1. Forex Market Insight

EUR/USD

The EUR/USD rose further on Wednesday, 27th October 2022, once hitting a high of 1.0092 and finally closing up 1.17% at 1.0083.

With the approach of European Central Bank’s (ECB) October meeting of Interest Rate Decision, interest rate hike expectations support the euro rose. However, economic risks may limit future gains.

This week, the ECB will again discuss interest rates. According to the information that have been disclosed and the statements of ECB officials, ECB will continue to raise interest rates, the market generally believes that ECB will continue to raise interest rates, but eurozone economic growth is weakening, the economic outlook is worrying.

The ECB will hold interest rate meetings on 27th October and 15th December, which will be the last two remaining meetings this year.

In the face of high inflationary pressure, the market generally expect that the ECB will continue to raise interest rates at this week’s meeting.

While central banks are expected to continue adjusting the interest rates, extra attention needs to be paid to the recessionary pressures facing the European economy.

The market expects the ECB to tighten policy more aggressively as winter approaches, possibly prompting a faster recession in the eurozone.

The IMF forecasts the Eurozone economy will grow 3.1% this year and 0.5% in 2023, respectively.

Among advanced economies, Germany’s economic growth rate in 2022 is expected to be 1.5%, and in 2023 is expected to fall into negative growth, growth rate of -0.3%.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9999 line today. If the EUR runs below the 0.9999 line, then pay attention to the support strength of the two positions of 0.9909 and 0.9852. If the strength of EUR rises over the 0.9999 line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound touched its highest level at 1.1638 on Wednesday, 26th October 2022 since 13th September, continuing its rally after Rishi Sunak became Britain’s prime minister, before closing up 1.39 percent at 1.1627.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1396 and 1.1273. If GBP runs above the 1.1501 -line, then pay attention to the suppression strength of the two positions of 1.1607 and 1.1756.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose to a two-week high on Wednesday, 26th October 2022, as markets expect the Federal Reserve to taper its aggressive stance on rate hikes from December, dragging down the dollar and U.S. bond yields.

Spot gold rose 0.8% to $1,665.09 per ounce, touching its highest since 13th October during the session. The focus today would be U.S. gross domestic product (GDP) data, followed by tomorrow’s U.S. core inflation data. These data could provide more clarity on the Fed’s rate hike trajectory.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1668-line today. If the gold price runs below the 1668-line, then it will pay attention to the support strength of the 1661 and 1645 positions. If the gold price breaks above the 1668-line, then pay attention to the suppression strength of the two positions of the 1675 and 1682.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices surged nearly 4% on Wednesday, 26th October 2022 supported by record high U.S. crude exports and higher U.S. refinery refining volumes than at the same time in previous years.

The dollar’s weakness also added support, as the recent strength of the dollar has been a factor that has clearly dampened oil market gains.

U.S. crude oil exports reached to a high record of 5.1 million barrels per day last week, causing net U.S. crude oil imports to fall to a record low. Capacity utilization at U.S. refineries remained steady at nearly 89%, the highest level for the same period since 2018.

Technical Analysis:

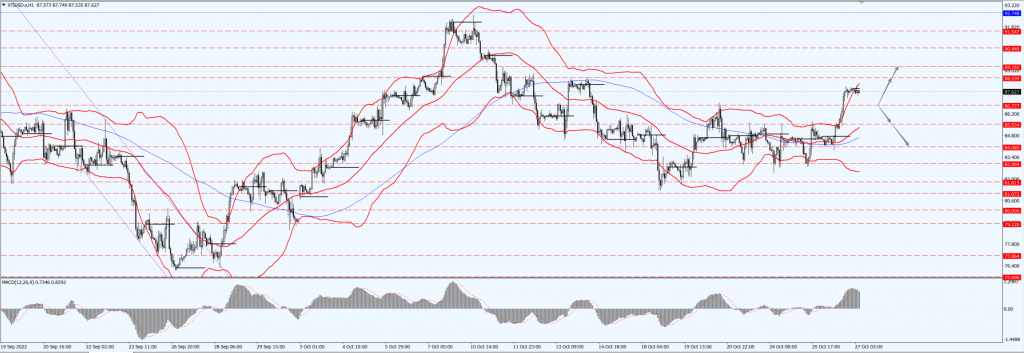

(Crude Oil 1-hour Chart)

Oil prices focus on the 86.77 line today. If the oil price runs above the 86.77-line, then focus on the suppression strength of the two positions of 88.53 and 89.25. If the oil price runs below the 86.77-line, then pay attention to the support strength of the two positions of 85.53 and 84.08.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.