1. Forex Market Insight

EUR/USD

As expected, the Federal Reserve raised rates by 75 basis points to 3.0-3.25% this week. The fifth rate hike of the year and its third consecutive 75 basis point hike, with a cumulative rate hike, with a cumulative rate hike of 300 basis points, the highest intensive rate hike since 1981.

The EUR/USD also continued to be under pressure to stay in the historic phase of lows because of the Fed’s big rate hike and the hawkish attitude it has shown towards future rate hikes.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9879-line today. If EUR runs steadily below the 0.9879-line, then pay attention to the support strength of the two positions of 0.9810 and 0.9770. If the strength of EUR breaks above the 0.9879-line, then pay attention to the suppression strength of the two positions of 0.9909 and 0.9999.

GBP Intraday Trend Analysis

Fundamental Analysis:

The British pound continued to stay near its historic stage lows against the U.S. dollar on Thursday, 22nd September 2022.

This comes after the Bank of England raised its key interest rate by less than the money market forecast.

The Bank of England raised interest rates by 50 basis points on Thursday, 22nd September 2022, raising the target rate to 2.25% from 1.75%, and said it would continue to respond “as strongly as necessary” to inflation, despite the economy entering a recession.

Clearly, this was a dovish surprise as the market almost completely digested the expectation of a 75 basis point rate hike.

However, the fact that three MPC members supported 75 bps may have prevented a sharp dovish revaluation of the GBP curve, which may be one of the reasons why the GBP did not fall sharply after the decision was announced.

Technical Analysis:

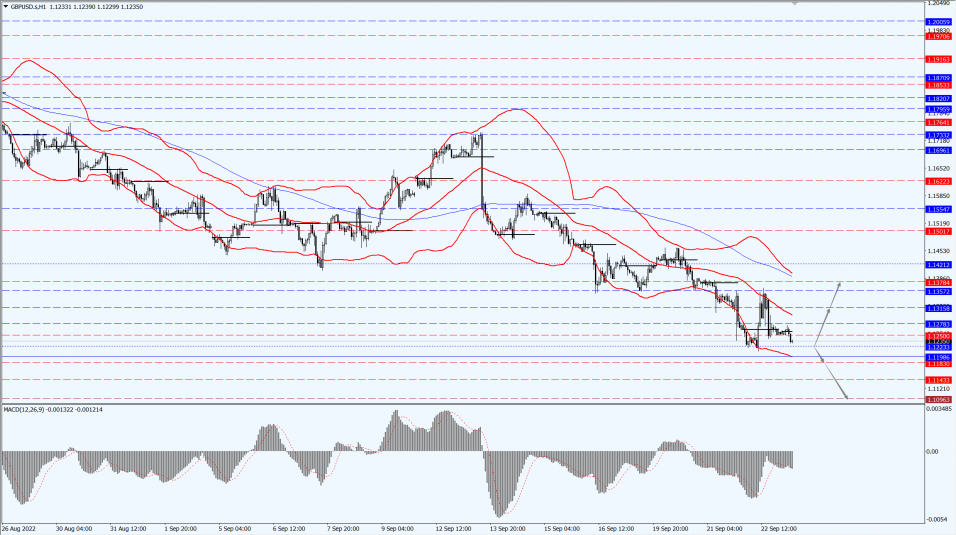

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1223-line today. If GBP runs below the 1.1223-line, it will pay attention to the suppression strength of the two positions of 1.1183 and 1.1096. If GBP runs above the 1.1223-line, then pay attention to the suppression strength of the two positions of 1.1315 and 1.1378.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell little on Thursday, 22nd September 2022, in oscillating trade, weighed down by a stronger dollar and rising U.S. bond yields, while the Federal Reserve’s hawkish policy stance overshadowed the outlook for non-interest-bearing gold.

