1. Forex Market Insight

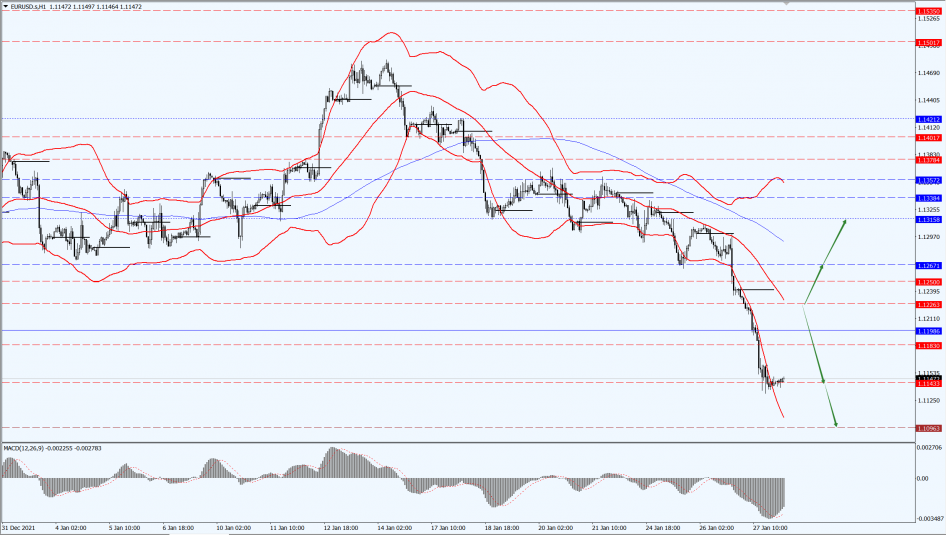

EUR/USD

The EURUSD fell by 0.95% to 1.1132, its lowest level since June 2020. With this, stops were triggered below the Nov. 24 low of 1.1186. At the same time, the Swiss franc fell as ECB policymakers makes dovish comments on inflation.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the suppression strength of the 1.1226-line. If the euro runs steadily below the 1.1226-line, we will pay attention to the support strength of 1.1143 and 1.1006 below.

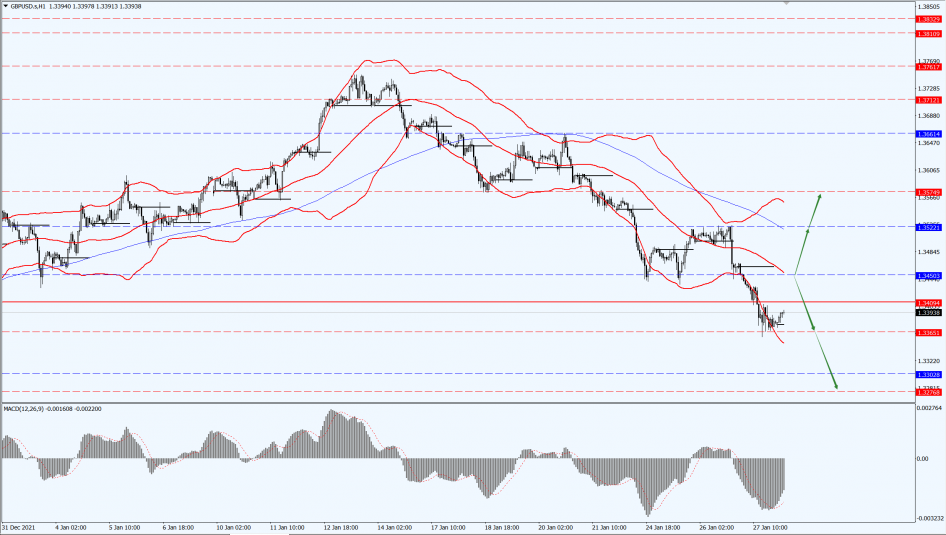

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound fell by 0.59% to 1.3383 against the U.S. dollar in late trading, as the market awaited the investigation report on the Downing Street party incident.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3450-line today. If the pound runs above the 1.3450-line, it will focus on the suppression of the 1.3522 and 1.3574 positions. If the pound runs below the 1.3450-line, it will focus on the support strength of the 1.3365 and 1.3276 positions.

2. Precious Metals Market Insight

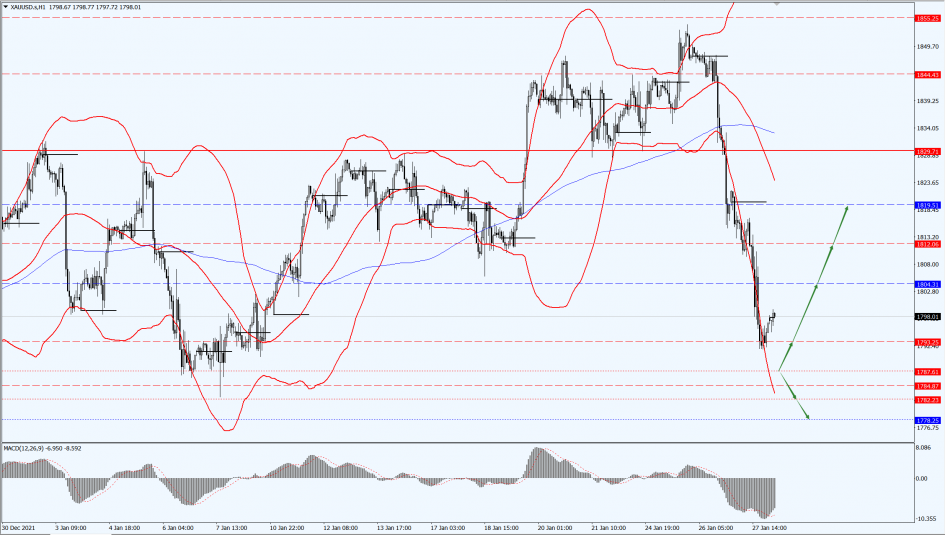

Gold

Fundamental Analysis:

Gold prices were hit hard for the second day in a row yesterday as strong U.S. economic data reinforced the rationale for the Federal Reserve to raise interest rates in March, leading to a stronger dollar.

However, safe-haven demand for U.S. stocks remains, which may slightly ease the downtrend in gold prices.

Intraday, focus on the U.S. PCE price index for December, in addition to the German and French GDP for the fourth quarter.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1787-line today. If the gold price runs steadily above the 1787-line, then it will pay attention to the suppression strength of the 1804 and 1819 positions. If the gold price falls below the 1787-line, it will open up further callback space. At that time, pay attention to the strength of 1782 and 1778.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell yesterday, retreating from a seven-year high as volatile stock markets and a stronger dollar put pressure on commodities.

Tensions between Russia and the West pushed prices higher this week, but the market is still weighing concerns about tight global supply and expectations that the Federal Reserve will soon tighten monetary policy.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85-line today. If the oil price runs below the 85-line, then pay attention to the support strength of the 82.83 and 80 positions. If the oil price runs above the 85-line, then pay attention to the suppression of 87 and 89.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.