1. Forex Market Insight

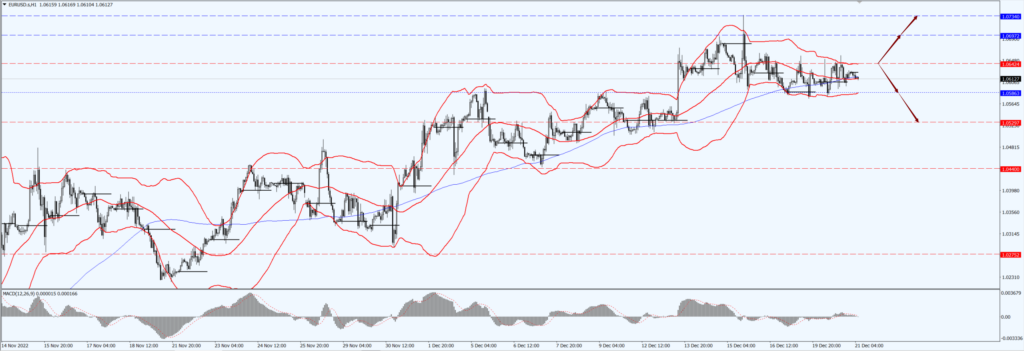

EUR/USD

Borrowing costs will continue to rise at a similar pace to the recent 50 basis points as officials try to curb price spikes, European Central Bank Deputy President Kim Doss said Monday 19th December 2022. His hawkish tone prompted economists and investors to revise upward their forecasts of how much the ECB will raise interest rates.

And market data from Germany suggests that the recession in Europe’s largest economy may be much milder than many economists feared just a few weeks ago. In other words, the ECB continues to raise interest rates, for Europe’s economic blow is currently still within acceptable limits.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0642 line today. If the EUR runs below the 1.0642 line, then pay attention to the support strength of the two positions of 1.0586 and 1.0529. If the strength of EUR rises over the 1.0642 line, then pay attention to the suppression strength of the two positions of 1.0697 and 1.0734.

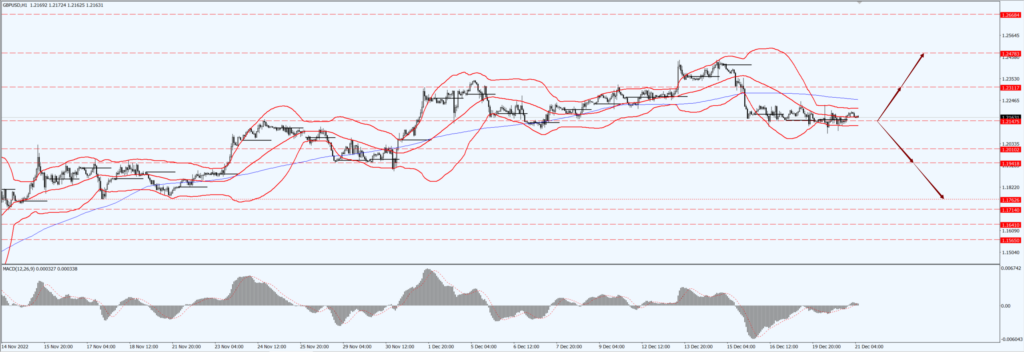

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England internal members of the vote began to appear disunity, which is the reason why the recent sell-off of the pound against the dollar interrupted the upward trend formed earlier.

However, there is a slowdown in interest rate hikes by the Federal Reserve, and the ECB’s tough stance, are the effective weight to suppress the dollar, so it can also provide corresponding support to the pound.

Technical Analysis:

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2147-line today. If GBP runs below the 1.2147-line, it will pay attention to the suppression strength of the two positions of 1.194 and 1.1762. If GBP runs above the 1.2147-line, then pay attention to the suppression strength of the two positions of 1.2311 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices climbed more than 1% on Tuesday 20th December 2022, touching a one-week high, and other precious metals also rallied amid a falling dollar as the market remained focused on the Federal Reserve’s interest rate strategy.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1822-line today. If the gold price runs below the 1822-line, then it will pay attention to the support strength of the 1808 and 1793 positions. If the gold price breaks above the 1822-line, then pay attention to the suppression strength of the two positions of 1832 and 1847.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices closed higher in choppy trading Tuesday 20th December 2022 as the prospect of a major winter storm hitting the U.S. worsened, raising concerns that millions of Americans may abandon their travel plans for the holiday season.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 75.04- line today. If the oil price runs above the 75.04 -line, then focus on the suppression strength of the two positions of 77.76 and 79.07. If the oil price runs below the 75.04 -line, then pay attention to the support strength of the two positions of 73.52 and 72.77.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.