1. Forex Market Insight

EUR/USD

A survey released Monday, 20th December 2022 showed that despite the energy crisis and high inflation, the economic outlook for Germany, Europe’s largest economy, improved near the end of the year, with German business confidence rising more than expected in December. The euro rose 0.2% to $1.06085.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0642 line today. If the EUR runs below the 1.0642 line, then pay attention to the support strength of the two positions of 1.0586 and 1.0529. If the strength of EUR rises over the 1.0642 line, then pay attention to the suppression strength of the two positions of 1.0734 and 1.0776.

GBP Intraday Trend Analysis

Fundamental Analysis:

The UK recession will be “mild but protracted”, with UK GDP expected to contract by 1.3% in 2023. The economy is likely to recover only partially by 2024, with growth expected to be 0.2%. 2022 rising energy and food prices, as well as rising headline inflation, have significantly reduced household purchasing power.

And rising interest rates have created another headwind to economic growth. Households are expected to rein in spending on non-essential items in 2023 in response to tightening incomes.

Technical Analysis:

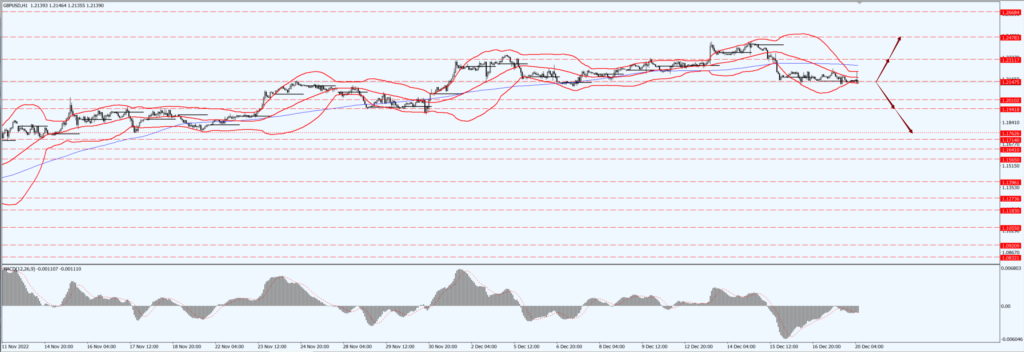

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2147-line today. If GBP runs below the 1.2147-line, it will pay attention to the suppression strength of the two positions of 1.194 and 1.1762. If GBP runs above the 1.2147-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell in muted trading Monday 20th December 2022 as expectations of higher interest rates pushed U.S. bond yields higher, overshadowing the impact of a weaker dollar. Spot gold fell 0.2% to $1,789.46 an ounce.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1793-line today. If the gold price runs below the 1793-line, then it will pay attention to the support strength of the 1783 and 1768 positions. If the gold price breaks above the 1793-line, then pay attention to the suppression strength of the two positions of 1808 and 1816.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose on Monday 20th December 2022 as optimism around easing restrictions on new crowns overshadowed concerns that a global recession will drag down energy demand. Energy ministers from European Union member states agreed Monday on a gas price cap after weeks of consultations on the emergency measure to curb the energy crisis to bridge differences of opinion among member states.

The price cap can be triggered from 15 February 2023. The agreement will enter into force after member states formally ratify it in writing.

Technical Analysis:

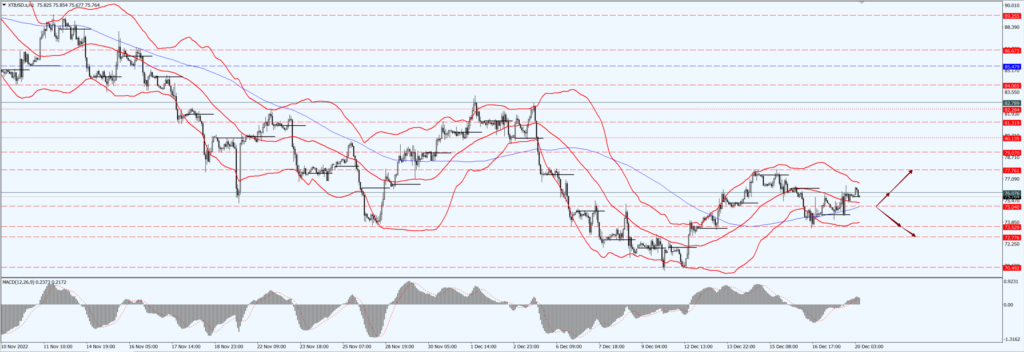

(Crude Oil 1-hour Chart)

Oil prices focus on the 75.04- line today. If the oil price runs above the 75.04 -line, then focus on the suppression strength of the two positions of 76.07 and 77.76. If the oil price runs below the 75.04 -line, then pay attention to the support strength of the two positions of 73.52 and 72.77.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.