1. Forex Market Insight

EUR/USD

Germany is facing a demographic change of historic proportions. Job vacancies in Germany now last an average of five months, while productivity per employee has not increased.

In its conclusion, it says that if this situation continues and the number of people working continues to decline for demographic reasons, then Germany’s GDP will be in a permanent contraction situation within three to four years.

Technical Analysis:

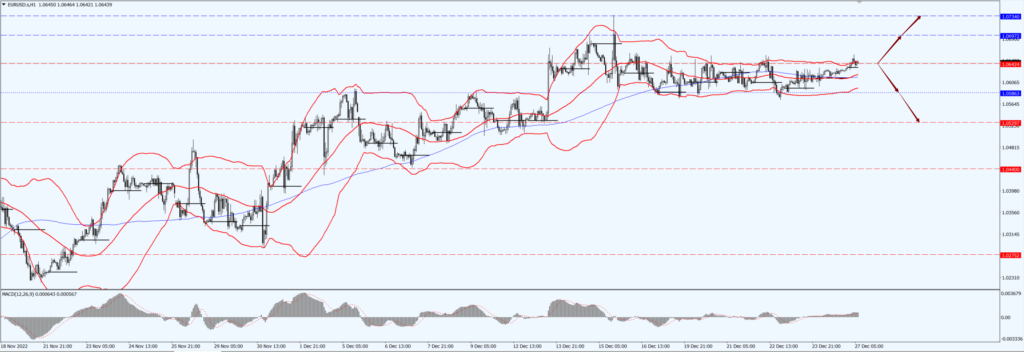

(EUR/USD 1-hour Chart)

We focus on the 1.0642 line today. If the EUR runs below the 1.0642 line, then pay attention to the support strength of the two positions of 1.0586 and 1.0529. If the strength of EUR rises over the 1.0642 line, then pay attention to the suppression strength of the two positions of 1.0697 and 1.0734.

GBP Intraday Trend Analysis

Fundamental Analysis:

The UK government’s austerity measures will not hurt economic growth in the short term. Much of the economic pain has been postponed until after the next general election. But the measures won’t help the economy much in the short term either.

By the end of 2023, the UK’s unemployment rate will rise from the current 3.6% to about 5%, resulting in about 200,000 people losing their jobs. The hotel and retail sectors are likely to lose the most as consumers’ discretionary spending power declines.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2147-line today. If GBP runs below the 1.2147-line, it will pay attention to the suppression strength of the two positions of 1.194 and 1.1762. If GBP runs above the 1.2147-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Today, early in the Asian market, spot gold shock slightly up, once hit two trading day high to $ 1804.78 near, China issued a clear Monday evening, since January 8, 2023, the new coronavirus pneumonia will be renamed to new coronavirus infection, the abolition of post-entry centralized isolation, the orderly resumption of outbound travel.

This makes the market risk appetite has improved, suppressing the dollar’s safe-haven demand, the dollar fell to a three-day low, to provide support for gold prices, while Russia and Ukraine’s geopolitical situation continues to also provide support for gold prices.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1808-line today. If the gold price runs below the 1808-line, then it will pay attention to the support strength of the 1793 and 1783 positions. If the gold price breaks above the 1808-line, then pay attention to the suppression strength of the two positions of 1816 and 1832.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil rose nearly 2% and now trades near $80.75 per barrel as investors return from the Christmas holiday and are helped by epidemic fears easing, boosting demand, with geopolitical tensions also helping the bulls.

Technical Analysis:

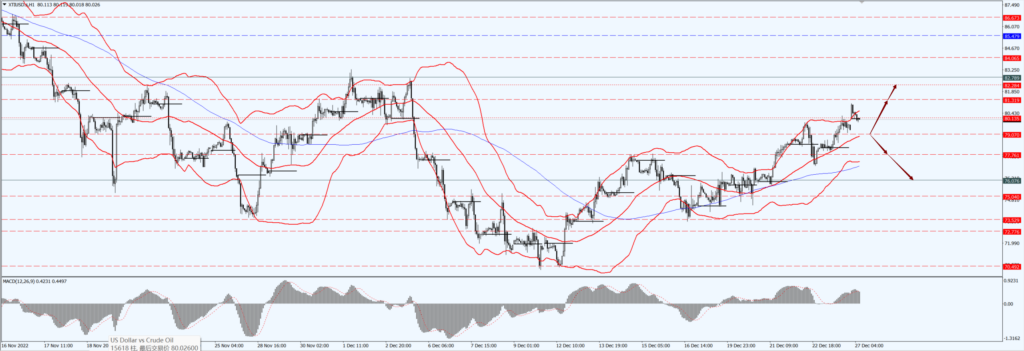

(Crude Oil 1-hour Chart)

Oil prices focus on the 79.07- line today. If the oil price runs above the 79.07 -line, then focus on the suppression strength of the two positions of 81.31 and 82.28. If the oil price runs below the 79.07 -line, then pay attention to the support strength of the two positions of 77.76 and 76.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.