1. Forex Market Insight

EUR/USD

The risk of financial fragmentation in euro countries must be nipped in the bud, European Central Bank President Christine Lagarde said Monday, 20th June 2022.

She was referring to the differences in borrowing costs among member countries.

The European Central Bank (ECB) decided at an emergency meeting last week to develop actions to curb the rising cost of borrowing in the southern countries.

Moreover, it has designed a new instrument to limit the differences in public debt yields across member countries.

Lagarde reiterated her plan and indicated that the interest rates will be increased by 25 basis points over the next few months.

If inflation increases further, rates will be raised by a greater margin in September.

After September, a “gradual but sustained” rate hike would be appropriate.

Lagarde added that while higher borrowing costs could slow growth and the ECB must be mindful of the risk of triggering a recession, its forecast is that the economy will continue to grow.

Technical Analysis:

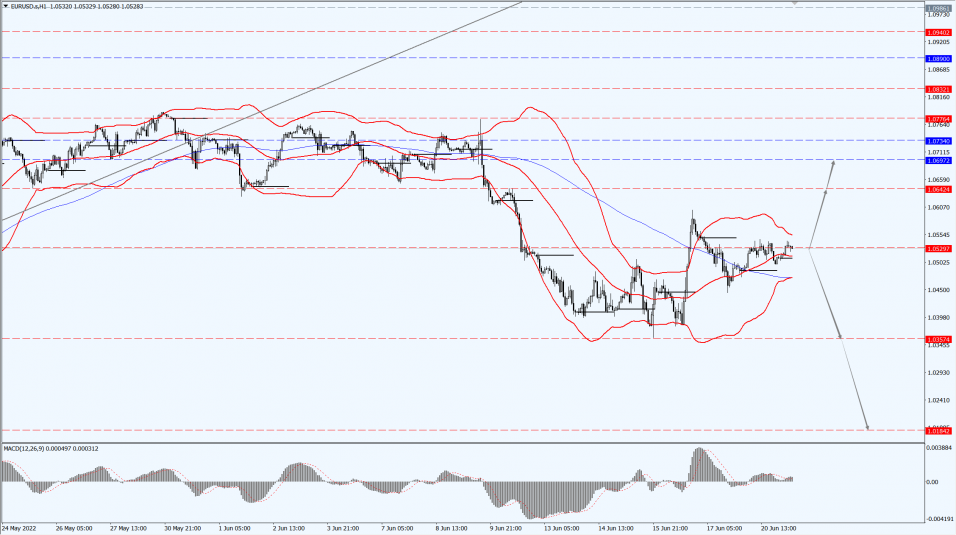

(EUR/USD 1-hour chart)

We focus on the 1.0529-line today. If EUR runs steadily below the 1.0529-line, then pay attention to the support strength of the two positions of 1.0357 and 1.0184. If the strength of EUR breaks above the 1.0529-line, then pay attention to the suppression strength of the two positions of 1.0642 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

Last week, the Bank of England raised borrowing costs by 25 basis points for the fifth time since December last year.

The UK benchmark interest rate is currently at its highest level since January 2009 at 1.25%.

Given that the Fed raised interest rates by 75 basis points the night before, the market is judging that the Bank of England will also take more action.

Yet, the UK economic outlook is the weakest of any major developed country.

This ultimately limited the Bank of England from following suit and continuing its cautiously slow pace of rate hikes.

Technical Analysis:

