PayPal Launches Dollar-Backed Stablecoin

Payments giant PayPal (PYPL.O) said on Monday it has launched a U.S. dollar stablecoin, becoming the first major financial technology firm to embrace digital currencies for payments and transfers.

Tesla Appoints Taneja CFO As Kirkhorn Steps Down

Tesla (TSLA.O) finance chief Zachary Kirkhorn has stepped down, surprising analysts who considered the 13-year veteran as a possible successor to CEO Elon Musk.

Wall Street Regains Ground As U.S. Inflation Report Nears

U.S. stocks finished higher on Monday, regaining some of the ground lost last week, as investors added positions ahead of Thursday’s highly awaited U.S. inflation report.

Today’s News

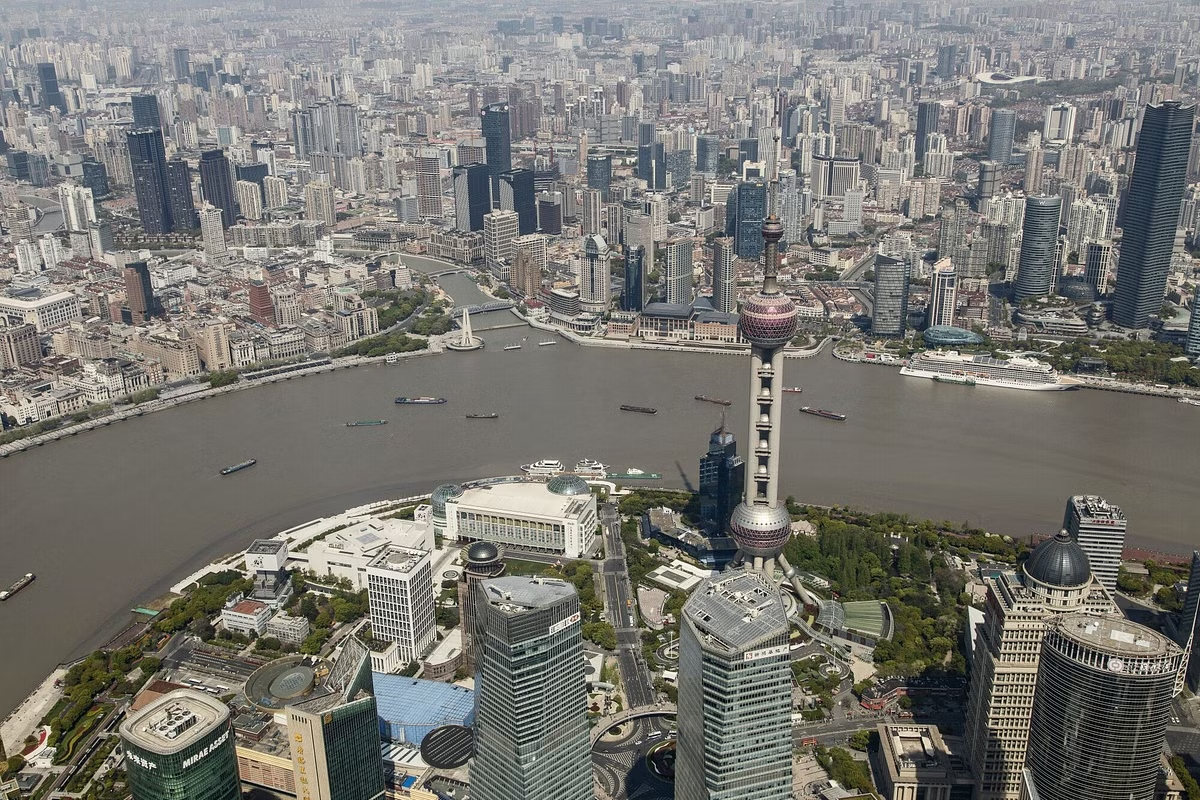

When China finally lifted its pandemic restrictions after three years of stringent controls, experts were expecting a boom in sales as the nation opens its doors to the world once more. Instead, demands were a shadow of what they used to be, prior to the pandemic.

It’s an ominous sign of the deflationary pressure that’s hitting Chinese businesses as the economy weakens, and threatening to undermine Beijing’s stimulus plans if consumers opt to defer spending.

Due to these circumstances, many were forced to slash prices and cut profits to make ends meet.

China is experiencing a rare period of falling prices. That’s a clear contrast to the rocketing inflation that followed the reopening of the U.S. and other major economies. For China, it is visible both at the factory gate and on the retail side.

Producer prices have been contracting on a yearly basis since October 2022, largely due to the falling prices for commodities like coal and crude oil. Data on Wednesday will likely depict a decline in consumer prices for July, which would be the first time since late 2020 that both consumer and producer prices experience such contractions.

Other related news include:

Mixed Speculations Ahead Of China Trade Data

Shares in Asia were mixed as traders awaited the release of a trade balance data from China to gauge the strength of the recovery in the world’s second-largest economy.

Stocks fell in Hong Kong and China, while equities in South Korea erased gains. Japanese and Australian shares held onto modest gains. Contracts for U.S. stocks slipped after the S&P 500 on Monday halted a four-day drop and the Dow Jones Industrial Average saw its biggest advance in more than seven weeks.

Political Considerations Are Hindering China Growth Stimulus

China is showing symptoms of a Japan-like stagnation, including a slump in property prices and declining exports. Meanwhile, services and high-tech manufacturing are on the rise.

The divergence is putting economists close to the government at loggerheads with policymakers in Beijing about whether the economy requires more support as a tug of war that’s likely to keep growth below its potential.

Weakening China Economy Spurs Measures

China’s economic activity lost more steam in July with manufacturing contracting again and the services sector weakening, as Beijing promises small measures of support to boost consumption.

The official manufacturing purchasing managers’ index rose slightly to 49.3, beating economists’ estimates but still remains below the 50 mark that separates expansion from contraction. The non-manufacturing gauge — which measures activity in the services and construction sectors — eased to 51.5, slightly weaker than expected. The sub-index focused on services waned to 51.5 from June’s 52.8.