1. Forex Market Insight

EUR/USD

After two rate hikes of 75 basis points, the ECB could scale back the pace of rate hikes, said Mario Centeno, governor of the Bank of Portugal and European Central Bank governing council member.

The ECB has a variety of tools at its disposal, and the interest rate tool is the instrument of choice to fight inflation.

When inflation peaks and its trajectory become predictable, other tools may be used. We must reduce the size of our balance sheet.

Technical Analysis:

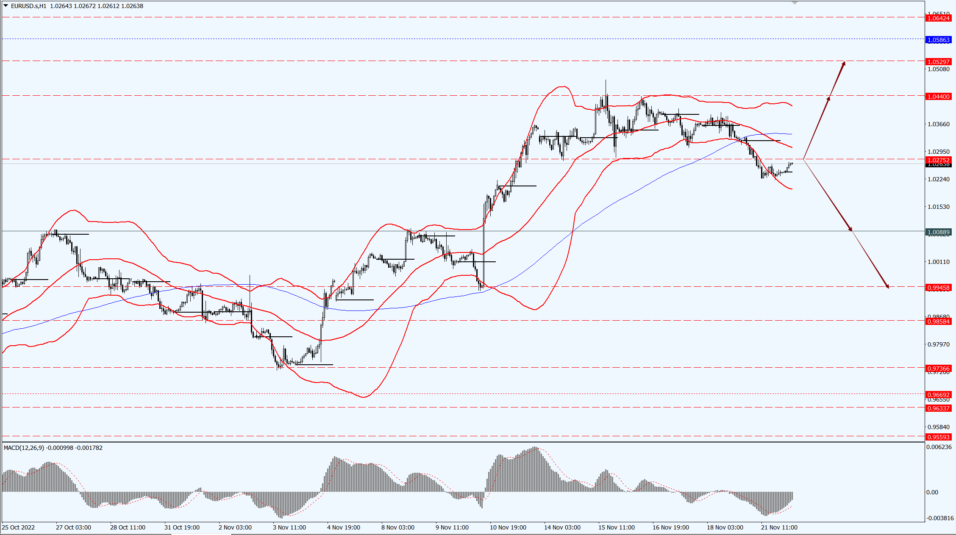

(EUR/USD 1-hour Chart)

We focus on the 1.0275 line today. If the EUR runs below the 1.0275 line, then pay attention to the support strength of the two positions of 1.0088 and 0.9945. If the strength of EUR rises over the 1.0275 line, then pay attention to the suppression strength of the two positions of 1.0440 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

A stronger dollar weighed on the pound on Monday, 21st November 2022 with the pound slipping 0.5% against the dollar to $1.1821, as the market braced for further weakness ahead of Tuesday’s public finance data and Wednesday’s preliminary PMI data.

Technical Analysis:

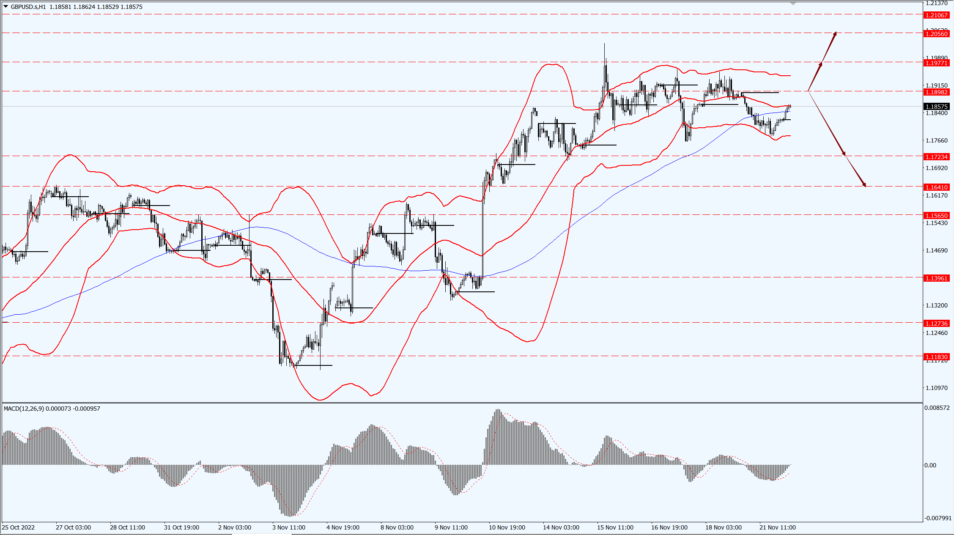

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1723-line today. If GBP runs below the 1.1723-line, it will pay attention to the suppression strength of the two positions of 1.1641 and 1.1565. If GBP runs above the 1.1723-line, then pay attention to the suppression strength of the two positions of 1.2056 and 1.2106.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices slid to their lowest in more than a week on Monday, 21st November 2022 down more than 1%, as the dollar extended gains and market attention turned to the minutes of the Federal Reserve’s November meeting to be released.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1747-line today. If the gold price runs below the 1747-line, then it will pay attention to the support strength of the 1727 and 1717 positions. If the gold price breaks above the 1747-line, then pay attention to the suppression strength of the two positions of 1754 and 1768.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices recovered from early losses Monday 21st November 2022 after Saudi Arabia denied reports that it was discussing increasing oil supplies with OPEC and its allies.

Near-month Brent crude futures spreads narrowed sharply last week, while U.S. crude reversed to positive spreads, reflecting waning supply concerns.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 79.07 line today. If the oil price runs above the 79.07-line, then focus on the suppression strength of the two positions of 81.12 and 82.78. If the oil price runs below the 79.07-line, then pay attention to the support strength of the two positions of 77.54 and 76.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.