1. Forex Market Insight

EUR/USD

Last week, the euro slumped by 1.70% against the dollar to 1.1150, hitting an intraday low of 1.1120 since June 2 last year.

Tensions in Ukraine have put the euro and Europe at risk, especially in energy, with markets priced in a higher risk premium for the euro and growing concerns that the impasse between Russia and the West could prompt the former to limit energy supplies to Europe.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1096-line. If the euro runs steadily above the 1.1096-line, we will pay attention to the suppression strength of 1.1183 and 1.1226 above. If the strength of the euro breaks below the 1.1096-line, we will pay attention to the support strength of the two positions of 1.1055 and 1.1031.

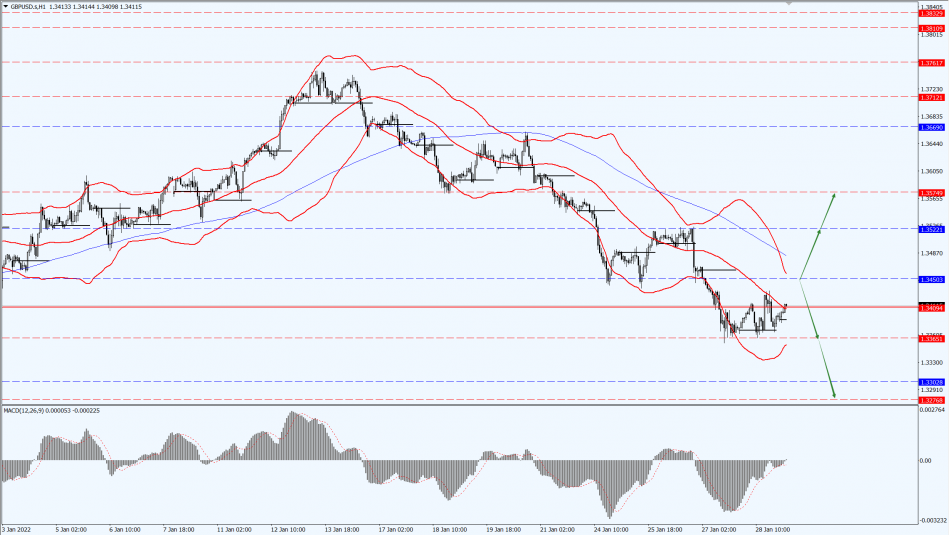

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound closed sharply lower against the dollar for the second week in a row, ending by 1.16% lower at 1.3396. In addition to the Fed rate hike and the situation in Ukraine, political uncertainty surrounding British Prime Minister Johnson weighed on market sentiment. The latest revelations about Johnson’s “partygate” imply increased political uncertainty. The British police launched an investigation into “partygate”.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3450-line today. If the pound runs above the 1.3450-line, it will focus on the suppression of the 1.3522 and 1.3574 positions. If the pound runs below the 1.3450-line, it will focus on the support strength of the 1.3365 and 1.3276 positions.

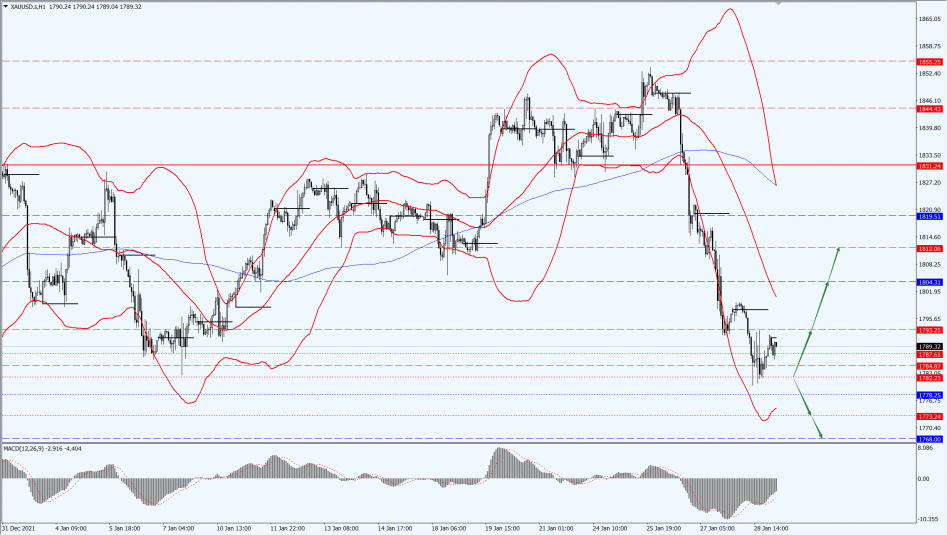

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Spot gold recorded its biggest weekly negative since Nov. 26, closing down by 2.35% to $1,791.57 per ounce and falling below the $1,780 mark during the session.

The Federal Reserve said last week that it may raise interest rates faster and more sharply in the coming months.

In addition, the performance of U.S. economic data also supported the Fed’s strong response to high inflation, helping the dollar index to record its biggest weekly positive since the week of June 18 last year. It rose strongly by 1.64% to 97.216 and hit a new high since July 1, 2020 to 97.441.

Meanwhile, the tension in Ukraine boosted safe havens, but the limited the support for gold prices.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1782-line today. If the gold price runs steadily above the 1782-line, then pay attention to the suppression strength of the 1793 and 1804 positions. If the gold price falls below the 1782-line, it will open up further callback space. At that time, pay attention to the strength of 1773 and 1768.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

International oil prices rose to more than seven-year highs last week and for the sixth week in a row, with Brent rising above the $90 mark as markets worried about a possible military conflict in Ukraine, which could disrupt energy markets, particularly gas supplies to Europe.

In the Middle East, the threat of the Houthis in Yemen to the UAE increased instability on the supply side.

With this, the NYMEX crude oil futures closed up by 2.90% to $87.29/barrel, a new high of $88.84/barrel since October 7, 2014. Meanwhile, ICE Brent crude oil futures closed up by 1.11% to $88.88/barrel, a new high of $90.27 since October 13, 2014 USD/barrel.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 85-line today. If the oil price runs below the 85-line, then pay attention to the support at 82.83 and 80. If the oil price runs above the 85-line, then pay attention to the suppression of 88.14 and 90.15.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.