1. Forex Market Insight

EUR/USD

The dollar retreated higher against the euro on Friday, 8th December 2022 following the release of November U.S. producer inflation data which is slightly higher-than-expected, providing a stronger case for the Federal Reserve to continue raising interest rates, even if the pace is slow.

While the PPI report showed that the underlying trend in inflation is moderating, it heightened concerns among market participants who fear that consumer inflation data out next week could also be higher than expected.

The data will be released ahead of the Federal Reserve’s December interest rate decision. The European Central Bank will also announce its interest rate decision this week, and markets are betting that they, like the Fed, will slow the pace of rate hikes by 50 basis points.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0529 line today. If the EUR runs below the 1.0529 line, then pay attention to the support strength of the two positions of 1.0440 and 1.0275. If the strength of EUR rises over the 1.0529 line, then pay attention to the suppression strength of the two positions of 1.0586 and 1.0642.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose to a four-day high, up 0.3% to $1.2273, as the British government announced reforms to maintain London’s status as one of the world’s most competitive financial centers.

The Bank of England will also announce its interest rate decision this week, and markets are betting that they, like the Federal Reserve, will slow the pace of rate hikes by 50 basis points.

As markets begin to digest expectations that interest rates will top out early next year, volatility in major currencies declines, moving closer to long-term averages.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2147-line today. If GBP runs below the 1.2147-line, it will pay attention to the suppression strength of the two positions of 1.2010 and 1.1941. If GBP runs above the 1.2147-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose on Friday, 8th December 2022, despite a rise in the dollar and U.S. bond yields, as markets took comfort in the prospect of a slower Fed rate hike ahead.

However, last week’s PPI data showed that U.S. producer prices rose more than expected in November, adding to uncertainty about the Fed’s policy outlook.

The dollar rose 0.1% after the data was released, and the yield on the 10-year U.S. Treasury note also rose. The focus now shifts to the U.S. Consumer Price Index (CPI), which comes out on Dec. 13.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1793-line today. If the gold price runs below the 1793-line, then it will pay attention to the support strength of the 1783 and 1768 positions. If the gold price breaks above the 1793-line, then pay attention to the suppression strength of the two positions of 1808 and 1832.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed lower in shaky trading on Friday, 8th December 2022, with both major indicators of crude oil posting their biggest weekly losses in months, as growing recession fears overshadowed any supply difficulties following the release of weak economic data in Europe and the U.S. Earlier in the session, oil prices found support at one point, rising more than 1%.

President Vladimir Putin said he may cut production in response to a price cap imposed on his crude exports. However, a slightly higher-than-expected increase in U.S. producer prices in November and news of the partial resumption of operations on the Keystone pipeline caused oil prices to give back gains, with index crude down more than $1.

Earlier this week, more than 14,000 barrels of crude oil spilled into a Kansas creek, causing the Keystone pipeline to suspend operations. Both indicator crudes are down about 10 percent on a weekly basis. This is the biggest weekly decline for U.S. crude since April and the biggest weekly decline for Brent crude since early August.

The U.S. crude oil market structure turned positive in spreads for the first time since November 2020. Contracts for near-month delivery are cheaper than far-month contracts for delivery a year later.

Near-month Brent crude oil prices are also lower than six-month forward contracts. The emergence of positive spreads indicates that there is less concern about the current supply situation due to weakening demand, which will encourage traders to replenish inventories.

Technical Analysis:

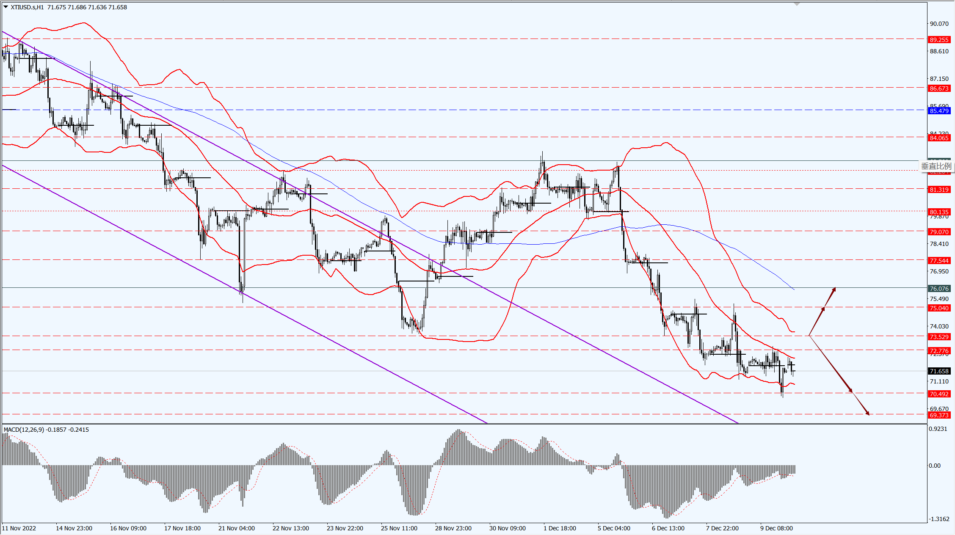

(Crude Oil 1-hour Chart)

Oil prices focus on the 73.52- line today. If the oil price runs above the 73.52 -line, then focus on the suppression strength of the two positions of 75.04 and 76.07. If the oil price runs below the 73.52 -line, then pay attention to the support strength of the two positions of 70.49 and 69.37.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.