Inflation Data Weighing In On Dollar

The dollar starts the week on the back foot after a mixed U.S. jobs report provided little directional conviction and as market focus turned to inflation data from the world’s two largest economies due this week. The U.S. economy added fewer jobs than expected in July, data showed, but it recorded solid wage gains and a decline in the unemployment rate.

Poland Steps In To Aid Leaky Russian Oil Pipeline

Polish pipeline operator PERN said it had halted pumping through a section of the Druzhba pipeline, which connects Russia to Europe, after detecting a leak in central Poland over the weekend, but it expects flows to resume by Tuesday. PERN said there was no indication of temperament from a third party, following a series of attacks on pipelines carrying Russian oil and gas since Moscow launched its invasion of Ukraine in 2022.

Asia Shares On Guard With Regards To U.S. Report

Asian share markets were in a cautious mood today after a mixed U.S. jobs report sparked a rally in beaten-down bonds, but new hurdles lay ahead in the shape of U.S. and Chinese inflation figures due later this week. MSCI’s broadest index of Asia-Pacific shares outside Japan <.MIAPJ0000PUS> was a fraction firmer in thin trade, after losing 2.3% last week. Japan’s Nikkei (.N225) slipped by 0.2% but found support at its July low.

Today’s News

In a turn of epic proportions, Nate Anderson of Hindenburg Research has successfully picked off his competition one at a time. In mere months this year, he erased as much as USD 99 billion off Gautam Adani, Jack Dorsey and Carl Icahn with their combined wealth while knocking USD 173 billion off the value of their publicly traded companies.

In an era when prominent short sellers have retreated from the limelight – fretting lawsuits, short squeezes and government probes – the deft researcher has emerged as the gutsiest bear around. Allies say he’s risking civil suits, physical attacks and potentially even overseas arrest.

Anderson with a team of roughly a dozen researchers, reaped relatively small profits from those fights. Within four weeks, the stock’s alleged overvalued assets plunged, erasing approximately USD 17 billion worth of the billionaire’s wealth. Yet the combined gain for all investors who shorted the shares before the report would have been at an estimate of USD 56 million if they timed their exits perfectly, according to data from S3 Partners, apart from the cost of setting up the bets.

More related news are as follows:

Adani’s Influence On India’s Economy Rebounds

Over three decades, billionaire Gautam Adani built a vast infrastructure network across India that’s become indispensable for both local businesses and foreign firms like Apple Inc. and Amazon.com Inc.

That control over parts of the country’s transport links, coal production and private electricity supply has proved a trump card for the Adani Group as it attempts to recover from the fallout of fraud allegations by Hindenburg Research. The short seller’s January report knocked as much as $153 billion off the Adani Group’s value and set off regulatory probes in India. Key findings are expected in the coming weeks.

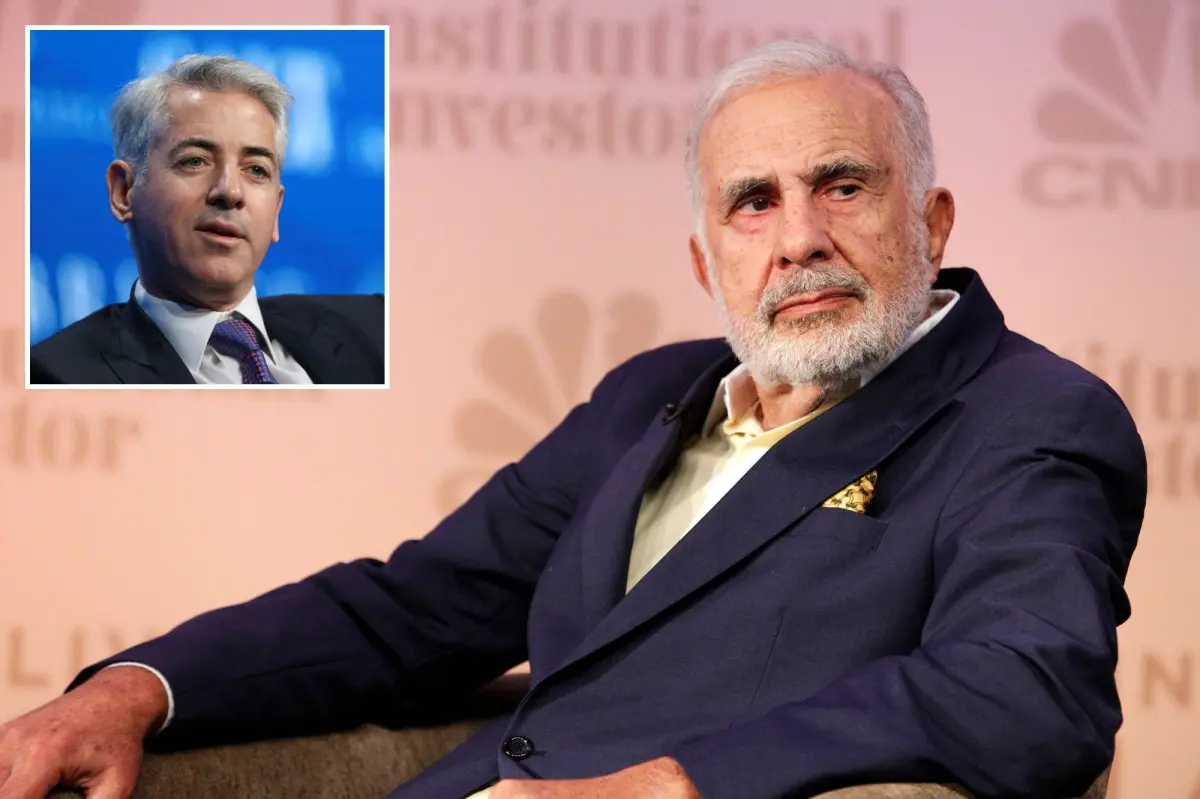

Icahn’s Continuous Stock Drop Raises Questions

Carl Icahn and Bill Ackman are back at it again as the pair of activist hedge-fund managers are sparring with the best of their abilities. Albeit Ackman is clearly enjoying watching Icahn’s holding company come under attack by short sellers.

Icahn Enterprises stock (ticker: IEP) continued to slide with a down of almost 21%, at an approximate of USD 19. That is a significant loss of over 60% from levels above USD 50 since the start of May 2023, before a short-seller report targeted the shares.

Short Selling And Hindenburg Research

If you buy low then sell high, chances are that you’ll be richer, and everybody will be happy. But reverse the trades with borrowed stock, known as short selling and you may be rich, but odds are that quite a few people will be displeased. Critics say that short sellers distort the market and that their practices can blur into market manipulation. “Shorts” say they’re keeping markets and companies honest. A series of negative reports from a short-selling firm, Hindenburg Research, have added fuel to the fire, as it targeted Carl Icahn’s Icahn Enterprises LP and companies affiliated with Indian billionaire Gautam Adani and Twitter co-founder Jack Dorsey.

Short sellers borrow shares, sell them, buy them back at a lower price and profit from the difference — unless the stock rises. Then they could lose money instead. In the case of recent events, Hindenburg Research did the former and is reaping the benefits while repercussions may lurk for founder Nate Anderson in the near future.