1. Forex Market Insight

EUR/USD

The European Commission has approved a €49 billion economic support program for Germany. According to the plan, the economic assistance will take the form of direct grants through energy suppliers for eligible beneficiaries to reduce electricity, gas and heating bills before being reimbursed by the German government for the subsidies provided by energy suppliers.

European Commission Executive Vice President Margrethe Vestager said that many industrial and commercial sectors in Germany have been hit by rising energy prices. The 49 billion euro support program will allow Germany to mitigate the impact of rising energy costs on its economy and temporarily protect electricity, gas and heat consumers from extreme price increases.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0642 line today. If the EUR runs below the 1.0642 line, then pay attention to the support strength of the two positions of 1.0586 and 1.0529. If the strength of EUR rises over the 1.0642 line, then pay attention to the suppression strength of the two positions of 1.0697 and 1.0734.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound fell against the U.S. dollar on Wednesday, 11th December 2022 as British public borrowing hit a record high in November, highlighting the challenges facing the U.K. economy. The pound was down 0.8% at $1.2091.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2147-line today. If GBP runs below the 1.2147-line, it will pay attention to the suppression strength of the two positions of 1.194 and 1.1762. If GBP runs above the 1.2147-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices were flat on Wednesday, 11th December 2022 holding above the key $1,800 level, with expectations of a slowdown in U.S. interest rate hikes providing support, but a rising dollar limiting further gains.

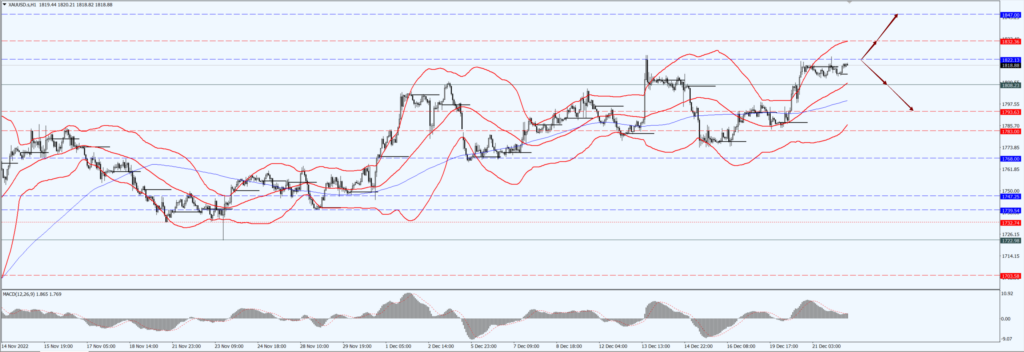

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1822-line today. If the gold price runs below the 1822-line, then it will pay attention to the support strength of the 1808 and 1793 positions. If the gold price breaks above the 1822-line, then pay attention to the suppression strength of the two positions of 1832 and 1847.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose more than $2 on Wednesday, 11th December 2022 after data showed a larger-than-expected decrease in U.S. crude inventories, but gains were limited as the U.S. is set to see a snowstorm that is expected to affect people’s travel plans.

Data from the U.S. Energy Information Administration (EIA) showed that U.S. crude oil inventories fell by 5.89 million barrels, compared with estimates of a 1.66 million barrel decrease. Market sources said data released by the American Petroleum Institute (API) on Tuesday, 10th December 2022 showed inventories fell by 3.1 million barrels in the week ended Dec. 16. Saudi Arabia’s energy minister said Tuesday 10th December 2022 that the much-criticized OPEC+ move to cut oil production has proven to be the right decision.

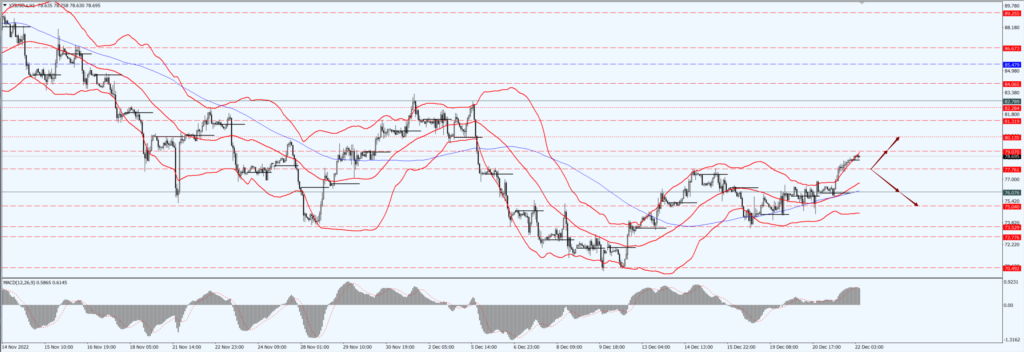

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 77.76- line today. If the oil price runs above the 77.76 -line, then focus on the suppression strength of the two positions of 79.07 and 80.13. If the oil price runs below the 75.04 -line, then pay attention to the support strength of the two positions of 76.07 and 75.04.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.