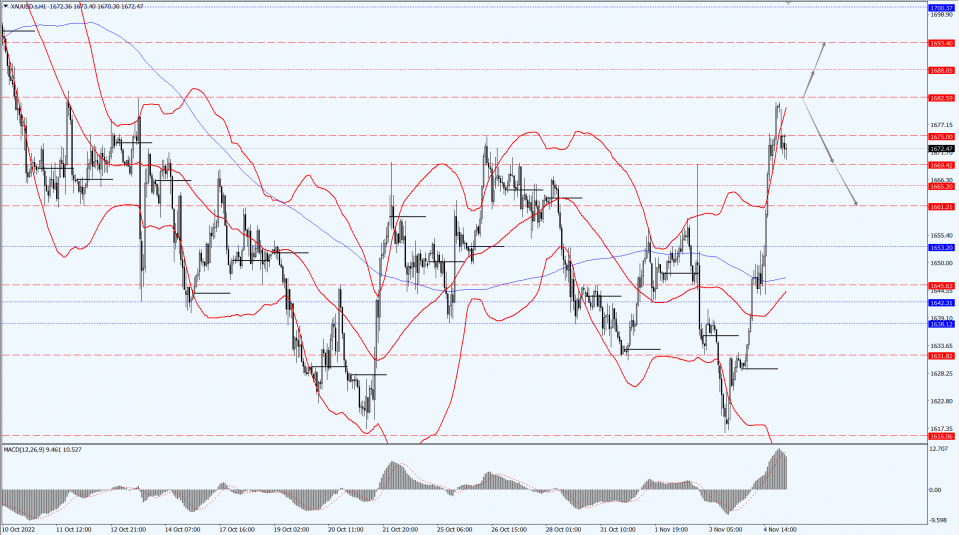

(Gold 1-hour Chart)

Gold pays attention to the 1682-line today. If the gold price runs below the 1682-line, then it will pay attention to the support strength of the 1669 and 1661 positions. If the gold price breaks above the 1682-line, then pay attention to the suppression strength of the two positions of the 1688 and 1693.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed up more than 5% on Friday, 4th November 2022 with the impending EU ban on Russian oil giving support to the market amid uncertainty over future interest rate hikes by the Federal Reserve. Fears of a global recession limited gains.

Technical Analysis:

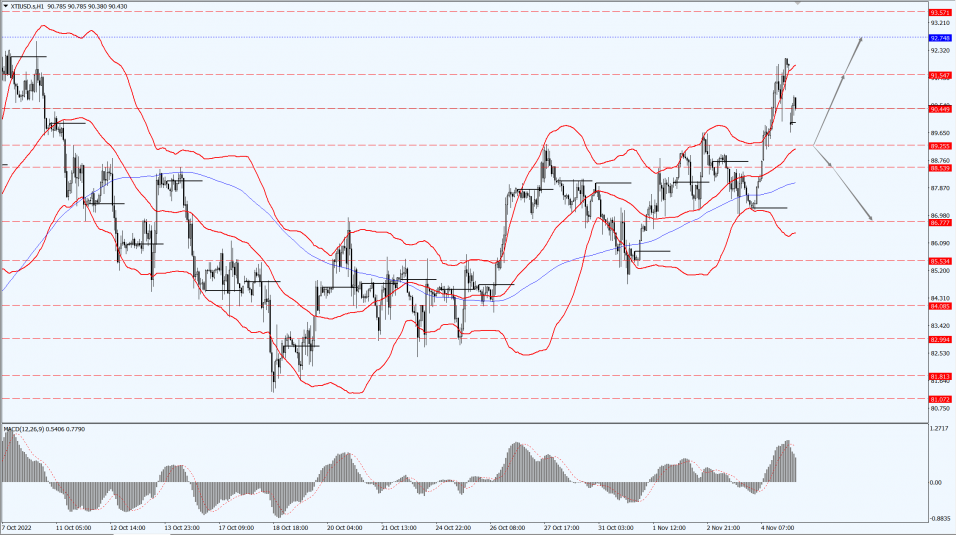

(Crude Oil 1-hour Chart)

Oil prices focus on the 89.25 line today. If the oil price runs above the 89.25-line, then focus on the suppression strength of the two positions of 91.54 and 92.74. If the oil price runs below the 89.25-line, then pay attention to the support strength of the two positions of 88.53 and 86.77.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.