U.S. Stocks

Fundamental Analysis:

U.S. stocks closed higher in choppy trading on Friday, 4th November 2022, ending a previous four-day losing streak, as the market assessed a mixed jobs report and comments from Federal Reserve officials on the pace of interest rate hikes.

The S&P 500 and Nasdaq both rose 2% at one point earlier in the session, and the Dow Jones Industrial Average climbed 1.9%, before gains narrowed and even briefly declined after the closely watched labor market report was released.

The report showed that the unemployment rate rose in October, suggesting that the job market may finally be starting to show some signs of loosening, which gives the Fed room to slow the pace of interest rate hikes from December.

But the data also showed that average hourly earnings rose slightly more than expected, as did employment gains, suggesting that the labor market remains largely entrenched.

Labor market data has been a major concern for the market, and the Fed has repeatedly said it wants to see signs of cooling before considering a pause in rate hikes.

Fed Chairman Jerome Powell’s hawkish remarks on Wednesday fueled concerns that the Fed’s rate hike action could last longer than previously expected, putting further pressure on stocks.

Last week, the Dow fell 1.39%, ending a previous four-week gain streak, while the S&P 500 fell 3.34% and the Nasdaq dropped 5.65%, its biggest weekly decline since January.

A mixed set of data released earlier last week showed that some parts of the economy are slowing, but also underscored the resilience of the U.S. labor market, despite the Fed’s aggressive rate hikes to curb inflation.

Technical Analysis:

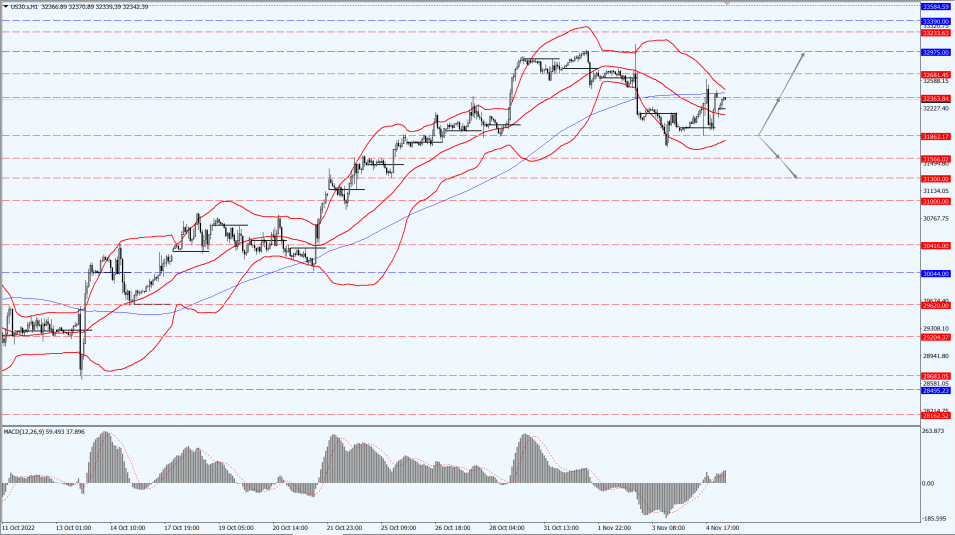

(Dow 30, 1-hour chart)

Execution Insight:

The Dow focuses on the 31863-line today. If the Dow runs steadily above the 31863-line, it will pay attention to the suppression strength of the 32363 and 32975 positions. If the Dow runs steadily below the 31863-line, it will pay attention to the support strength of the 31566 and 31300 positions.

Hong Kong Stocks

Fundamental Analysis:

The FTSE China A50 Index futures opened lower in the morning, extending losses to 1%.

Hong Kong’s major indices also opened lower collectively, with the Hang Seng Index (HSI) down 0.8% at 16031.79 points, the Hang Seng TECH Index (HSTECH) down 1.81% at 3205.11 points, and the Hang Seng China Enterprises Index (HSCEI) down 1.25% at 5414.14 points.

On the market, large technology stocks generally fell.

Auto stocks fell, led by new energy auto stocks lower, Internet medical stocks, restaurant stocks, sporting goods stocks, cell phone concept stocks fell in general.

On the other hand, semiconductor stocks, gold stocks strengthened significantly, back to A was accepted by the SSE, Hua Hong Semiconductor Limited (1347.HK) opened sharply higher by nearly 7%.

Zijin Mining Group Company Limited (2899.HK) intends to 4.06 billion yuan to acquire 654 million H shares of Zhaojin Mining Industry Company Limited (1818.HK), both of which opened higher.

The Hong Kong stock market may maintain a consolidation trend in the short term, digesting domestic and international uncertainty, waiting for clearer policy signals and positive catalysts.

Although the market has rebounded recently, valuations remain attractive. Upside at current levels outweighs downside risks, and investors are advised to focus on potential catalysts.

In the medium term, the market is judged to have reversed or will depend on the realization of the following two factors:

- The Federal Reserve slowing the pace of interest rate hikes.

- Clearer evidence that China’s economic growth is emerging from the doldrums.

Technical Analysis:

(HK50, 1-hour chart)

Execution Insight:

HK50 focuses on the 15995-line today. If HK50 can run stably above the 15995-line, then focus on the suppression strength of the 16964 and 17535 positions. If the HK50 runs below the 15995-line, then pay attention to the support strength of the 15136 and 14309 positions.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the 11665-line today. If the A50 runs steadily below the 11665-line, pay attention to the support strength of the two positions of 11447 and 11220. If the A50 runs above the 11665-line, it will open up further upward space. At that time, pay attention to the two positions of 12336 and 12659.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to find out more.

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, make no representation or warranties to the information displayed and Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, as well as managers, shall not be liable for any direct, indirect, special or consequential loss or damages incurred as a result of any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.