1. Forex Market Insight

EUR/USD

Ahead of the Fed meeting, weaker-than-expected inflation data had some investors pining for Powell to take a more dovish tone at Thursday’s 15th December 2022 news conference.

But Powell said it was still too early to talk about a Fed rate cut and that the Fed’s focus was on setting policy that would allow inflation to return to its 2% target over time. The euro rose 0.43% against the dollar in late New York trading at $1.0674.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0642 line today. If the EUR runs below the 1.0642 line, then pay attention to the support strength of the two positions of 1.056 and 1.0529. If the strength of EUR rises over the 1.0642 line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0734.

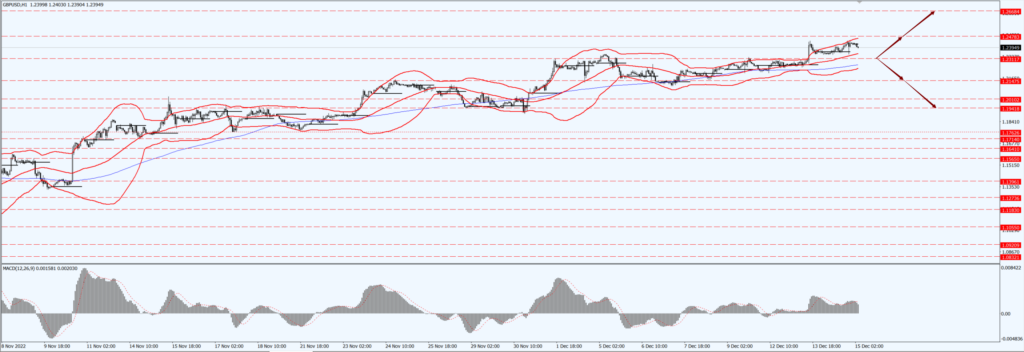

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound rose 0.49% against the U.S. dollar on Wednesday, 14th December 2022 for the sixth consecutive trading day, the highest intraday hit 1.2446, a new high since June 13, closing at 1.2425.

The European Central Bank interest rate resolution and the Bank of England will come together, the market is expected to raise interest rates by 50 basis points, in addition, this trading day will also be released in November U.S. retail sales data (commonly known as “horror data”), the U.S. November industrial production data and initial jobless claims change data, the market on the U.S. retail sales data is expected to be poor, so that the dollar index faces further downside risk.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2311-line today. If GBP runs below the 1.2311-line, it will pay attention to the suppression strength of the two positions of 1.2147 and 1.1941. If GBP runs above the 1.2311-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

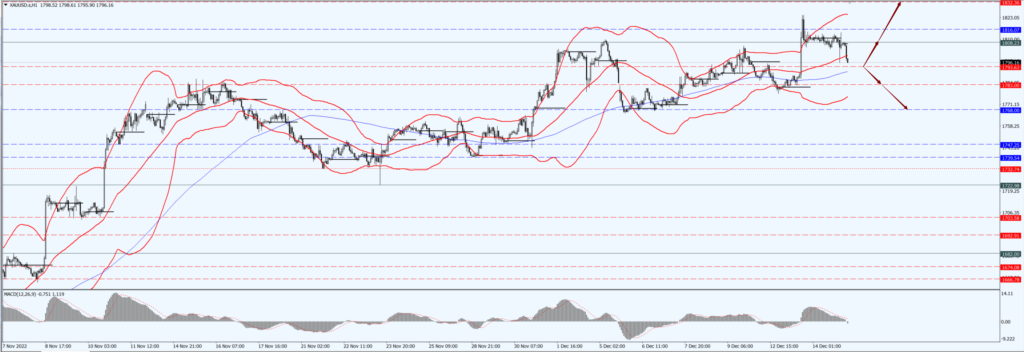

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold slipped Wednesday 14th December 2022 as the Federal Reserve said interest rates will remain high in the new year and said it was too early to consider a rate cut. “Our focus right now is really on adjusting the policy stance to be restrictive enough to ensure that inflation returns to the 2% target over time, rather than cutting rates,” Fed Chairman Jerome Powell said at a news conference after the latest policy meeting.

Spot gold fell 0.1% to $1,808.09 an ounce, down as much as 0.8% at one point after the Fed announced a 50 basis point rate hike as expected and forecast borrowing costs would rise by at least another 75 basis points by the end of 2023.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1793-line today. If the gold price runs below the 1793-line, then it will pay attention to the support strength of the 1783 and 1768 positions. If the gold price breaks above the 1793-line, then pay attention to the suppression strength of the two positions of 1808 and 1832.

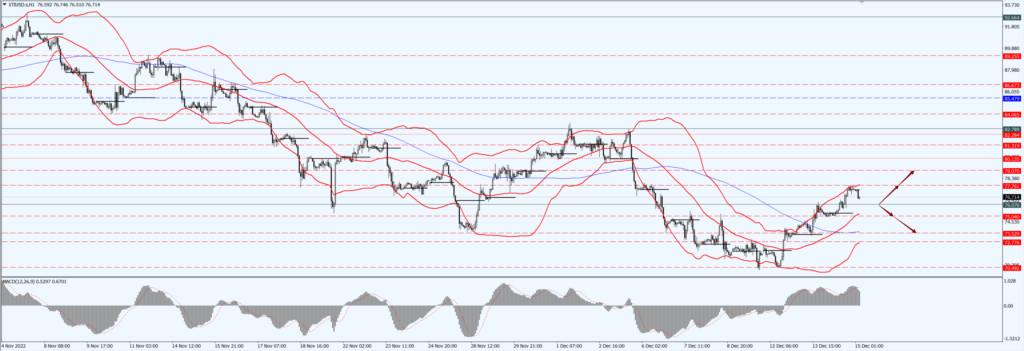

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose more than $2 on Wednesday after the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) forecast a rebound in demand next year and a further decline in expectations for U.S. interest rate hikes as inflation slows.

The U.S. Energy Information Administration (EIA) said Wednesday 14th December 2022 that crude oil inventories rose 10.2 million barrels in the week ended Dec. 9, the largest increase since March 2021, as the Strategic Petroleum Reserve (SPR) was released, and refinery activity declined. This sent a bearish signal.

Looking ahead to 2023, OPEC said it expects oil demand to grow by 2.25 million bpd next year to 101.8 million bpd, with demand from the world’s top importer likely to rise. The International Energy Agency (IEA) sees oil demand in the big Asian countries recovering next year after shrinking by 400,000 barrels per day in 2022.

The agency raised global oil demand growth expectations to 1.7 million barrels per day in 2023, with total demand expected to reach 101.6 million barrels per day.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 76.07- line today. If the oil price runs above the 76.07 -line, then focus on the suppression strength of the two positions of 77.54 and 79.07. If the oil price runs below the 76.07 -line, then pay attention to the support strength of the two positions of 75.04 and 73.52.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.