1. Forex Market Insight

EUR/USD

The euro fell as much as 1.2% against the dollar to $1.1090, the lowest level since June 2020. Meanwhile, hedge funds and options-related accounts sold euros, and real money accounts both sold and bought euros.

One-month implied volatility climbed to its highest level in nearly two years, and the market’s demand for low-delta euro put options continued to be strong.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, we will pay attention to the support strength of the 1.1096-line. If the euro runs steadily above the 1.1096-line, we will pay attention to the suppression strength of the two positions of 1.1183 and 1.1226. If the strength of the euro breaks below the 1.1096-line, we will pay attention to the support strength of the 1.1031-line.

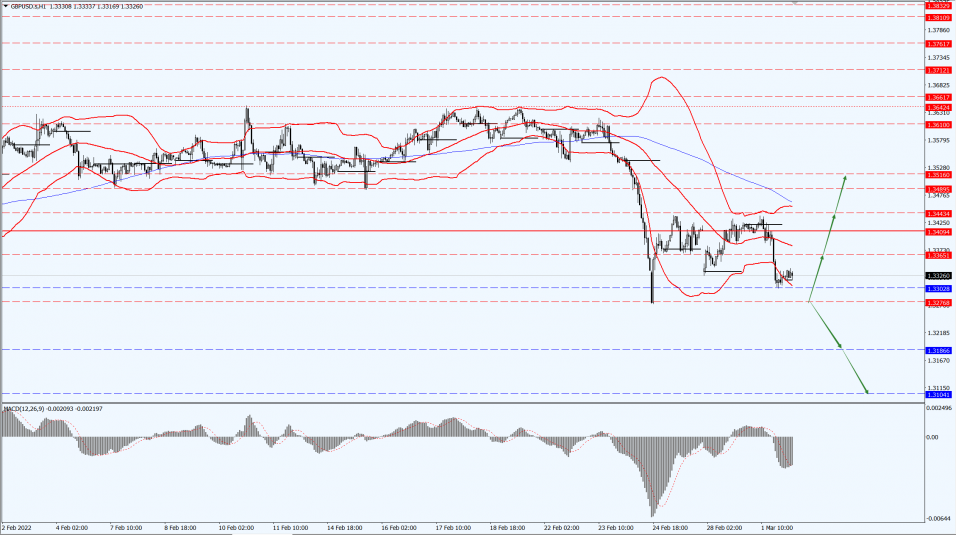

GBP Intraday Trend Analysis

Fundamental Analysis:

Members of the Bank of England’s Monetary Policy Committee (MPC) said in a recent speech that the impact of rising energy prices on the CPI may be temporary.

Energy prices are unlikely to generate sustained inflation. If no action is taken, CPI is likely to remain persistently above 2%. Plus, further modest tightening of monetary policy may be needed.

However, the overall trend for pound remains weak due to the tense situation between Russia and Ukraine.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3276-line today. If the pound runs above the 1.3276-line, it will pay attention to the suppression strength of the two positions of 1.3365 and 1.3443. If the pound runs below the 1.3276-line, it will pay attention to the support strength of the 1.3186-line.

2. Precious Metals Market Insight

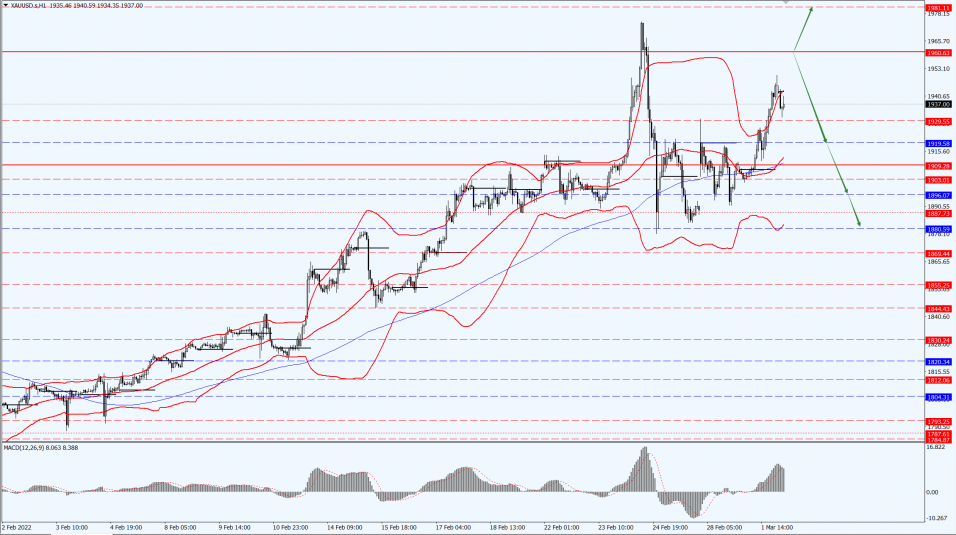

Gold

Fundamental Analysis:

Gold extended its rally yesterday, with spot gold rising more than 2% to break the 1950 barrier late in the New York market. The market was worried that global economic growth would face increasing risks due to sanctions against Russia.

U.S. Treasuries climbed as investors abandoned bets on the Federal Reserve raising interest rates by 50 basis points this month.

With this, gold prices had their best month since 2016 in February as demand for the precious metal rose.

Ultimately, the rise in gold prices underscores investor concerns that the Russian-Ukrainian war is clouding the economic outlook while inflation soars.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold is focused on the 1960-line today. If the gold price runs steadily below the 1960-line, then it will pay attention to the support strength of the two positions of 1919 and 1896. If the gold price breaks above the 1960-line, it will open up further upward space, and then pay attention to the suppression strength of the 1981-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Yesterday, crude prices surged on Tuesday, 1st March 2022, after news that the United States and major economies had teamed up to release emergency oil reserves did little to curb investor fears of severe global supply disruptions. That said, U.S. crude oil rose 11% to above $106 per barrel.

The International Energy Agency (EIA) agreed to release 60 million barrels of oil from global inventories, equivalent to less than six days of Russia’s oil production. As countries cascade financial sanctions against Russia, there are growing fears that global supplies will be disrupted.

The International Energy Agency (EIA) agreed to release 60 million barrels of oil from global inventories, equivalent to less than six days of Russia’s oil production. As countries cascade financial sanctions against Russia, there are growing fears that global supplies will be disrupted.

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 99.50-line today. If the oil price runs above the 99.50-line, then focus on the suppression of the 104.53 and 111.95 positions; if the oil price breaks below the 99.50-line, then pay attention to the support strength of the 95.05 and 91.54 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectaly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision