Elon Musk Takes Advantage Of China’s Lost In India

China’s loss in India could be Elon Musk’s gain. Tesla (TSLA.O) has had a red-carpet welcome from India for its proposal to invest in the country, while its largest rival in electric vehicles, China’s BYD (002594.SZ), has been stopped cold by increased scrutiny from New Delhi.

More Aggressive Rate Cuts For Brazil Central Bank

Brazil’s central bank kicked off its rate-cutting cycle more aggressively than expected on Wednesday, reducing its benchmark interest rate by 50 basis points and signaling more of the same in the months ahead due to an improving inflation outlook.

Australians Protest To Work From Home Permanently

Before COVID-19 sent one-third of the global workforce home, the Melbourne property surveyor that employs drone operator Nicholas Coomber called its 180-strong staff into the office every day at 9 a.m. to hand out assignments.

Today’s News

Staring at the face of adversity are local-currency investors from emerging Asian nations who aren’t shying away from hedging their overseas investments even as the cost of protection rises to the highest in 14 years amid concern dollar weakness may erode the value of their portfolios.

The aggregate hedging cost for funds from seven emerging-Asian economies has risen to the highest since at least 2009, according to data compiled by Bloomberg, mainly due to the divergence between their monetary policies and those of the US. And while the prospect of a Federal Reserve rate pause ensures that gap doesn’t widen further, increasing bearishness toward the dollar is prompting investors to safeguard their holdings.

Asian currencies rose by 1.5% versus the dollar in July as they racked three straight months of losses, according to a Bloomberg Index. Meanwhile, asset managers have boosted their short dollar bets to a record level in July, while hedge funds also flipped to a net short position on the US currency in the same month, Commodity Futures Trading Commission data show.

Other related news include:

Stocks In Asia Dips For Third Consecutive Day

Shares in Asia fell for a third day in a row, following losses on Wall Street, as better-than-expected U.S. labor market data boosted speculations that the Federal Reserve will maintain its tight policy for much longer than originally intended.

Equity benchmarks in Japan, Australia and Hong Kong all declined, while those in China barely changed. Taiwan’s markets are shut due to the approach of a typhoon. Evergrande Property Services Group Ltd., a unit of the highly indebted developer, slid by about half in Hong Kong as the company resumed trading for the first time since March 2022.

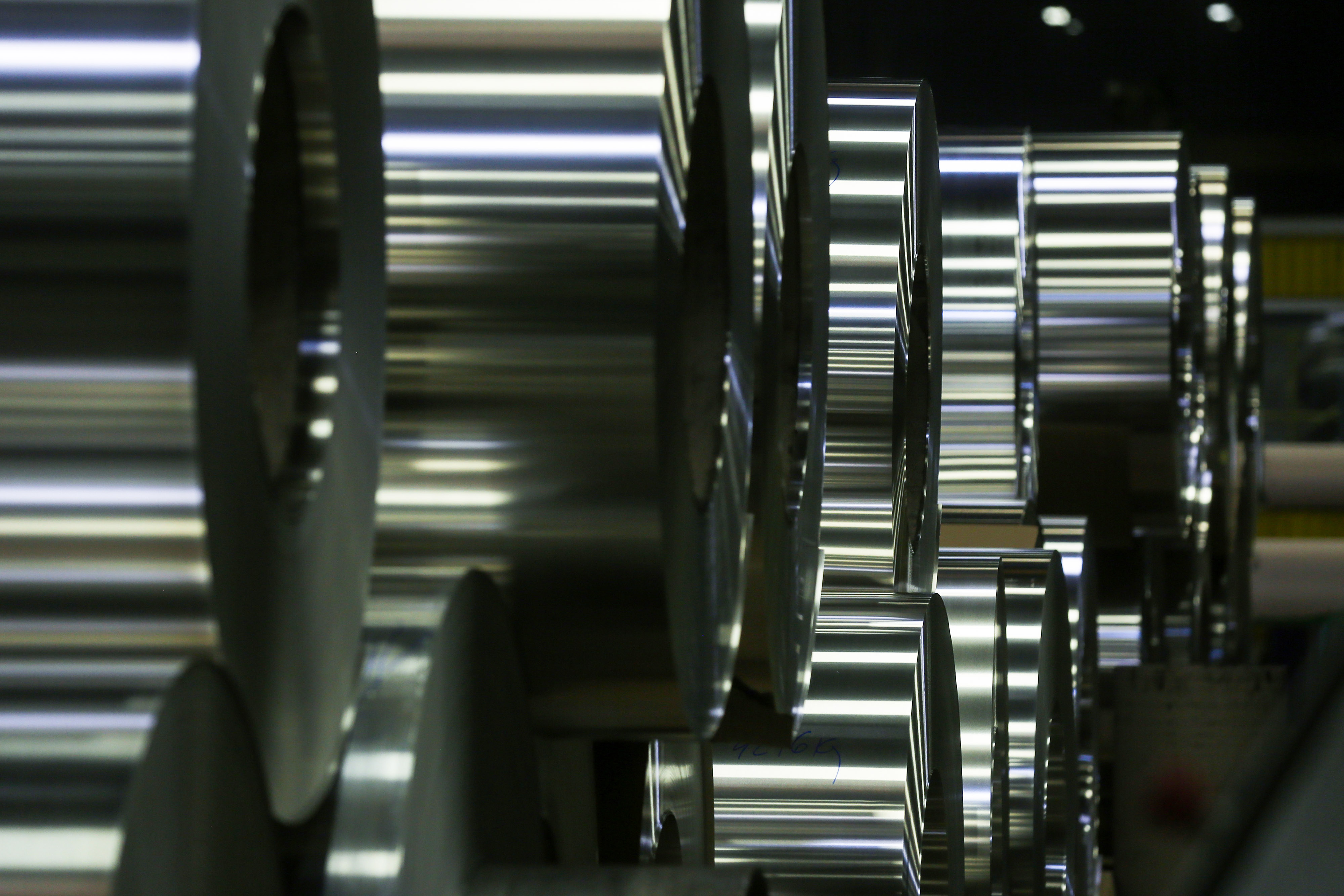

China Spooks Commodity Traders With Probe

Chinese authorities are intensifying a crackdown on some commodities transactions they view as offering little economic benefit, leading to a pullback by industry participants that is poised to reduce both trading volumes and volatility in the domestic market.

Authorities have escalated probes into trades they suspect are being used to obtain cheap financing or government subsidies rather than serving the real economy, according to traders and officials with knowledge of the investigations.

First Contract Of The Year For Hong Kong PMI

Hong Kong’s private sector activity contracted in July for the first time this year, providing further proof of the slowdown in the financial hub’s post-COVID recovery.

The S&P Global Purchasing Managers’ Index fell to 49.4 last month from 50.3 in June, slipping below the 50 mark that separates expansion from contraction for the first time since December. Overall optimism slipped to the weakest since November, according to a statement accompanying the data.