1. Forex Market Insight

EUR/USD

U.S. consumer prices rose less than expected for a second straight month in November, posting the smallest year-over-year gain in nearly a year as gasoline and health care and used car and truck costs fell, data released Tuesday 13th December 2022 showed.

The U.S. consumer price index (CPI) climbed 7.1% in the 12 months to November, the smallest gain since December 2021, after rising 7.7% in October.

Excluding volatile food and energy prices, the core CPI rose 0.2% in November after rising 0.3% in October.

In the 12 months to November, core CPI rose 6.0% after a 6.3% increase in October. Non-U.S. currencies generally surged after the data was released, with the euro hitting a new more than six-month high against the dollar to 1.0672, closing at 1.0631, up about 0.89%.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0529 line today. If the EUR runs below the 1.0529 line, then pay attention to the support strength of the two positions of 1.0440 and 1.0275. If the strength of EUR rises over the 1.0529 line, then pay attention to the suppression strength of the two positions of 1.0586 and 1.0642.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England is about to release its December interest rate resolution and minutes, and the market generally expects the BoE to raise rates by 50 basis points this time.

The BoE is expected to raise rates by 50 basis points, bringing them to 3.50%. Market conditions have cooled down due to a more balanced fiscal policy, so the BoE is expected to resume a slower rate hike.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2311-line today. If GBP runs below the 1.2311-line, it will pay attention to the suppression strength of the two positions of 1.2147 and 1.1941. If GBP runs above the 1.2311-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold rose more than 1% Tuesday to its highest point in more than five months after a smaller-than-expected rise in U.S. consumer prices pushed expectations for a slowdown in interest rate hikes by the Federal Reserve.

Spot gold climbed 1.7% to $1,810.98 an ounce, touching its highest point since June 30 at the start of the session.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1808-line today. If the gold price runs below the 1808-line, then it will pay attention to the support strength of the 1783 and 1768 positions. If the gold price breaks above the 1808-line, then pay attention to the suppression strength of the two positions of 1832 and 1847.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Crude oil prices closed above $80 a barrel on Tuesday 13th December 2022 and posted their biggest one-day gain in more than a month as markets began to favor risky assets after U.S. data showed slowing inflation.

The market was also buoyed by supply disruption concerns, including the fact that the Keystone pipeline from Canada to the U.S. remains out of service after a massive leak last week.

Technical Analysis:

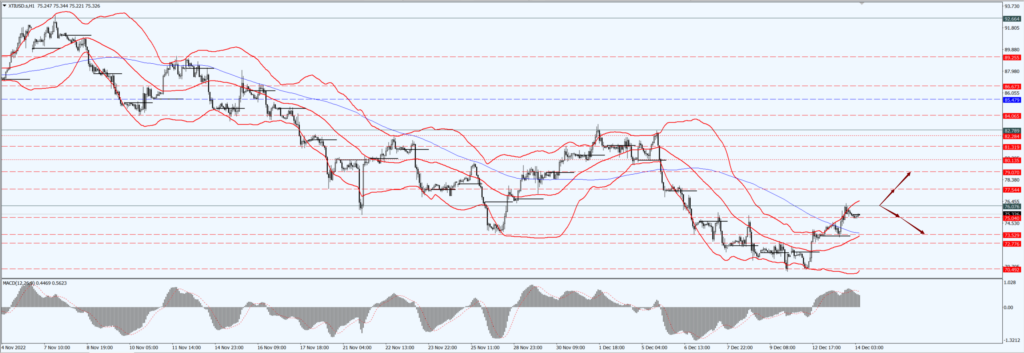

(Crude Oil 1-hour Chart)

Oil prices focus on the 76.07- line today. If the oil price runs above the 76.07 -line, then focus on the suppression strength of the two positions of 77.54 and 79.07. If the oil price runs below the 76.07 -line, then pay attention to the support strength of the two positions of 75.04 and 73.52.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.