1. Forex Market Insight

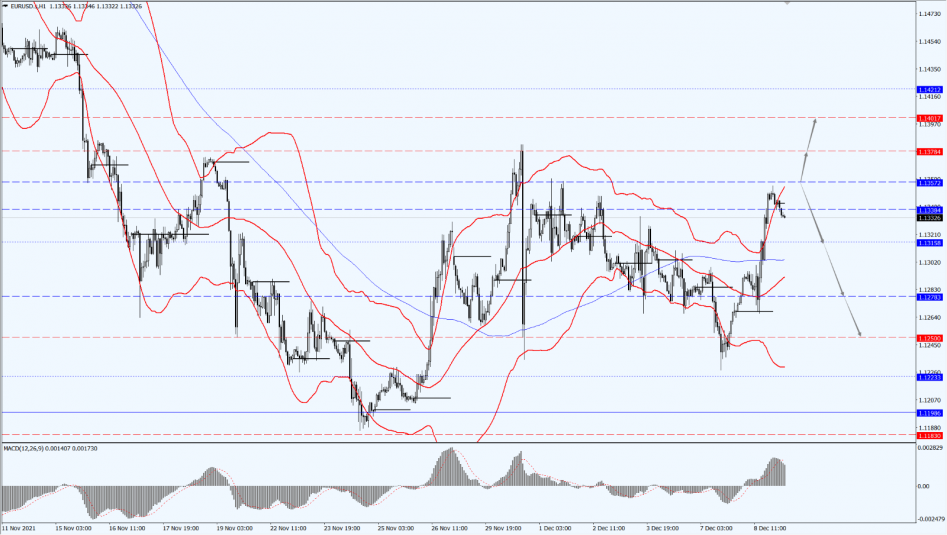

EUR/USD

Concerns about Omicron appear to have eased slightly, especially as more and more data suggests that the new variant is causing less severe symptoms than previously thought, albeit unconfirmed.

Investors’ appetite for riskier assets has improved this week, with reports of only mild symptoms in South African Omicron-infected individuals. During this interval, the euro rose by 0.67% against the dollar to 1.1343.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the suppression of the 1.1357-line. If the euro runs stably below the 1.1357-line, we will look at the continuity of the euro’s callback strength. At that time, pay attention to the support at 1.1315 and 1.1278 below. If the euro’s strength breaks through the 1.1357-line, then pay attention to the suppression force at the two positions of 1.1378 and 1.1401, especially the suppression force at the first line of 1.1378.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell by 0.30% to 1.3204 against the dollar, hitting 1.3163 intraday, the lowest level in nearly a year. After Prime Minister Johnson implemented stricter restrictions in England, requiring people to work from home, wear masks in public places and use vaccine passes to slow the spread of the Omicron variant. Meanwhile, the money markets lowered bets on rate hikes, with expectations of only 6 basis points for the Bank of England to raise rates next week.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3302-line. If the pound runs below the 1.3302-line, then pay attention to the support at the 1.3186 and 1.3104 positions. If the pound strength rises above the 1.3302-line, then pay attention to the 1.3409-line suppression.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices surged higher and were largely flat yesterday as investors waited to find direction from the Fed meeting and U.S. inflation data. Cooling concerns about the outbreak also reduced the appeal of safe-haven gold. During this interval, keep an eye on the U.S. initial claims and Chinese inflation data during the day.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold still pays attention to the 1784-line today. If the price of gold runs below the 1784-line, then pay attention to the support of the 1768 and 1760 positions. If the gold price rebounds above the 1784-line again, it will open up a further room for rebound. At that time, pay attention to the suppressive strength in two positions of 1804 and 1812.

3. Commodities Market Insight

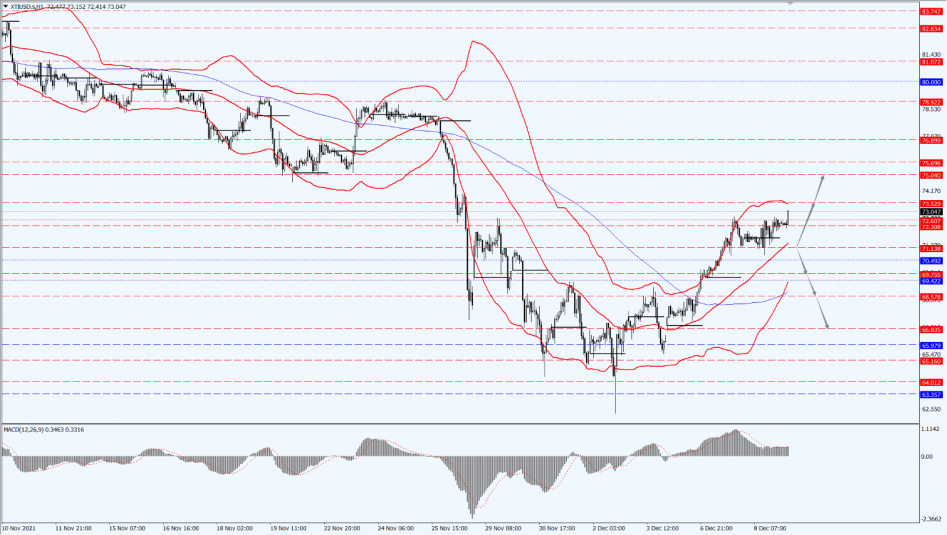

WTI Crude Oil

Fundamental Analysis:

Oil prices rose on Wednesday, 8th December 2021 as a study showed that an existing Covid-19 vaccine is effective against the new virus variant, allaying fears of plummeting fuel demand, plus geopolitical tensions coupled with disappointing Iranian nuclear talks boosted oil prices. Intraday focus on the U.S. initial jobless claims for the week ended Dec. 4, and the final monthly rate of U.S. wholesale inventories in October.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices are paying attention to the 71.13-line. If oil prices run above the 71.13-line, the pressures at 73.52 and 75.04 will be followed in turn. If the oil price drops below 71.13, further downside space will be opened. At that time, pay attention to the strength of support at 69.75 and 68.57.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.