1. Forex Market Insight

EUR/USD

With inflation in the eurozone rising to record highs in recent months, the European Central Bank has abandoned its pledge not to raise interest rates this year. But now, the market is worried that the Ukraine crisis will drag down the eurozone no matter how it escalates.

Some policymakers are publicly advocating an end to bond purchases this year. The ECB has previously said that an end to bond purchases is a prerequisite for a rate hike.

Russian President Vladimir Putin officially recognized the independence of two separate regions in eastern Ukraine and ordered Russian troops to conduct “peacekeeping operations” in the region, escalating the security crisis there.

The West worries that the crisis could spark a massive war. An estimated 100,000 Ukrainians have fled their homes, the UN refugee agency said. Western countries such as the United States have responded with tough sanctions.

Technical Analysis:

(EUR/USD 1-hour chart)

Today, we will pay attention to the support strength of the 1.1096-line. If the euro runs steadily above the 1.1096-line, we will pay attention to the suppression strength of the two positions of 1.1267 and 1.1315. If the strength of the euro breaks below the 1.1096-line, we will pay attention to the support of the 1.1031-line.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Ukrainian-Russian conflict has temporarily amplified market moves in an already jittery market due to high inflation, rising interest rates and an imminent hike.

The market has fully priced in another 25bps rate hike by the Bank of England at its coming meeting on March 17, and another rate hike at its next meeting in May.

Technical Analysis:

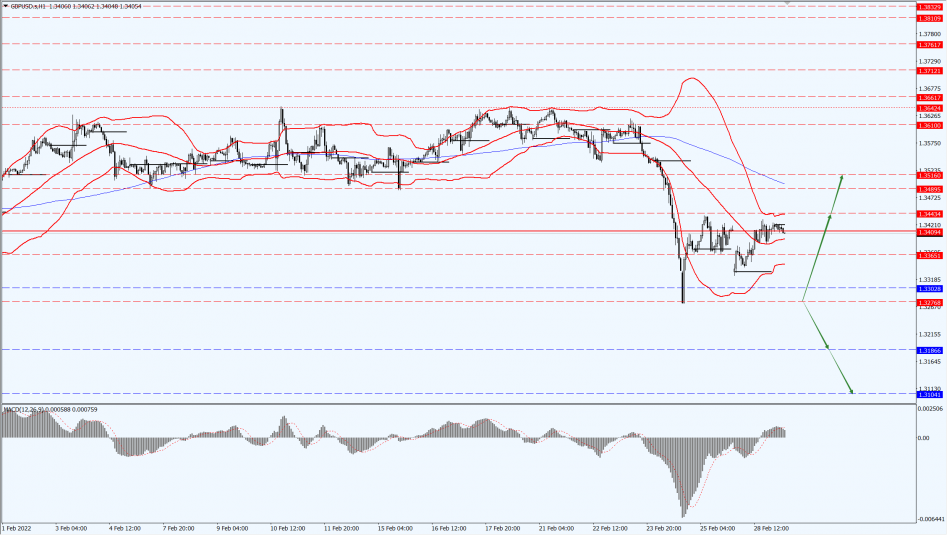

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3276-line today. If the pound runs above the 1.3276-line, it will is focused on the suppression of the two positions of 1.3443 and 1.3516. If the pound runs below the 1.3276-line, it will pay attention the support strength of the 1.3186-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Yesterday (28th February 2022), the spot gold price maintained a shaky upward trend during the European session. The overall performance of gold prices remained very strong as they maintained near the $1,900 mark.

The conflict between Russia and Ukraine fueled risk aversion in the market, supporting gold prices.

In addition, factors such as Western sanctions, central bank gold purchases, and the Fed’s slowdown in interest rate hike expectations are also supportive factors for gold prices. However, factors like stronger dollar limit the rise in gold prices.

Investors need to pay close attention to two key events this week, one is Federal Reserve Chairman Jerome Powell’s semi-annual policy speech to the U.S. Congress on Wednesday and Thursday.

