U.S. Stocks

Fundamental Analysis:

U.S. stocks closed sharply higher on Wednesday, 11th January 2023 with the S&P 500 and Nasdaq both up more than 1%, as investors felt optimistic ahead of an inflation report that could give the Federal Reserve room to slow the pace of aggressive interest rate hikes.

Economists interviewed by Reuters forecast that the highly anticipated report, due out Thursday, will show the U.S. consumer price index (CPI) rose 6.5% year-on-year in December, slowing from November’s 7.1% growth rate.

Among the sectors, real estate and non-essential consumer goods stocks were the strongest performers, while Microsoft, Amazon and other mega-cap growth stocks gave the biggest boost to the S&P 500.

The indicator index is up so far in 2023 after falling sharply last year.

Hopes that the Fed may soon slow the pace of aggressive tightening after seven rate hikes in 2022 have boosted the market in recent sessions, even as speeches from some Fed officials support the view that the Fed needs to be wary of raising rates to fight inflation.

This week also marks the start of the fourth-quarter earnings season for S&P 500 component companies, which are expected to report lower year-over-year earnings overall, according to Lufthansa IBES data.

Later this week, large U.S. banks will kick off earnings season, with quarterly earnings expected to fall as the risk of recession rises due to tighter monetary policy.

Technical Analysis:

(Dow 30, 1-hour chart)

Execution Insight:

The Dow today pays attention to the 33949-line. If the Dow runs stably above the 33949-line, then pay attention to the suppression strength of the 34221 and 34477 positions.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks in the morning session three major indices dived to turn down.

The Hang Seng TECH Index (HSTECH) once fell nearly 3%, closed down 1.89% at noon, the Hang Seng Index (HSI), and Hang Seng China Enterprises Index (HSCEI) points are down 0.33% and 0.54%.

The half-day net southbound capital inflow was HK$1.131 billion, the market turnover was HK$93.6 billion.

On the market, large technology stocks have fallen dragged the market lower, Kuaishou Technology (1024.HK) fell more than 4%, Tencent Holdings Limited (0700.HK), Alibaba Group Holding Limited (9988.HK) fell more than 3%, Meituan (3690.HK), Baidu, Inc. (9888.HK), JD.com, Inc. (9618.HK) are down, but NetEase, Inc. (9999.HK) counter trend up about 5%.

Restaurant stocks fell in front, under the sea to hold a close to 120 billion Hong Kong dollars, domestic housing stocks and property management stocks fell significantly, hand games stocks, home appliances, power stocks, education stocks, aviation stocks fell.

On the other hand, most of the auto stocks rose, BYD shares rose more than 6% of the best performance, oil stocks, pork concept stocks, copper stocks strong, COFCO Joycome Foods Limited (1610.HK) jumped 9%.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 pays attention to the 20467-line today. If HK50 can run stably above the 20467-line, then pay attention to the suppression strength of the two positions of 21450 and 22127.

FTSE China A50 Index

Technical Analysis:

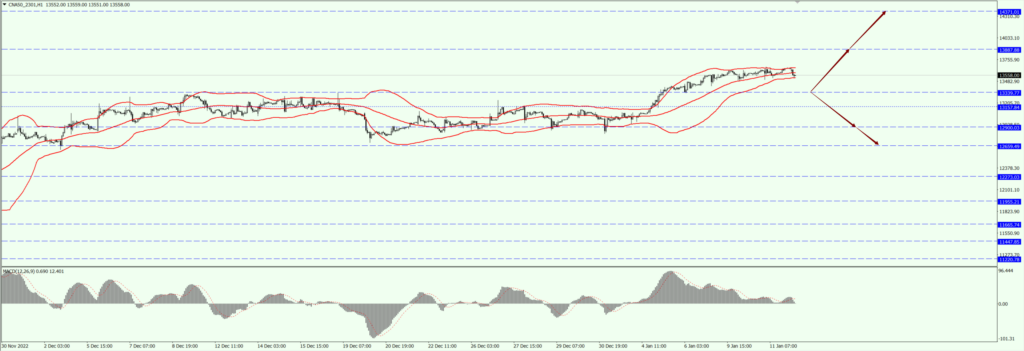

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 13339-line today. If A50 runs stably below the 13339-line, pay attention to the support strength of the 12900 and 12659 positions. If the A50 runs above the 13339-line, it will open up further upside space.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.