1. Forex Market Insight

EUR/USD

European Central Bank (ECB) President Christine Lagarde said Monday that by the end of September, the ECB may get the key interest rate out of negative territory and may raise rates further.

The hawkish comments led to the biggest gains for EUR/USD, which ended the day up 1.13% at $1.0687, up as much as 3.4% from the multi-year intraday low of $1.0349 touched on 13th May 2022.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0697-line today. If EUR runs steadily above the 1.0697-line, then pay attention to the support strength of the two positions of 1.0734 and 1.0776. If the strength of EUR breaks below the 1.0697-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

UK unemployment rate hitting a nearly 48-year low in the first three months of 2022.

U.K. inflation surged 9% annual rate in April, retail sales unexpectedly rose in April.

Strong economic data from the U.K. suggested that markets may not need to further scale back expectations for a rate hike by the Bank of England.

However, it is important to note that the Fed remains firmly focused on fighting inflation, which means its current rapid tightening policy is still in automatic operation.

This stance is more hawkish than the Bank of England, indicating that GBP may still encounter significant resistance in the market outlook.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2243. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices climbed yesterday, 23rd May 2022, boosted by a weaker dollar and concerns about economic growth.

However, the rise in U.S. Treasury yields led to a narrowing of gold’s gains.

Spot gold rose 0.4% to $1,853.70 an ounce.

Earlier in the session, it rose more than 1% to touch the highest since 9th May 2022 at $1,865.29.

U.S. gold futures settled 0.3% higher at $1,847.80.

Technical Analysis:

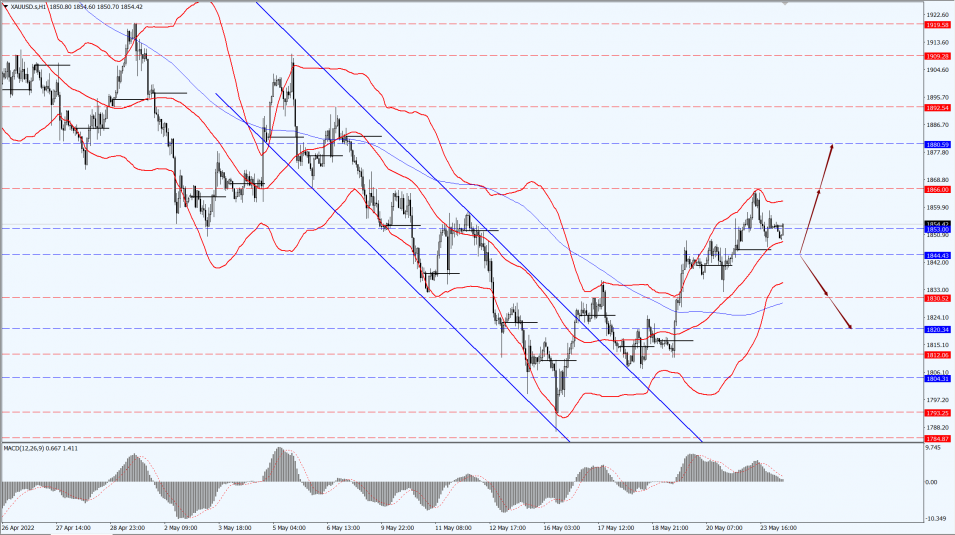

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1844-line today. If the gold price runs steadily below the 1844-line, then it will pay attention to the support strength of the 1830 and 1820 positions. If the gold price breaks above the 1844-line, then pay attention to the suppression strength of the two positions of the 1866 and 1880.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. crude oil prices were little changed on Monday, 23rd May 2022, on fears of a possible recession, offsetting the prospect of fuel demand driven by the upcoming U.S. summer driving season and cooling virus concerns.

U.S. crude futures rose 1 cent, or 0.01%, to settle at $110.29 a barrel.

Meanwhile, Brent crude futures rose 0.87 cent, or 0.7%, to settle at $113.42 a barrel.

Technical Analysis:

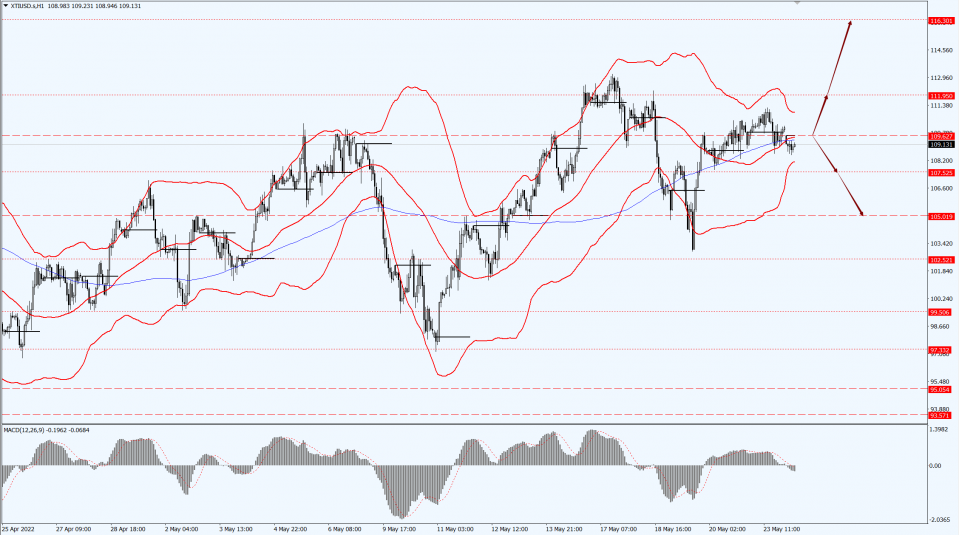

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 109.62-line today. If the oil price runs below the 109.62-line, then focus on the suppression strength of the two positions of 107.52 and 105.52. If the oil price runs above the 109.62-line, then pay attention to the support strength of the two positions of 111.95 and 116.30.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.