1. Forex Market Insight

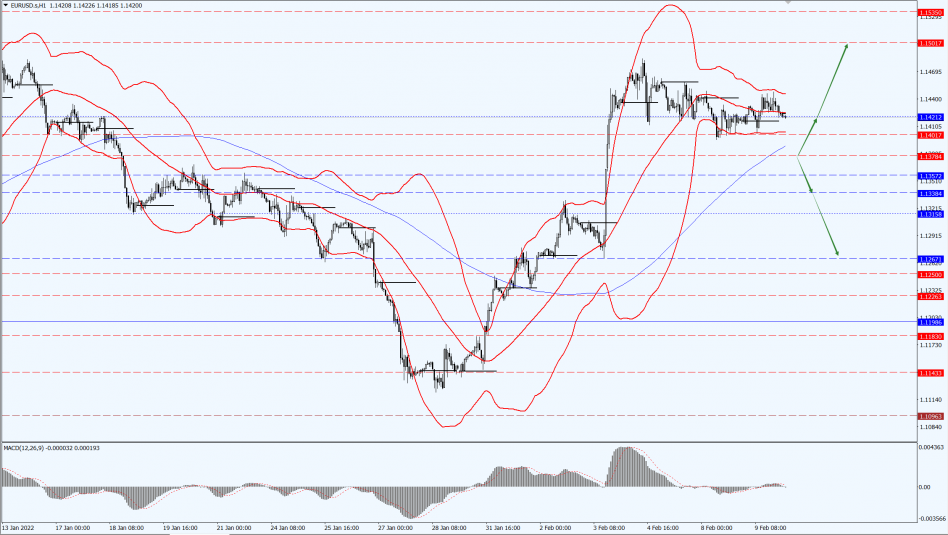

EUR/USD

Last week, European Central Bank President Christine Lagarde said for the first time that monetary policy is likely to be tightened this year, which caught the market off guard, and the market has revised its expectations for an ECB rate hike.

But Lagarde said Monday, 7th February 2022, that there is no need to tighten policy sharply, trying to ease investors’ expectations of hawkish action by the central bank.

However, a major shift in expectations for central bank policy over the past week, especially for the ECB, has dampened the dollar’s recent rally.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1378-line. If the euro runs steadily above the 1.1378-line, we will pay attention to the suppression strength of the two positions above 1.1421 and 1.1501.

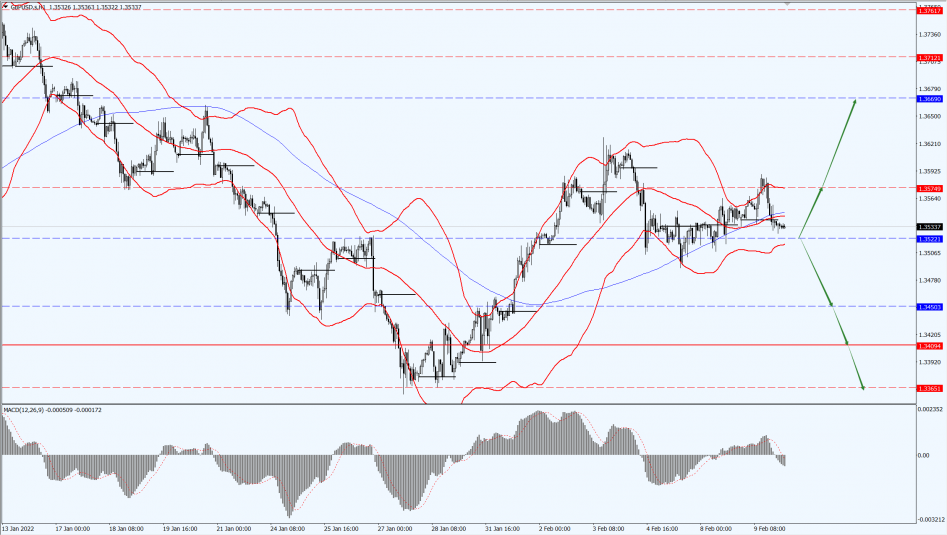

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound fell by 0.06% to 1.3535 against the dollar as Bank of England chief economist Huw Pill doused market expectations that the central bank will soon start selling U.K. Treasuries once interest rates reach 1%.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3522-line today. If the pound runs above the 1.3522-line, it will pay attention to the suppression strength of the 1.3574 and 1.3669 positions. If the pound runs below the 1.3522-line, it will pay attention to the support strength of the 1.3450 and 1.3409 positions.

