1. Forex Market Insight

EUR/USD

The euro fell 0.1% to $0.9955 after dropping more than 1% last Thursday, 27th October 2022, after the European Central Bank raised rates by 75 basis points as expected, but took a more dovish tone on the interest rate outlook.

Last week, the euro rose about 0.93%. German data somewhat supported the euro, which showed Europe’s largest economy unexpectedly avoided recession in the third quarter, while inflation surprised to the upside, driven by a painful energy standoff with Russia.

U.S. data last Thursday, 27th October 2022 showed that consumer spending rose more than expected in September, while core inflationary pressures remained elevated, leaving the Federal Reserve still on track to continue raising interest rates by 75 basis points next week.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9999 line today. If the EUR runs below the 0.9999 line, then pay attention to the support strength of the two positions of 0.9909 and 0.9852. If the strength of EUR rises over the 0.9999 line, then pay attention to the suppression strength of the two positions of 1.0116 and 1.0190.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound rose against the dollar, extending gains recorded earlier last week after Rishi Sunak was appointed as Britain’s third prime minister in two months, with the pound up 0.39% at $1.1609, up about 2.65% on the week.

Technical Analysis:

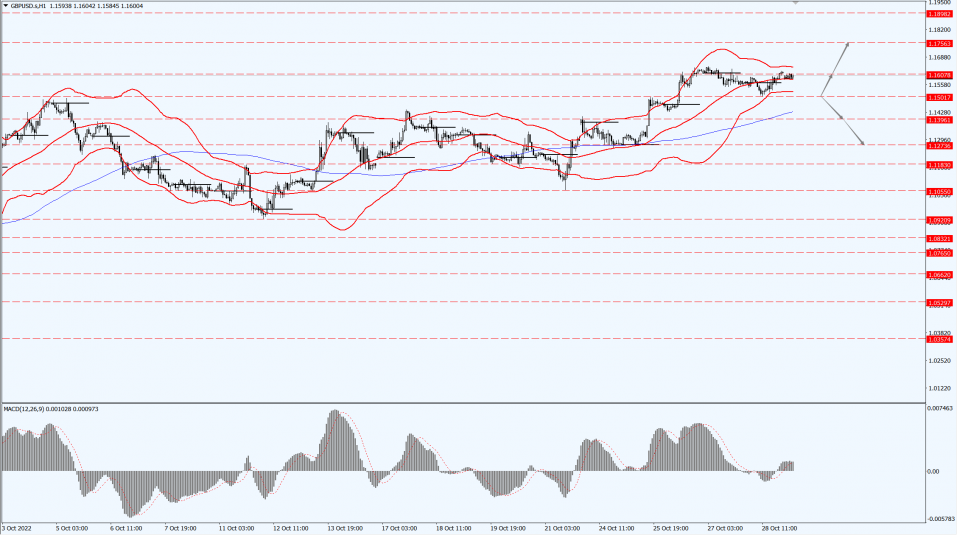

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two GBP is mainly focused on the 1.1501-line today. If GBP runs below the 1.1501-line, it will pay attention to the suppression strength of the two positions of 1.1396 and 1.1273. If GBP runs above the 1.1501 -line, then pay attention to the suppression strength of the two positions of 1.1607 and 1.1756.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell more than 1% on Friday as the dollar and U.S. bond yields climbed after data showed core inflationary pressures remained high, cementing expectations that the Federal Reserve will raise interest rates sharply again next week.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, rose 0.6% in September, the Commerce Department said.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1637-line today. If the gold price runs below the 1637-line, then it will pay attention to the support strength of the 1627 and 1616 positions. If the gold price breaks above the 1637-line, then pay attention to the suppression strength of the two positions of the 1654 and 1661.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell about 1% Friday on epidemic-limiting concerns, but both crude benchmarks are poised to rise on a weekly basis on supply concerns and unexpectedly strong economic data.

U.S. gasoline futures fell about 3%, while U.S. diesel futures jumped about 5% to touch their highest since mid-June. Last week, Brent crude rose about 2% and U.S. crude up about 3%.

Data on last Thursday, 27th October 2022 showed that U.S. gross domestic product (GDP) rebounded strongly in the third quarter, underscoring the resilience of the world’s largest economy and oil-consuming nation.

Germany’s economy unexpectedly grew in the third quarter, emerging from the threat of recession, but economic conditions remain very precarious as a painful energy standoff with Russia leads to a surge in inflation, data showed on Friday, 28th October 2022.

Energy services firm Baker Hughes said active U.S. oil and natural gas rigs decreased this week, but in October notched their first monthly increase since July.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 86.77 line today. If the oil price runs above the 86.77-line, then focus on the suppression strength of the two positions of 88.53 and 89.25. If the oil price runs below the 86.77-line, then pay attention to the support strength of the two positions of 85.53 and 84.08.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.