1. Forex Market Insight

EUR/USD

European Central Bank President Christine Lagarde said Friday, 2nd December 2022 that inflation expectations should remain stable and the public needs to know that it will return to the target level.

Markets will be closely watching the ECB meeting to be held Dec. 14-15, when officials will decide whether to raise rates for a third consecutive time by 75 basis points or slow the pace to 50 basis points.

Europe’s inflation slowed last month for the first time in a year and a half and could provide support for a modest rate hike. Lagarde said earlier this week that she would be surprised if euro zone inflation had peaked.

Meanwhile, some hawkish officials at the ECB warned against prematurely ending action to keep inflation in check.

She also said Friday that the outlook for the coming period will remain uncertain, and that Europe is going through a very challenging period in which the situation is changing. In addition, the impact of a stronger dollar on the euro zone is smaller than its impact on emerging economies.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 1.0586 line today. If the EUR runs below the 1.0586 line, then pay attention to the support strength of the two positions of 1.0529 and 1.0440. If the strength of EUR rises over the 1.0586 line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

Since last December, the Bank of England has raised interest rates eight times to 3%, and at its November meeting, Ramsden also expressed support for a 75 basis point rate hike.

Currently, the market is widely expected to see the BoE raise rates by another 50 basis points in December. With inflation at 11.1%, more than five times the target level, the BoE is under pressure to respond aggressively to prices.

However, the Monetary Policy Committee is divided on the strength of further policy tightening given the dampening effect of the looming recession on demand.

In November, two members voted in favor of a rate hike of less than 75 basis points, as they argued that the cost of living crisis justified a more gradual approach by the BoE.

The Office for Budget Responsibility now expects U.K. household incomes to shrink by 7% over the next two years.

Technical Analysis:

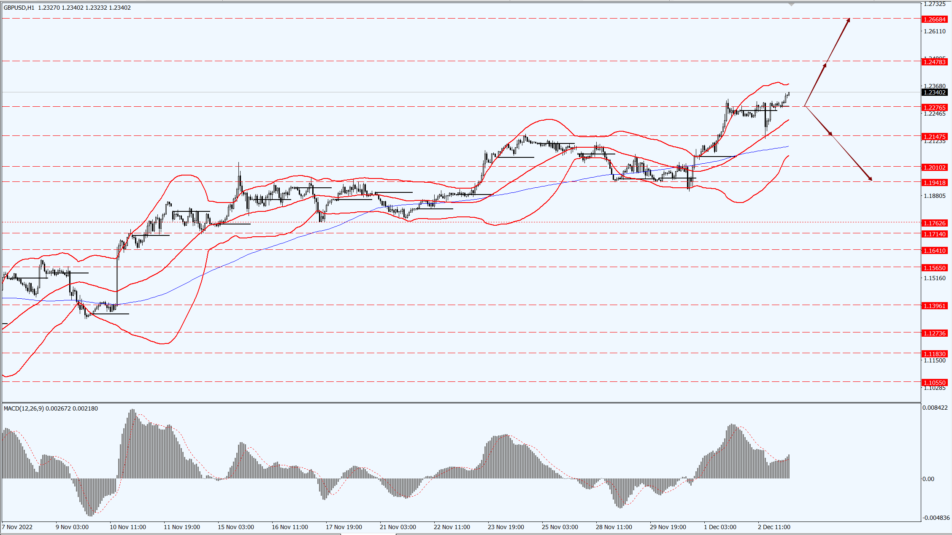

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.2276-line today. If GBP runs below the 1.2276-line, it will pay attention to the suppression strength of the two positions of 1.2147 and 1.1941. If GBP runs above the 1.2276-line, then pay attention to the suppression strength of the two positions of 1.2478 and 1.2668.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices retreated from a nearly four-month high on Friday, 2nd December 2022 after strong U.S. jobs data raised concerns that the Federal Reserve may stick to its aggressive monetary policy of tightening.

Data on Friday showed that the U.S. added more jobs than expected in November and payrolls improved, despite growing concerns about a recession.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1808-line today. If the gold price runs below the 1808-line, then it will pay attention to the support strength of the 1793 and 1783 positions. If the gold price breaks above the 1808-line, then pay attention to the suppression strength of the two positions of 1816 and 1832.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Crude oil fell 1.5% in oscillating trading on Friday, with the OPEC+ alliance of the Organization of Petroleum Exporting Countries (OPEC) and its allies set to meet on Sunday, 11th December 2022 and an EU ban on Russian crude oil set to take effect next Monday, 12th December 2022.

Russian oil production could fall by 500,000-1 million barrels per day in early 2023 as the EU will ban seaborne imports of Russian oil from Monday. Poland agreed to an EU deal to set a $60 per barrel price cap on Russian seaborne oil, which will push the EU to formally ratify the agreement over the weekend.

U.S. employers added more jobs than expected and raised payrolls in November. This could give the Fed more reason to keep raising rates.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 82.78- line today. If the oil price runs above the 82.78 -line, then focus on the suppression strength of the two positions of 84.06 and 85.47. If the oil price runs below the 82.78 -line, then pay attention to the support strength of the two positions of 80.13 and 79.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.