1. Forex Market Insight

EUR/USD

After ECB President Lagarde issued a hawkish stance last week, admitting that inflationary pressures are unlikely to ease in the near term, the door to a rate hike in the eurozone this year is now open.

This is certainly something that was unthinkable just a few weeks ago.

Klaas Knot, the Dutch Central Bank president and one of the hawkish members of the ECB’s governing council, said on Sunday (Feb. 6) that he expects the ECB to raise interest rates in the fourth quarter of this year.

The ECB is expected to start raising interest rates in September and raise rates twice by 25 basis points before the end of the year, and expects the central bank to end its bond-buying program in the second or third quarter.

In any case, this does change the situation in the foreign exchange market. The euro’s status as a permanent financing currency is over, or close to it. With one of the world’s most dovish central banks no longer so dovish, the upside for the euro could be quite large.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1378-line. If the euro runs steadily above the 1.1378-line, we will pay attention to the suppression strength of the two positions above 1.1501 and 1.1535.

GBP Intraday Trend Analysis

Fundamental Analysis:

The Bank of England’s policy is more hawkish than previous market expectations, with three more rate hikes expected in 2022, raising the benchmark rate to 1.25%.

In December 2021, the Bank of England raised its benchmark rate to 0.25% from a record low of 0.1% in response to continued upward inflationary pressures. That month, U.K. CPI rose 5.4% year-on-year, the highest in nearly 30 years.

With the UK’s benchmark lending rate likely to rise again in the coming months, it is likely that living standards will inevitably take a hit. The Bank of England is working hard to ensure that the U.K. does not experience the second-round effects of so-called hyperinflation.

A day ago, the Bank of England raised interest rates for the second time in a row to 0.5%. With that, U.K. inflation may peak at 7.25% in April 2022.

Last December, the Bank of England fired the first shot at a global rate hike by a mainstream central bank, raising its key interest rate to 0.25% from a record low of 0.1%.

Due to high inflationary pressures in the UK, the Bank of England is already widely expected to raise rates by 25 basis points again before this interest rate resolution meeting.

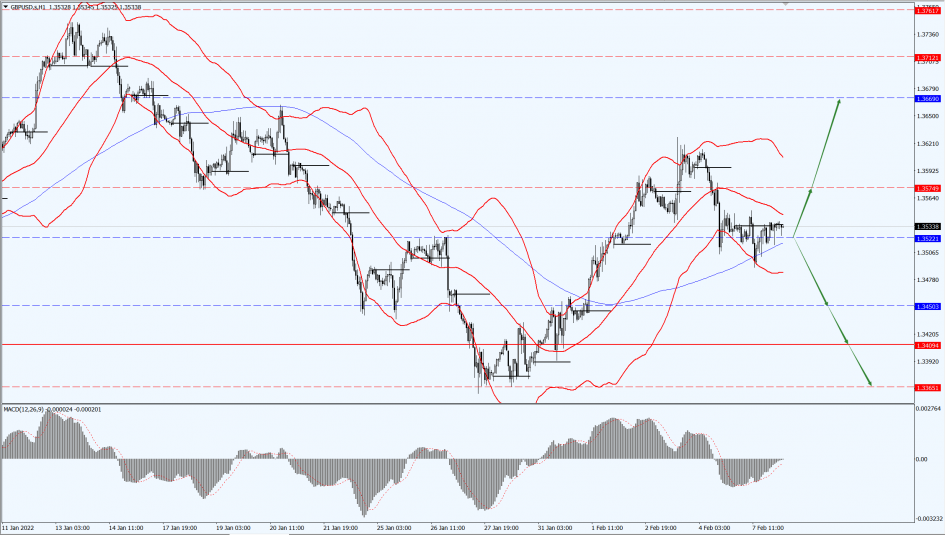

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly concerned about the 1.3522-line today. If the pound runs above the 1.3522-line, it will pay attention to the suppression strength of the 1.3574 and 1.3669 positions. If the pound runs below the 1.3522-line, it will pay attention to the support strength of the 1.3450 and 1.3409 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices rose to a more than one-week high yesterday, supported by inflation concerns and lingering geopolitical risks as markets await key inflation data to judge the Fed’s rate hike trajectory.

