U.S. Stocks

Fundamental Analysis:

The S&P 500 index, an indicator of U.S. stocks, closed higher in shaky trading on Friday, 18th November 2022 as gains in defense stocks overshadowed declines in energy stocks and investors ignored hawkish comments from Federal Reserve officials about interest rate hikes.

Boston Fed Bank President Collins said that with little evidence that price pressures are abating, the Fed may need to raise rates by another 75 basis points to keep inflation under control.

For the week, the S&P 500 fell 0.7%, retreating slightly after a strong month-long rally.

The previous rally was aided by weaker-than-expected inflation data, driving the perception that the Fed may soften its aggressive stance on rate hikes.

The Nasdaq fell 1.6% for the week, while the Dow was essentially flat.

Defensive stocks led gains among S&P 500 sectors, with utilities up 2%, real estate up 1.3% and health care up 1.2%.

Energy stocks fell 0.9% as oil prices retreated, weighed down by concerns about weakening demand and further increases in U.S. interest rates.

Technical Analysis:

(Dow 30, 1-hour chart)

Execution Insight:

The Dow today pays attention to the 33233-line. If the Dow runs stably above the 33233-line, then pay attention to the suppression strength of the 33584 and 33949 positions.

Hong Kong Stocks

Fundamental Analysis:

On Friday, the Nasdaq Golden Dragon China Index closed down 3%, Hong Kong stocks closed down collectively at noon.

The Hang Seng Index (HSI) fell 2.09%, the HSCEI fell 2.87% once below 3600 points, the Hang Seng China Enterprises Index (HSCEI) fell 2.22%.

The net southbound capital inflow was 3.227 billion Hong Kong dollars for half a day, the market turnover was 64 billion Hong Kong dollars.

On the plate, the weighted technology stocks fell collectively, Bilibili Inc. (9626.HK) fell 7%, JD.com, Inc. (9618.HK) fell 5%, Meituan (3690.HK), Alibaba Group Holding Limited (9988.HK) fell 4%.

The market continues to focus on the epidemic, restaurant stocks fell collectively, Haidilao International Holding Ltd. (6862.HK) fell more than 9%, the worst performance of blue chip.

During the Macau Grand Prix, the number of passengers fell short of expectation. Gaming stocks fell, with Melco International Development Limited (0200.HK) falling by 8%.

iPhone14Pro delivery was again delayed, Apple concept stocks fell collectively, Sunny Optical Technology (Group) Company Limited (2382.HK) fell nearly 5% led the decline.

Qatar will ban the sale of alcohol in the World Cup venues, beer stocks plunged, Budweiser Brewing Company APAC Limited (1876.HK) fell 6%.

Hong Kong retail stocks, education stocks, luxury stocks, tobacco stocks, gold stocks, sporting goods stocks and many other stocks fell.

In addition, power stocks, semiconductor stocks, port transportation stocks and a few other stocks strengthened.

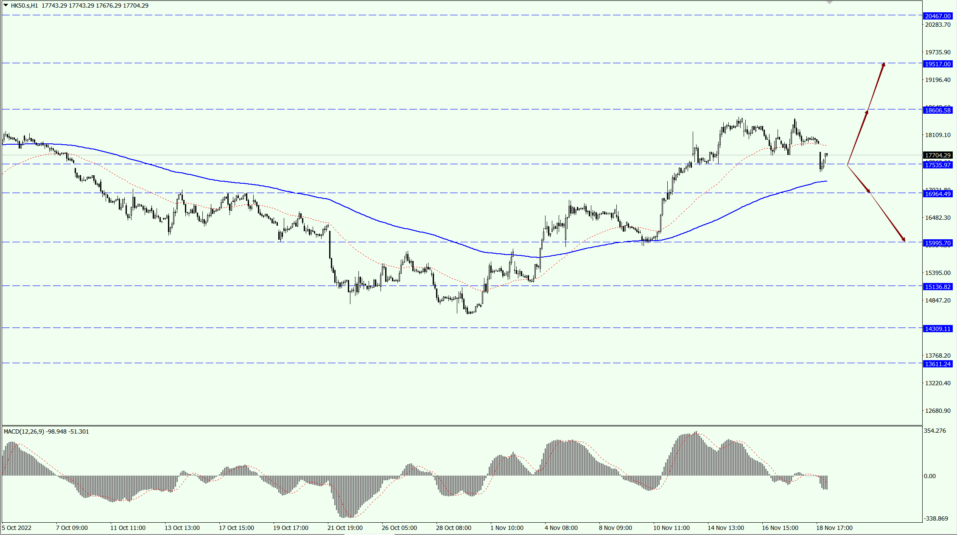

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 pays attention to the 17535-line today. If HK50 can run stably above the 17535-line, then pay attention to the suppression strength of the two positions of 18606 and 19517.

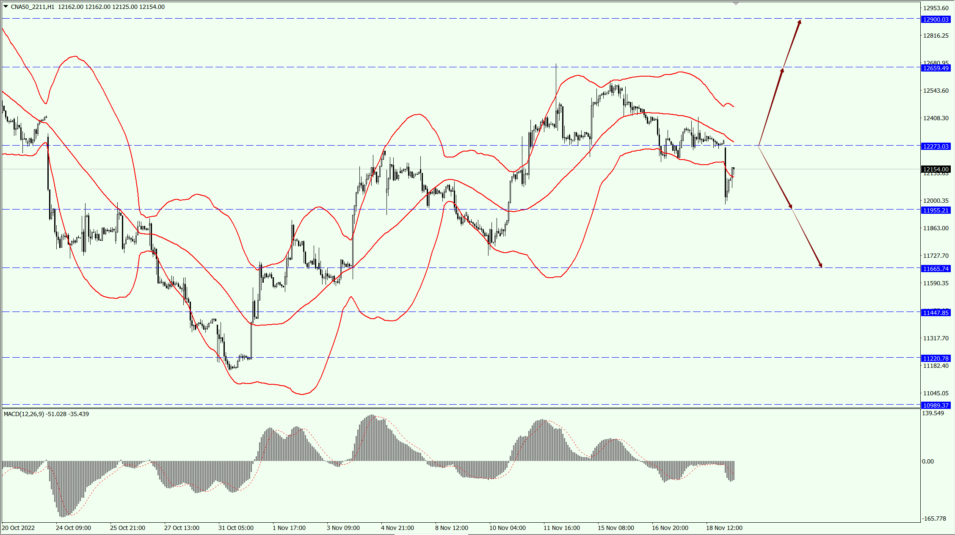

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12273-line today. If A50 runs stably below the 12273-line, then pay attention to the support strength of the two positions of 11955 and 11665. If A50 runs above the 12273-line, it will open up further upside space.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.