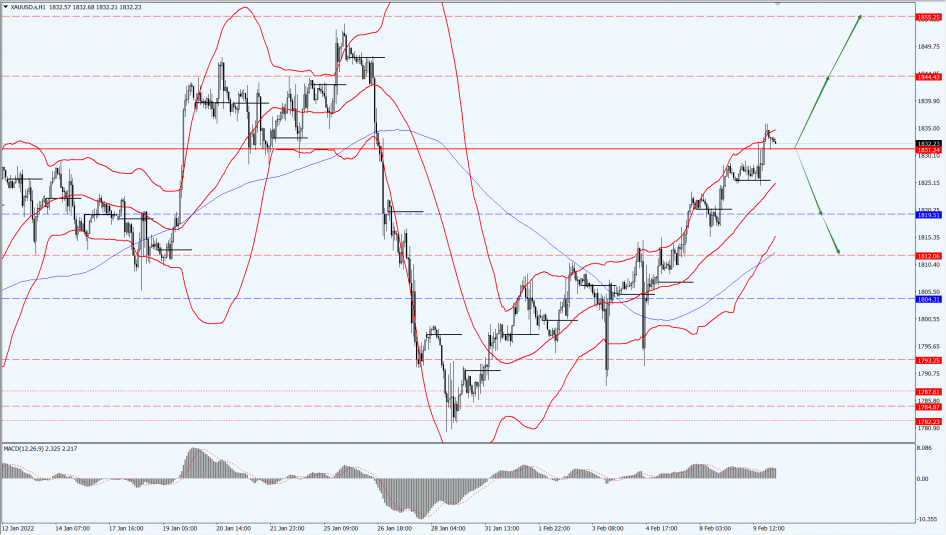

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Boosted by a weaker dollar and falling U.S. bond yields, spot gold refreshed its nearly two-week high to $1,835.82 per ounce, though gold prices fluctuated in a narrow range as the market was reluctant to make big bets ahead of U.S. inflation data.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1831-line today. If the gold price runs steadily above the 1831-line, then pay attention to the suppression strength of the 1844 and 1855 positions. If the gold price falls below the 1831-line, it will open up further callback space. At that time, pay attention to the strength of the two positions at 1819 and 1812.

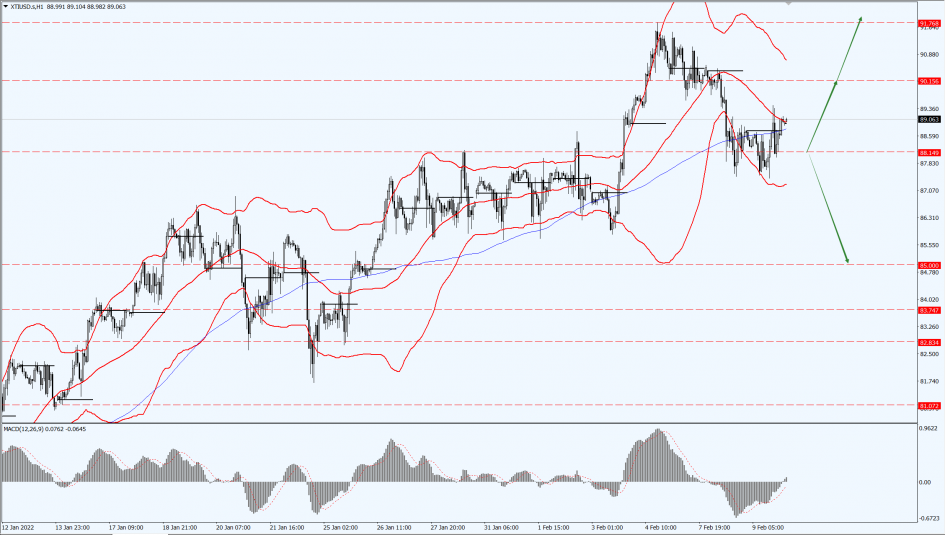

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, Brent oil rose by 1.12% in late trading to close at $91.8 per barrel.

According to data released by the U.S. Energy Information Administration (EIA), crude oil inventories decreased by 4.756 million barrels to 410.4 million barrels in the week ended February 4, the lowest commercial inventory level since October 2018.

Meanwhile, gasoline inventories decreased by 1.644 million barrels and refined oil decreased by 930,000 barrels, with Brent oil once surging higher to $92.09 per barrel after the release of the data.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 88.14-line today. If the oil price runs below the 88.14-line, then focus on the support of the 85-line. If the oil price runs above the 88.14-line, then pay attention to the suppression of the 90.15 and 91.76 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.