Technical Analysis:

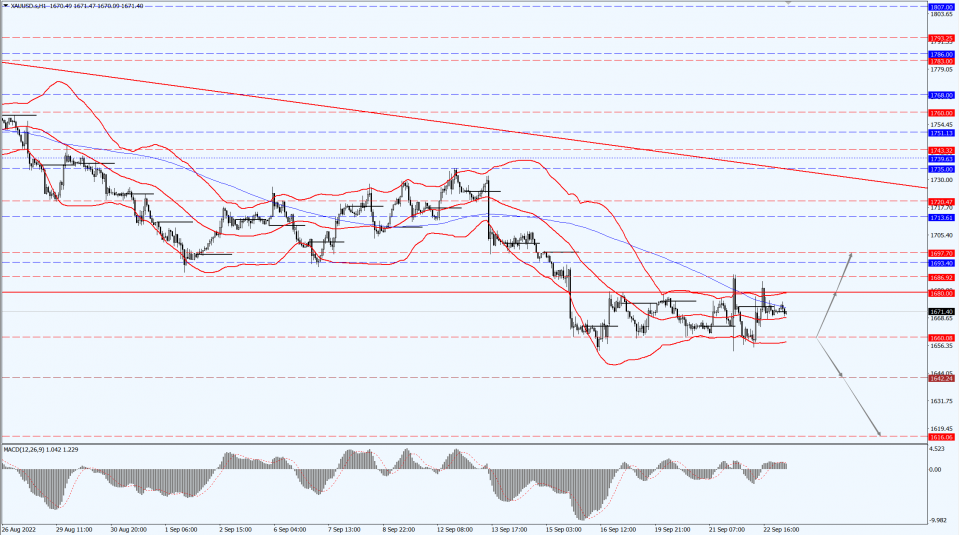

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1660-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1642 and 1616 positions. If the gold price breaks above the 1660-line, then pay attention to the suppression strength of the two positions of the 1680 and 1697.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed nearly 1% Thursday, 22nd September 2022, trimming earlier gains as markets focused on Russian oil supply issues, a rebound in Asian demand and a lower-than-expected interest rate hike by the Bank of England than some had expected.

Technical Analysis:

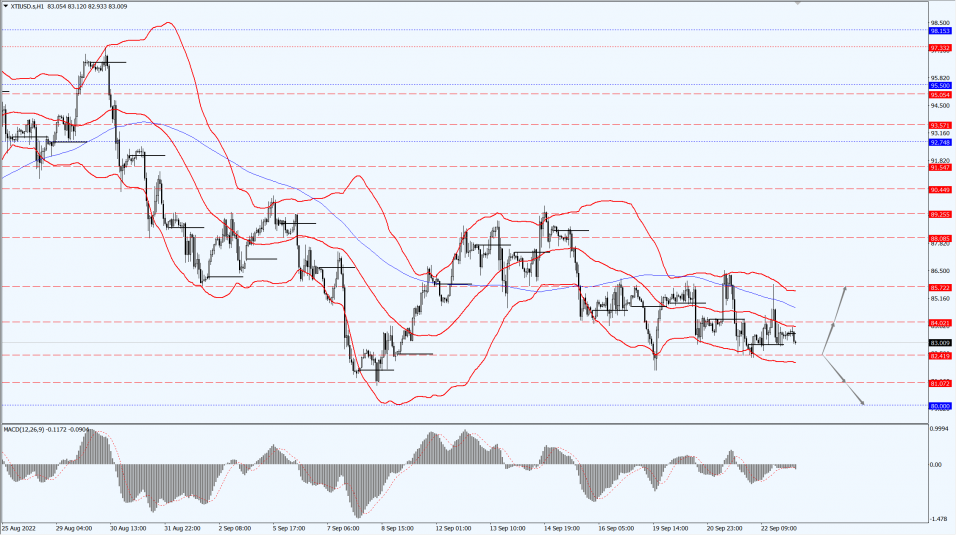

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 82.41-line today. If the oil price runs above the 82.41-line, then focus on the suppression strength of the two positions of 84.02 and 85.72. If the oil price runs below the 82.41-line, then pay attention to the support strength of the two positions of 81.07 and 80.00.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.