On the other hand, Fed rate hike expectations and rising U.S. bond yields have limited gold price gains. The main focus during the day is the U.S. trade account data for December.

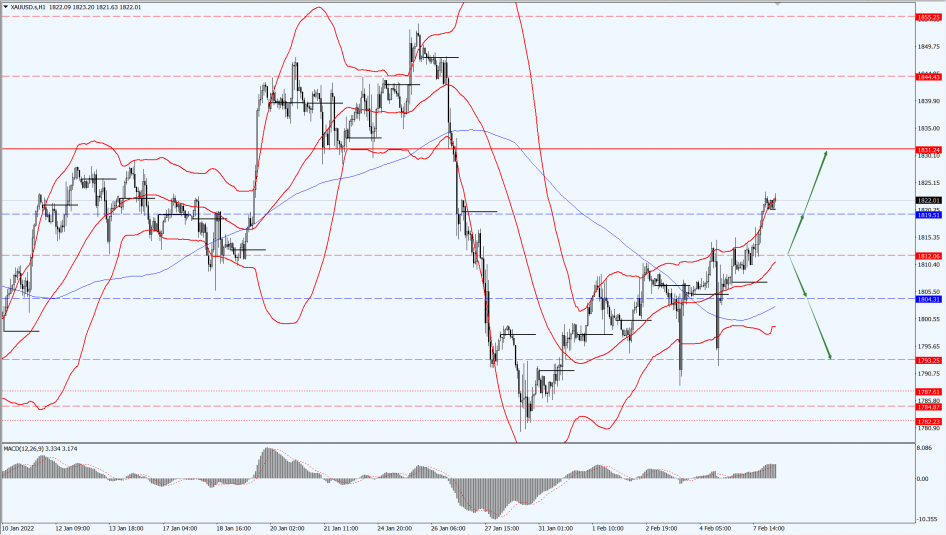

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1812-line today. If the gold price runs steadily above the 1812-line, then pay attention to the suppression strength of the 1819 and 1831 positions. If the gold price falls below the 1812-line, it will open up further callback space. At that time, pay attention to the strength of the 1804 and 1793 positions.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices retreated from a seven-year high to close lower on Monday, 7th February 2022, on faint signs of progress in nuclear talks between the U.S. and Iran, which could push the U.S. to lift sanctions on Iranian oil exports. Keep an eye on the monthly EIA report during the day.

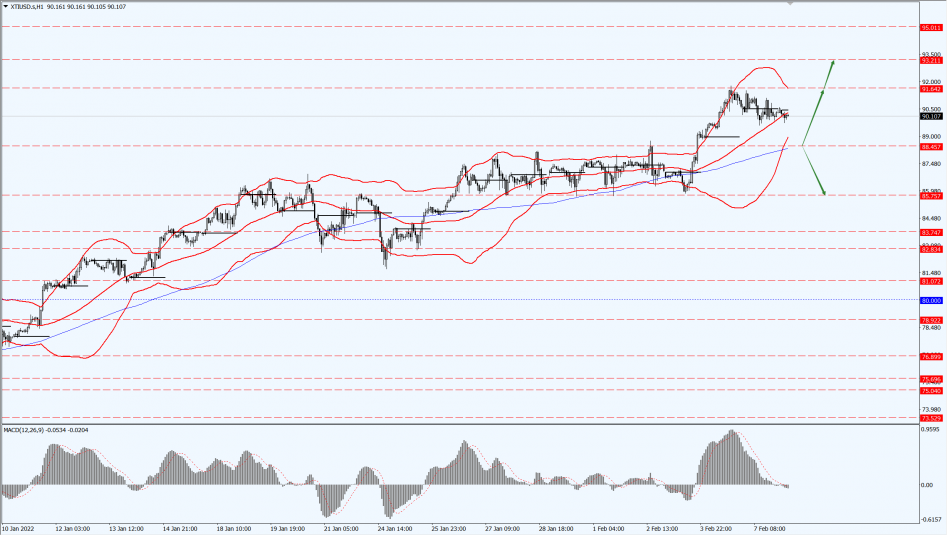

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.45-line today. If the oil price runs below the 88.45-line, then pay attention to the support of the 85.75-line. If the oil price runs above the 88.45-line, then pay attention to the suppression of the 91.64 and 93.21 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.