U.S. Stocks

Fundamental Analysis:

U.S. stocks closed higher for a second straight day on Tuesday, 18th October 2022, as solid quarterly results from Goldman Sachs and Lockheed Martin eased concerns about weak earnings this earnings season.

Goldman Sachs shares rose 2.33% after reporting a smaller-than-expected drop in quarterly profit as higher net interest income cushioned the blow from a slowdown in the investment banking business.

The investment bank, which is reorganizing its business into three divisions, largely capped a quarterly report from major financial firms on an upbeat note, although some banks raised loan-loss provisions in anticipation of a troubled economy ahead.

Weapons maker Lockheed Martin jumped 8.69% after the company reported stronger-than-expected quarterly revenue and maintained its revenue forecast for 2022.

The stock’s surge helped lift the S&P Industrial Stock Index, making it the best performer among 11 major sectors.

Signs that the Fed’s aggressive path of rate hikes could begin to weigh on the labor market are beginning to surface.

The stock was little changed after it was reported that Microsoft will lay off fewer than 1,000 employees this week, becoming the latest U.S. technology company to cut jobs or slow hiring amid a global economic slowdown.

The Fed’s policy path has many investors worried that it could plunge the economy into recession by making policy mistakes and raising interest rates too much.

Comments from Fed officials have been largely unanimous about the need for the Fed to curb inflation.

A report said ratings agency Fitch has slashed its U.S. growth forecasts for this year and next, warning that Fed rate hikes and inflation would send the economy into a 1990-style recession.

But economic data on Tuesday showed that the manufacturing sector continued to perform solidly despite the Fed’s efforts, although those efforts appear to have put significant pressure on the housing market.

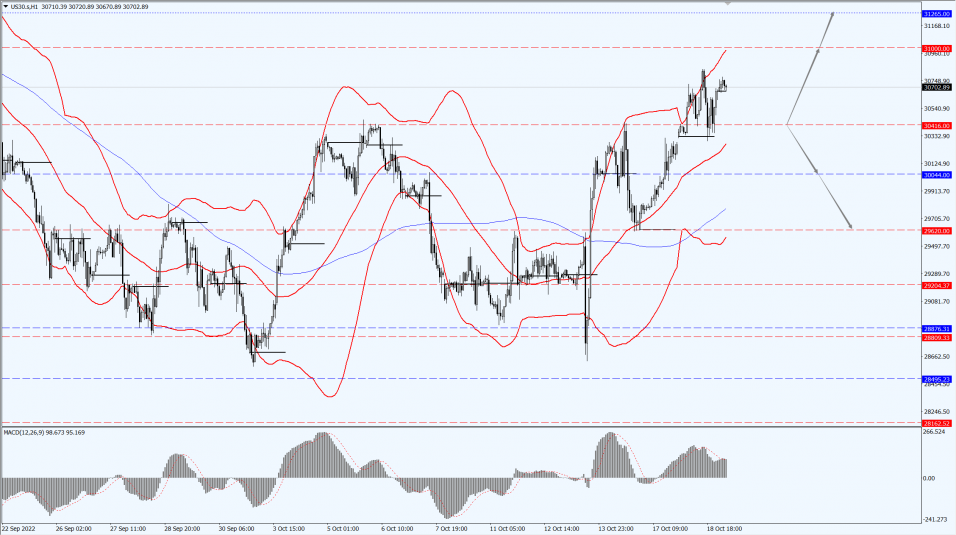

Technical Analysis:

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 30416-line today. If the Dow runs steadily above the 30416-line, it will pay attention to the suppression strength of the 31000 and 31265 positions. If the Dow runs steadily below the 30416-line, it will pay attention to the support strength of the 30044 and 29620 positions.

Hong Kong Stocks

Fundamental Analysis:

Hong Kong stocks, which rebounded strongly yesterday, opened lower, with the HSI down 0.64%, the national index down 0.69% and the Hang Seng Technology Index down 0.82%.

Technology, new energy vehicles, pharmaceutical stocks led the fall, Hansoh Pharmaceutical Group Company Limited (3692.HK) fell nearly 3% to lead the decline in blue chips, XPeng Inc. (9868.HK) fell more than 4%.

On the market, most of the large technology stocks fell, NetEase, Inc. (9999.HK), JD.com, Inc. (9618.HK) fell nearly 2%, Kuaishou Technology (1024.HK), Tencent Holdings Limited (0700.HK), ALIBABA (1688.HK) are down more than 1%, Meituan (3690.HK), Baidu, Inc. (9888.HK) fell slightly.

Yesterday’s sharp rebound in the trend of automotive stocks divergence, sporting goods continue to fall, the recent strong pharmaceutical stocks part of the pullback, photovoltaic stocks, semiconductor stocks, power stocks fell in general.

On the other hand, most of the heavy infrastructure stocks rose, China Railway Group Limited (0390.HK), CRRC Corporation Limited (1766.HK), Metallurgical Corporation of China Ltd. (1618.HK) were up about 1%, software stocks in general.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 17535-line today. If HK50 can run stably above the 17535-line, then pay attention to the suppression strength of the 18606 and 19517 positions. If the HK50 runs below the 17535-line, then pay attention to the support strength of the 16664 and 15995 positions.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 12733-line today. If the A50 runs steadily below the 12733-line, it will pay attention to the support strength of the two positions of 12423 and 12260. If the A50 runs above the 12733-line, it will open up further upward space. At that time, pay attention to the two positions of 12945 and 13157.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.