1. Forex Market Insight

EUR/USD

The euro was flat against the dollar at $1.0535. The euro has gained nearly 8% so far in the fourth quarter, with investors previously believing the ECB would stick to its aggressive course of raising interest rates.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0529 line today. If the EUR runs below the 1.0529 line, then pay attention to the support strength of the two positions of 1.0440 and 1.0275. If the strength of EUR rises over the 1.0529 line, then pay attention to the suppression strength of the two positions of 1.0586 and 1.0642.

GBP Intraday Trend Analysis

Fundamental Analysis:

The dollar rose 0.5% against the pound after official data earlier showed that the British economy rose slightly more than expected in October from a year earlier, but the outlook remains bleak.

Economic output was affected by a one-off public holiday in September for Queen Elizabeth’s funeral. The pound was flat against the dollar in late trading at $1.2270.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2147-line today. If GBP runs below the 1.2147-line, it will pay attention to the suppression strength of the two positions of 1.2010 and 1.1941. If GBP runs above the 1.2147-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell Monday, 12th December 2022 as the market awaited U.S. inflation data and the Federal Reserve’s decision to raise interest rates later in the week. Spot gold was down 0.9% at $1,780.19 an ounce.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1783-line today. If the gold price runs below the 1783-line, then it will pay attention to the support strength of the 1768 and 1747 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of 1793 and 1808.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose about $2 on Monday, 12th December 2022 as investors were nervous about the supply situation, with a key pipeline supplying the U.S. remaining shut and Russia threatening to cut production but easing restrictions on new crowns brought support to the fuel demand outlook.

Last week, both indicators reached their lowest since December 2021, with markets worried that a possible global recession could hurt oil demand.

Technical Analysis:

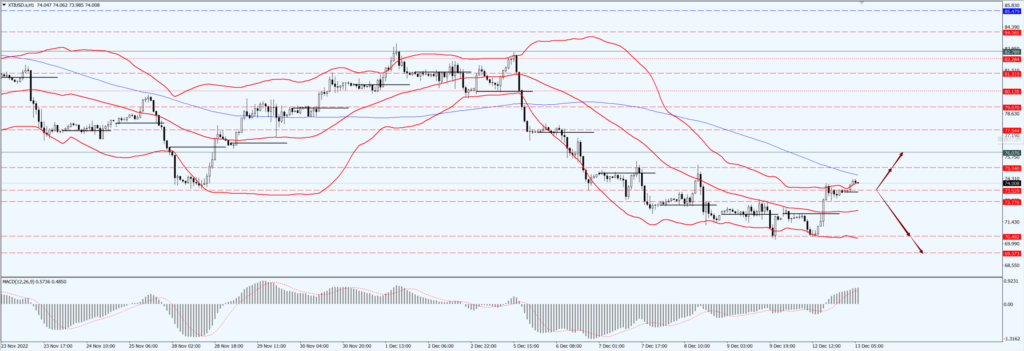

(Crude Oil 1-hour Chart)

Oil prices focus on the 73.52- line today. If the oil price runs above the 73.52 -line, then focus on the suppression strength of the two positions of 75.04 and 76.07. If the oil price runs below the 73.52 -line, then pay attention to the support strength of the two positions of 70.49 and 69.37.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.