1. Forex Market Insight

EUR/USD

The euro fell 0.63% against the dollar to $1.0644, the lowest level since March 2020.

The euro fell further after reports that Russian gas supplies to Poland under the Yamal contract had been halted.

The euro has been hit hard by fears that the war in Ukraine will hit the European region’s economy and also by expectations that the European Central Bank will act much slower than the Federal Reserve in raising interest rates.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0697-line today. If the euro runs steadily below the 1.0697-line, then pay attention to the support strength of the two positions of 1.0529 and 1.0357. If the strength of the euro breaks above the 1.0697-line, then pay attention to the suppression strength of the two positions of 1.0776 and 1.0832.

GBP Intraday Trend Analysis

Fundamental Analysis:

The market continues to be driven by Powell’s speech that essentially finalized a 50 basis point rate hike in May, and the dollar index is constantly pushing towards highs.

On the other hand, the UK retail sales rate in March fell sharply by 1.4% and the core rate fell by 1.1%, both much worse than expected, suggesting that UK consumers are restraining their shopping desires under the pressure of the rising cost of living, leaving the Bank of England in a difficult position between inflation and economic growth.

Meanwhile, British Prime Minister Boris is embroiled in the “partygate” scandal. Other than that, political uncertainty is also putting pressure on the pound.

Technical Analysis:

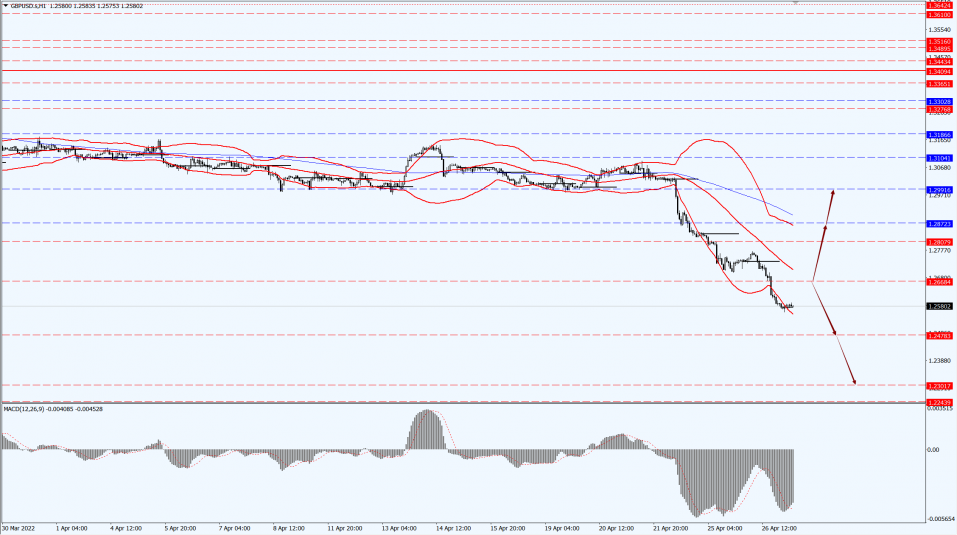

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2872-line today. If the pound runs below the 1.2872-line, it will pay attention to the suppression strength of the two positions of 1.2668 and 1.2478. If the pound runs below the 1.2872-line, then pay attention to the support strength of the two positions of 1.2991 and 1.3104.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices recovered slightly yesterday, 26th April 2022, from a more than one-month low hit in the previous session, and spot gold rose slightly to close above 1,900 as investors sought a safe-haven amid concerns about stagnant global economic growth and surging inflation.

As uncertainty surrounding the war and the Fed’s tightening plans keep markets on the sidelines, U.S. bond yields are sliding, which will likely offset the pressure on gold from the rising dollar.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1909-line today. If the gold price runs steadily below the 1909-line, then it will pay attention to the support strength of the 1895 and 1880 positions. If the gold price breaks above the 1909-line, then pay attention to the suppression strength of the two positions of the 1919-line and 1929-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil rose more than 3%, closing at $101.78 per barrel in late trading. Russia suspended natural gas supplies to Poland, and the market expects that the European Union may continue to consider options to cut Russian oil imports.

Ultra-low-sulfur diesel futures on the New York Mercantile Exchange (NYMEX) rose 9.2% to settle at $4.47 a gallon, a record closing high, after Poland said Russia warned it would halt natural gas supplies on Wednesday, 27th April 2022.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 99.50-line today. If the oil price runs above the 99.50-line, then focus on the suppression strength of the 102.52 and 107.52 positions. If the oil price runs below the 99.50-line, then pay attention to the support strength of the 97.33 and 95.05 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.