Technical Analysis:

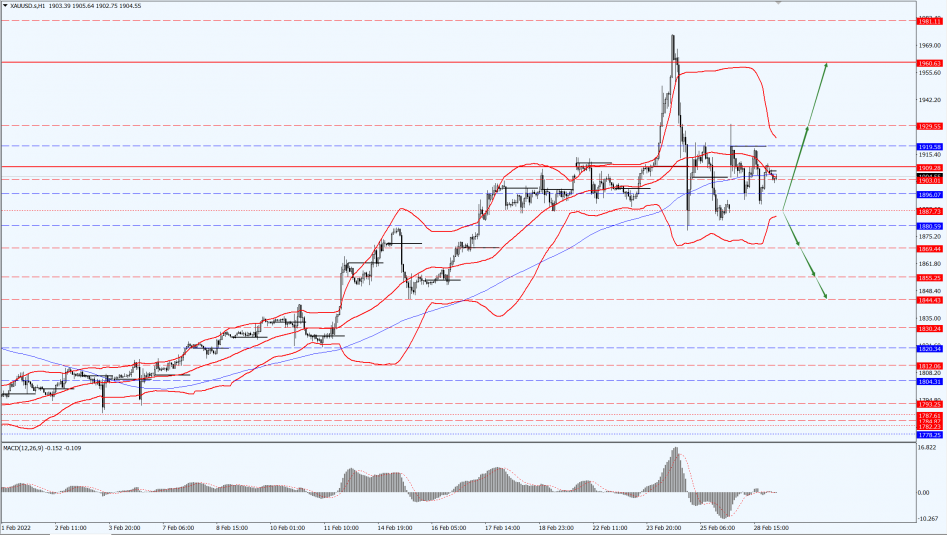

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1887-line today. If the gold price runs steadily above the 1887-line, then pay attention to the suppression of the 1929 and 1960 positions. If the gold price breaks below the 1887-line, it will open up further downward trend. At that time, pay attention to the strength of a position of 1869 and 1855.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, oil prices soared and U.S. oil was approaching the 100 mark. As Western allies imposed more sanctions on Russia and blocked some Russian banks from accessing the global payment system, this could have a serious impact on Russia’s oil exports.

With this, oil prices fell after news that the United States and other countries were considering using strategic crude oil reserves.

Technical Analysis:

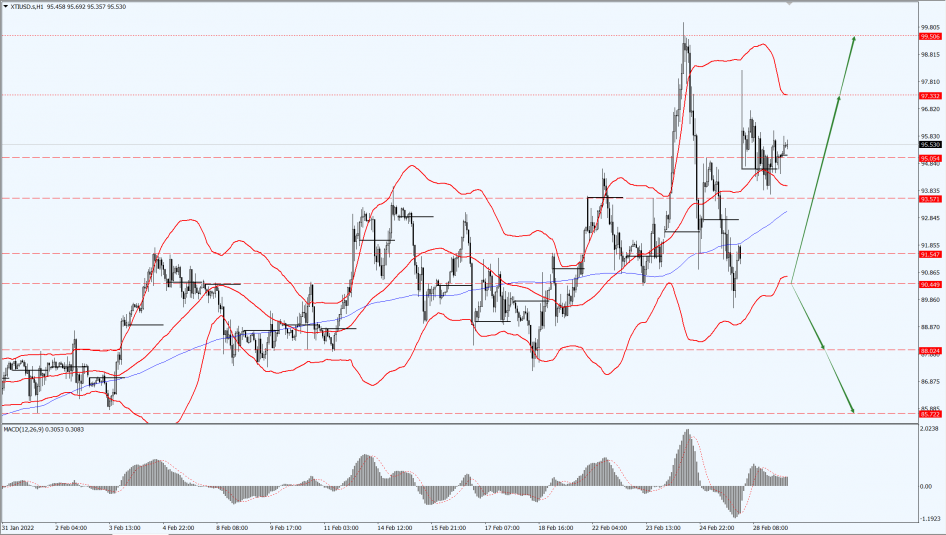

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 91.54-line today. If the oil price runs above the 91.54-line, then focus on the suppression of the 95.05 and 97.33 positions. If the oil price breaks below the 91.54-line, then pay attention to the support of the 90.44-line.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectaly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.