1. Forex Market Insight

EUR/USD

A slew of data in recent weeks has been pointing to strong U.S. business activity, a tight labor market, strong retail sales and higher monthly producer prices. The hotter-than-expected data has helped keep the dollar strong.

But it has also increased concerns that the Fed may need to keep interest rates higher for longer if inflation is to reach the Fed’s target. This concern has led to an extension of the rally in the U.S. index, thus putting continued downward pressure on the euro.

Technical Analysis:

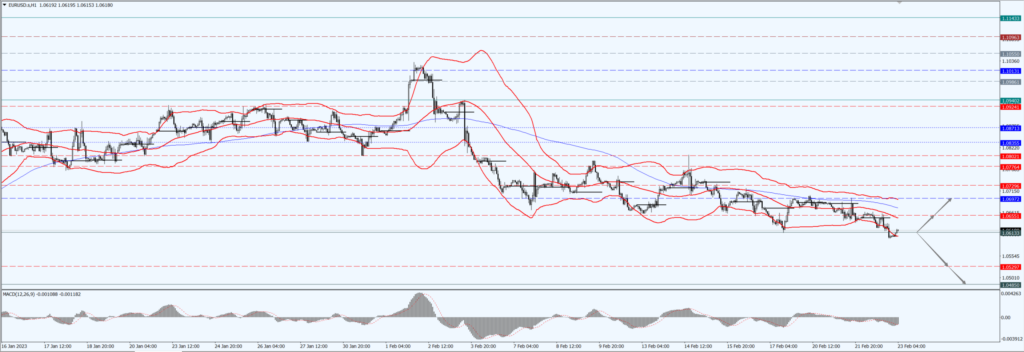

(EUR/USD 1-hour Chart)

We focus on the 1.0613 line today. If the EUR runs below the 1.0613 line, then pay attention to the support strength of the two positions of 1.0529 and 1.0485. If the strength of EUR rises over the 1.0613 line, then pay attention to the suppression strength of the two positions of 1.0655 and 1.0485.

GBP Intraday Trend Analysis

Fundamental Analysis:

U.K. inflation may fall sharply from double digits to near 2% by the end of the year, as a rapid drop in gas prices puts the Sunac government on track to address some of its biggest economic challenges.

CPI in the U.K. is expected to likely fall to 2.3% in November, well below the Bank of England’s forecast that it will remain around 4% in the fourth quarter of this year.

The faster decline in inflation this year is mainly reflected in easing price pressures, particularly in energy. Overall inflation in the UK is therefore expected to slow to below 5% from July.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2010-line today. If GBP runs below the 1.2010-line, it will pay attention to the suppression strength of the two positions of 1.1902 and 1.1762. If GBP runs above the 1.2010-line, then pay attention to the suppression strength of the two positions of 1.2117 and 1.2261.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell Wednesday, 22nd February 2023 as the dollar rose after minutes from the Federal Reserve’s latest policy meeting showed policymakers support more rate hikes to curb inflation.

Gold is highly sensitive to rising U.S. interest rates as they increase the opportunity cost of holding gold.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1832-line today. If the gold price runs below the 1832-line, then it will pay attention to the support strength of the 1820 and 1808 positions. If the gold price breaks above the 1832-line, then pay attention to the suppression strength of the two positions of 1845 and 1866.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell $2 to a two-week low on Wednesday 22nd February 2023 as markets became more concerned that recent economic data will signal more aggressive interest rate hikes by central banks, which would weigh on growth and fuel demand.

In the week ended Feb. 17, crude oil inventories jumped about 9.9 million barrels, gasoline stocks rose about 890,000 barrels and distillate stocks rose about 1.37 million barrels.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices today focus on 75.04- line, if oil prices run at 75.04 – line above, then pay attention to 76 and 77.31 two positions of suppression strength; if oil prices run at 75.04 – line below, then pay attention to 73.52 and 72.77 two positions of support strength.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.