1. Forex Market Insight

EUR/USD

The euro rose against the dollar on Thursday, 8th December 2022 with the ECB so far behind the inflation curve that the bank “has no reason to slow down the pace of rate hikes now.

The market expects the ECB to raise rates by 75 basis points next week, which is above market pricing of about 50 basis points, according to data from Refinitiv.

The current deposit rate of 1.50% will have to rise at least above the core inflation rate. Last November, core inflation in the eurozone was 5%.

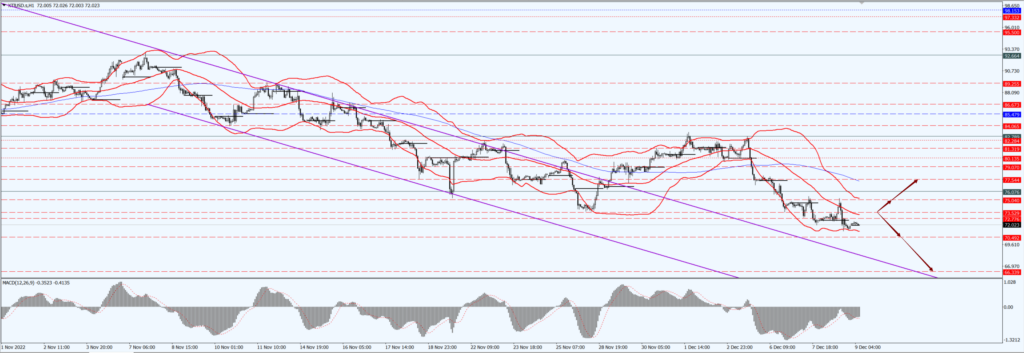

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0529 line today. If the EUR runs below the 1.0529 line, then pay attention to the support strength of the two positions of 1.0440 and 1.0275. If the strength of EUR rises over the 1.0529 line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

A Reuters poll released on Thursday 8th December 2022 showed that market forecasts for the Bank of England’s terminal interest rate ranged between 3.5% and 4.75%.

The pound could fluctuate further if expectations that the BoE rate could top out remain widely divergent following next week’s BoE rate decision.

Money markets currently suggest that the Bank of England rate will be 4.5% by May 2023, with a 50% chance of reaching 4.75% by August 2023. The pound could benefit if the Bank of England takes a tough stance and raises rates to 4.75% or higher next year.

However, this could increase the risk of the U.K. falling into a deep recession, which could hurt the pound. Most Reuters poll respondents currently expect a prolonged and mild recession in the UK.

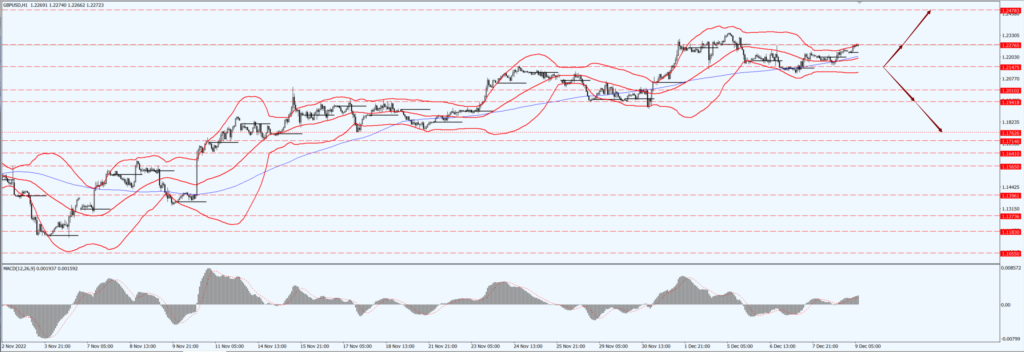

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2147-line today. If GBP runs below the 1.2147-line, it will pay attention to the suppression strength of the two positions of 1.1941 and 1.1762. If GBP runs above the 1.2147-line, then pay attention to the suppression strength of the two positions of 1.2276 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose on Thursday, 8th December 2022 as the market expects the Federal Reserve to raise interest rates by 50 basis points next week.

The Fed is expected to raise rates by a modest 50 basis points at its Dec. 13-14 meeting, but this should not be seen as a shift to a more moderate policy stance.

The World Gold Council’s recently released Gold Demand Trends Report notes that global central bank gold purchasing trends are in line with our published annual central bank research for 2022.

In this research, a quarter of respondents indicated an intention to increase gold reserves in the next 12 months (up from a fifth in 2021).

Looking ahead, while the net gold sales by central banks in the last two months of the year cannot be ignored, it is believed that 2022 will still end with a strong net buying performance by central banks.

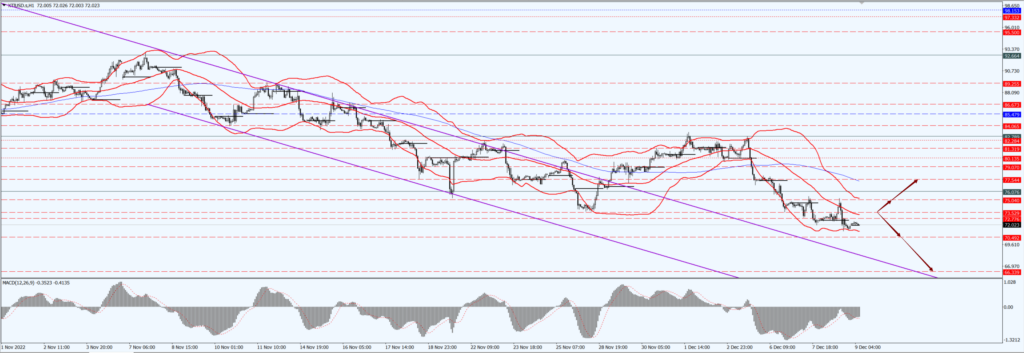

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1783-line today. If the gold price runs below the 1783-line, then it will pay attention to the support strength of the 1768 and 1747 positions. If the gold price breaks above the 1783-line, then pay attention to the suppression strength of the two positions of 1808 and 1832.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell more than 1% Thursday, 8th December 2022 hitting their lowest level of the year so far at $71.10 a barrel during the session, but as TC Energy said Thursday it had halted oil deliveries from the Keystone pipeline, which has a capacity of 610,000 barrels a day, after an oil leak was discovered in Nebraska, USA.

The emergency shutdown occurred around 8 p.m. local time Wednesday after an alarm went off due to a detected drop in pipeline pressure. The affected portion of the pipeline has been isolated and barricades have been deployed to contain the leak as it migrates downstream, picking up slightly.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 73.52- line today. If the oil price runs above the 73.52 -line, then focus on the suppression strength of the two positions of 75.04 and 77.54. If the oil price runs below the 73.52 -line, then pay attention to the support strength of the two positions of 70.49 and 66.33.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.