1. Forex Market Insight

EUR/USD

The euro fell slightly against the dollar to 1.0713 on Wednesday, 8th February 2023, not far from Tuesday’s new low of $1.0669 touched since Jan. 9.

But the euro is still well above the 20-year low of $0.953 touched in September. The market also digested hawkish statements from two German policymakers at the ECB.

German central bank president and ECB governing council member Nagel told Germany’s Stock Market Daily that the ECB needs to raise interest rates further sharply to push inflation back to 2%.

His colleague Schnabel said it was unclear whether the ECB’s rate hikes so far would push inflation back to 2%.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0729 line today. If the EUR runs below the 1.0729 line, then pay attention to the support strength of the two positions of 1.0697 and 1.0642. If the strength of EUR rises over the 1.0729 line, then pay attention to the suppression strength of the two positions of 1.0776 and 1.0802.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose 0.19% against the dollar to $1.2070 on Wednesday, 8th February 2023, recovering from a one-month low of $1.196 touched on Tuesday.

Recently, the pound has been a bit too weak as the market perceived the Bank of England’s meeting last Thursday to be cautious about the policy outlook.

Meanwhile, Peel noted that the Monetary Policy Committee has not yet reached a turning point in interest rates while reiterating that the central bank will take all necessary measures to reduce inflation in the UK.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2010-line today. If GBP runs below the 1.2010-line, it will pay attention to the suppression strength of the two positions of 1.902 and 1.782. If GBP runs above the 1.2010-line, then pay attention to the suppression strength of the two positions of 1.2111 and 1.2222.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose slightly in oscillating trading on Wednesday, 8th February 2023, as the market looked to more economic data to assess the Fed’s rate hike strategy.

New York Fed President Williams said Wednesday that the main motivation for him to make future Fed rate cut expectations is the need to react to the possibility of lower inflation levels in the future.

Gold is highly sensitive to U.S. interest rate hikes because they increase the opportunity cost of holding gold.

Following the strong U.S. jobs report, market participants are now awaiting next week’s January inflation data, which could provide more clues to the Fed’s rate hike path.

Technical Analysis:

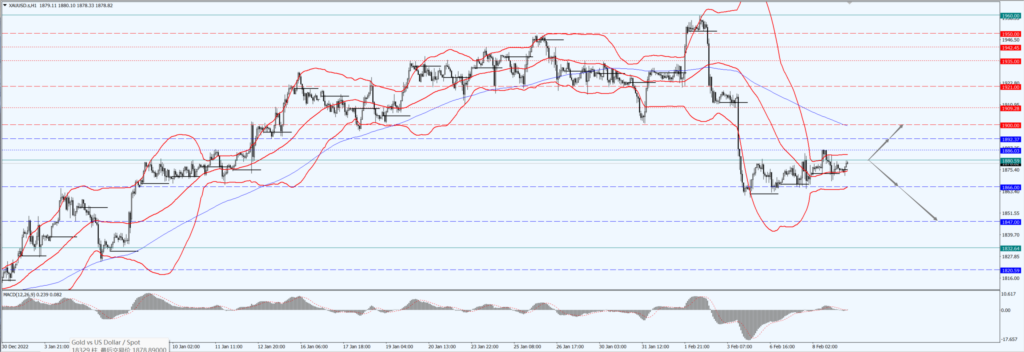

(Gold 1-hour Chart)

Gold pays attention to the 1880-line today. If the gold price runs below the 1880-line, then it will pay attention to the support strength of the 1866 and 1847 positions. If the gold price breaks above the 1880-line, then pay attention to the suppression strength of the two positions of 1892 and 1900.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose for a third straight day on Wednesday, 8th February 2023, as markets felt more comfortable with the risks, a day after a speech by the Federal Reserve chairman eased concerns about future interest rate hikes.

The market hopes less aggressive rate hikes will help the U.S. escape a sharp economic slowdown or recession, the latter of which would hit oil demand.

Meanwhile, the end of new crown restrictions in China is also expected to support fuel demand. On the supply side, the Organization of Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, decided last week to keep production restrictions in place.

An Iranian official said Wednesday that the organization will likely stick to its current policy at its next meeting. U.S. crude inventories rose 2.4 million barrels to 455.1 million barrels in the week ended Feb. 3.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 75.04 – line today. If the oil price runs above the 75.04 -line, then focus on the suppression strength of the two positions of 76.00 and 76.89. If the oil price runs below the 75.04 -line, then pay attention to the support strength of the two positions of 73.52 and 72.37.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.