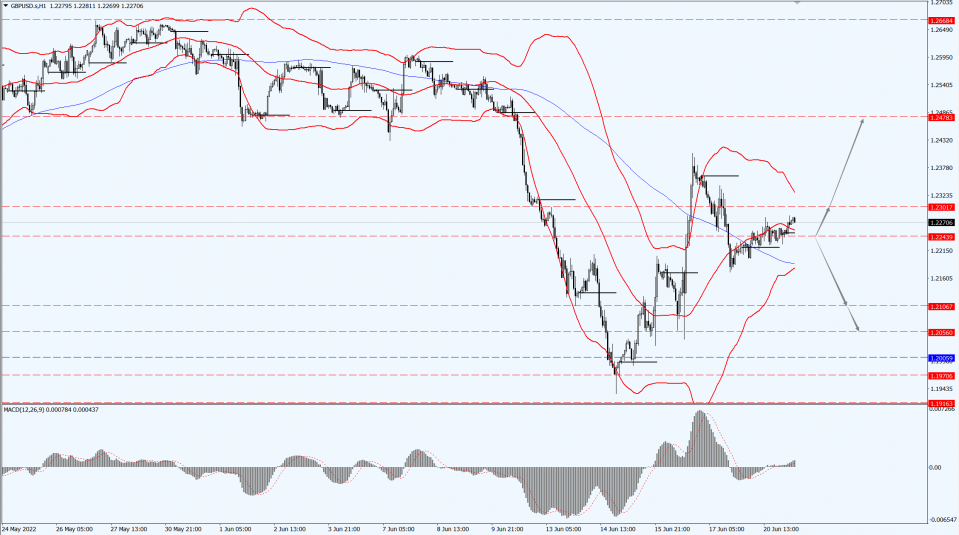

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2243-line today. If GBP runs below the 1.2243-line, it will pay attention to the suppression strength of the two positions of 1.2106 and 1.2056. If GBP runs above the 1.2243-line, then pay attention to the suppression strength of the two positions of 1.2301 and 1.2478.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Recently, the U.S. dollar index has retreated from near its highest level in about 20 years, rekindling some demand for gold from overseas buyers.

The Russian-Ukrainian geopolitical situation also provided support to gold prices.

However, most central banks around the world, including the ECB officials and the Fed officials, continue to release signals of further interest rate hikes in the future, making gold bulls wary

In addition, the congressional testimony of the Fed Chairman Powell will be ushered in this week, and the market is currently in a wait-and-see mood.

Technical Analysis:

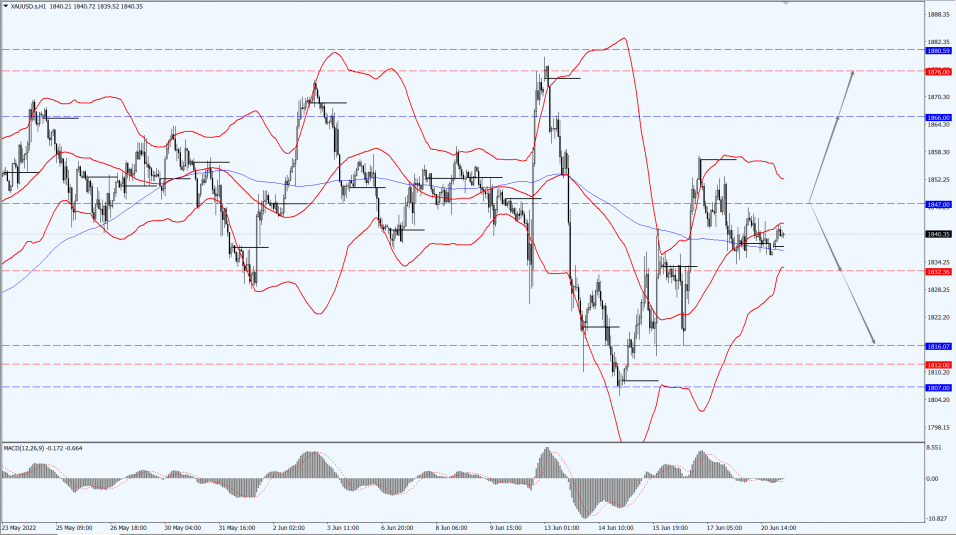

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1847-line today. If the gold price runs steadily below the 1847-line, then it will pay attention to the support strength of the 1832 and 1816 positions. If the gold price breaks above the 1847-line, then pay attention to the suppression strength of the two positions of the 1866 and 1876.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. crude oil futures for August are now at $108.85 per barrel.

Oil prices pared losses from last week’s drop on Monday, 20th June 2022, after Biden said a U.S. recession was “not inevitable”.

Markets are still pondering whether aggressive monetary policy tightening will shrink the economy and curb consumption.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 111.95-line today. If the oil price runs above the 111.95-line, then focus on the suppression strength of the two positions of 116.30 and 120.00. If the oil price runs below the 111.95-line, then pay attention to the support strength of the two positions of 107.52 and 105.01.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.